Get the free The Income-tax Ordinance, 1984 - bdlaws minlaw gov

Show details

This document outlines the provisions, appeals, and procedures related to income tax in Bangladesh, including the rights of taxpayers and processes for disputing tax assessments.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form income-tax ordinance 1984

Edit your form income-tax ordinance 1984 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form income-tax ordinance 1984 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form income-tax ordinance 1984 online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form income-tax ordinance 1984. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

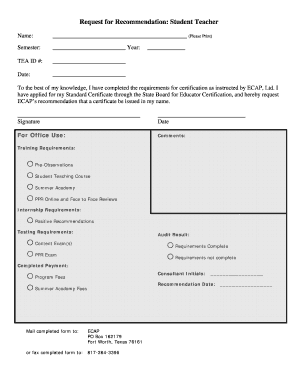

How to fill out form income-tax ordinance 1984

How to fill out The Income-tax Ordinance, 1984

01

Obtain the relevant form for The Income-tax Ordinance, 1984 from the tax authority.

02

Fill out personal information such as name, address, and identification number.

03

Report all income sources including salaries, business profits, and investments.

04

Deduct eligible expenses as outlined in the ordinance to calculate taxable income.

05

Calculate the tax due based on applicable tax rates and any available credits.

06

Double-check all entries for accuracy to avoid mistakes.

07

Submit the completed form to the tax authority before the deadline.

Who needs The Income-tax Ordinance, 1984?

01

Individuals earning income above the threshold set by the government.

02

Businesses and corporations operating within the jurisdiction.

03

Self-employed individuals who need to report their income and expenses.

04

Residents and non-residents with income sourced from the relevant areas governed by the ordinance.

Fill

form

: Try Risk Free

People Also Ask about

What is tax law, simply explained?

Tax law or revenue law is an area of legal study in which public or sanctioned authorities, such as federal, state and municipal governments (as in the case of the US) use a body of rules and procedures (laws) to assess and collect taxes in a legal context.

What is the purpose of the Income Tax Act?

The Income Tax Act 58 of 1962 intends: to consolidate the law relating to the taxation of incomes and donations.

What was the Income Tax Act of 1894?

Congress passed the 1894 Wilson-Gorman Tariff Act, which contained an income tax provision of 2% on incomes of over $4,000 (equivalent to $135,951.63 in 2022 U.S. Dollars). Supporters of this new income tax argued that it was not specifically a “direct” tax, which would require it to be apportioned among the states.

What was the major feature of the Tax Reform Act of 1986?

The Tax Reform Act of 1986 lowered the top tax rate for ordinary income from 50% to 28% and raised the bottom tax rate from 11% to 15%. This was the first time in U.S. income tax history that the top tax rate was lowered and the bottom rate was increased at the same time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

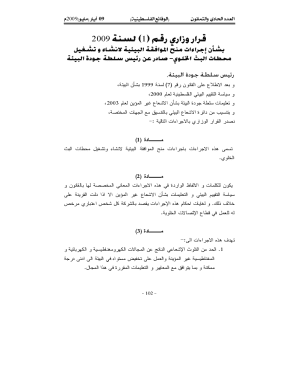

What is The Income-tax Ordinance, 1984?

The Income-tax Ordinance, 1984 is a legal framework in Pakistan that governs the taxation of income, outlining the rules and regulations for assessing and collecting income tax from individuals and entities.

Who is required to file The Income-tax Ordinance, 1984?

Individuals and entities who earn income above a certain threshold are required to file under The Income-tax Ordinance, 1984. This includes individuals, companies, and associations of persons.

How to fill out The Income-tax Ordinance, 1984?

To fill out The Income-tax Ordinance, 1984, taxpayers must complete the prescribed income tax return forms, providing accurate financial information, including income sources, deductions, and tax credits, and submit it to the Federal Board of Revenue.

What is the purpose of The Income-tax Ordinance, 1984?

The purpose of The Income-tax Ordinance, 1984 is to establish a comprehensive legal framework for the assessment and collection of income tax, ensure compliance, and provide guidelines for tax administration in Pakistan.

What information must be reported on The Income-tax Ordinance, 1984?

Taxpayers must report their total income, including salaries, business income, dividends, interest, and any other income sources, along with allowable deductions, tax credits, and any taxes paid during the year.

Fill out your form income-tax ordinance 1984 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Income-Tax Ordinance 1984 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.