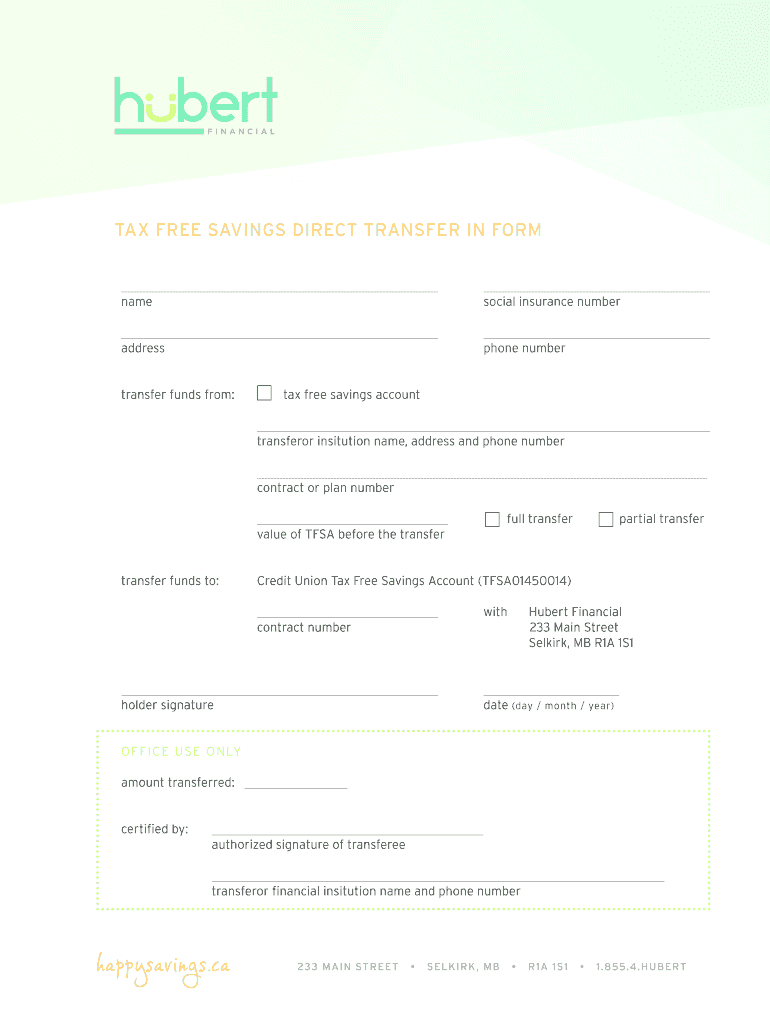

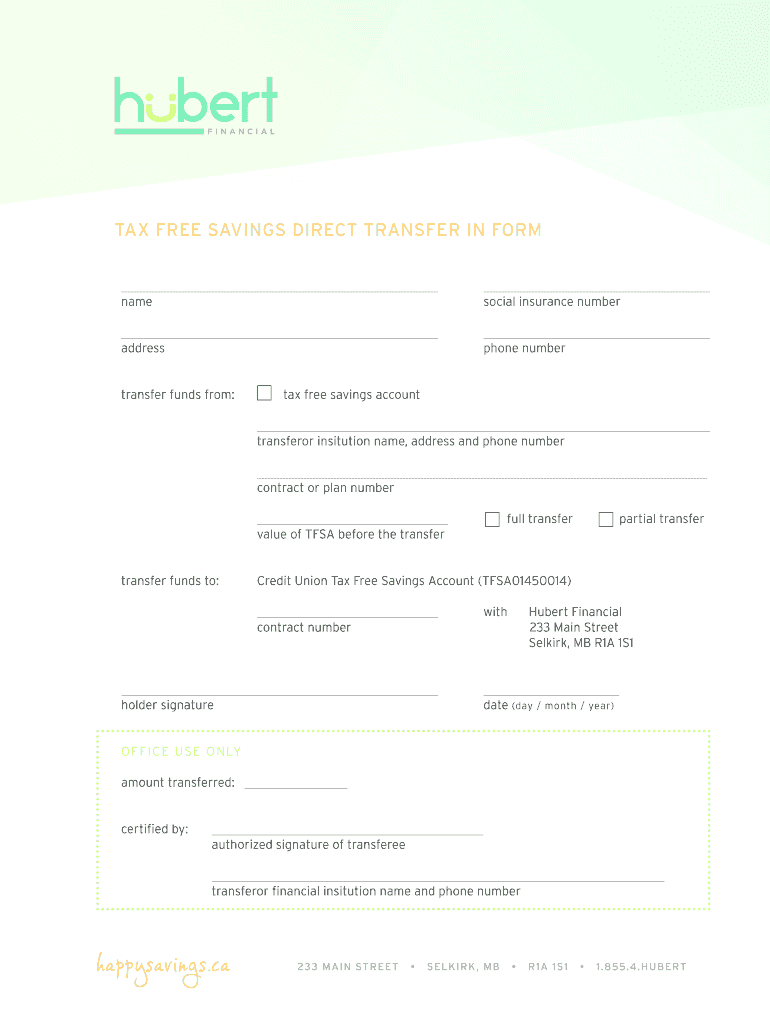

Get the TAX FREE SAVINGS DIRECT TRANSFER IN FORM name social insurance number address phone numbe...

Show details

TAX FREE SAVINGS DIRECT TRANSFER IN FORM name social insurance number address phone number transfer funds from: tax-free savings account transferor institution name, address and phone number contract

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax savings direct transfer

Edit your tax savings direct transfer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax savings direct transfer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax savings direct transfer online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax savings direct transfer. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax savings direct transfer

How to fill out tax savings direct transfer:

01

Gather necessary information: Collect all relevant financial documents and information including your tax identification number, bank account details, and any applicable tax forms or documents provided by your employer or financial institution.

02

Determine eligibility: Ensure that you meet the requirements to contribute to a tax savings direct transfer account. Typically, these accounts are available to individuals who have a qualifying high deductible health plan and do not participate in any other healthcare or medical savings accounts.

03

Contact your employer or financial institution: Reach out to your employer or financial institution to obtain the necessary forms or guidance on how to set up a tax savings direct transfer account. They will provide you with the required paperwork or online portal to facilitate the process.

04

Complete the forms: Fill out the provided forms accurately and thoroughly. This may include providing personal information, confirming your eligibility, specifying the amount you wish to contribute, and authorizing the direct transfer from your paycheck or bank account.

05

Seek professional advice if needed: If you are unsure about any aspect of filling out the forms or the implications of contributing to a tax savings direct transfer account, consider consulting a tax professional or financial advisor for guidance.

06

Submit the forms: Once you have carefully reviewed and completed the forms, submit them to your employer or financial institution according to their instructions. Make sure to keep copies of all submitted documents for your records.

07

Monitor and manage your account: After your tax savings direct transfer account is set up, regularly review your contributions and assess if any adjustments are necessary. Keep track of your account balance and any tax benefits or deductions associated with your contributions.

08

File your taxes appropriately: When filing your taxes, ensure that you accurately report your tax savings direct transfer contributions and any applicable deductions or benefits. Consult the guidance provided by the tax authorities or seek professional advice to ensure compliance with tax regulations.

Who needs tax savings direct transfer?

01

Self-employed individuals: Freelancers, independent contractors, and small business owners who do not have access to employer-sponsored healthcare benefits may benefit from a tax savings direct transfer account.

02

Individuals with high deductible health plans: If you have a qualifying high deductible health plan, a tax savings direct transfer account can help you set aside funds specifically for medical expenses while enjoying certain tax advantages.

03

Individuals looking to save on taxes: Contributions made to a tax savings direct transfer account are often tax-deductible, providing individuals with an opportunity to reduce their taxable income and potentially lower their overall tax liability.

04

Those seeking to save for future medical expenses: By contributing to a tax savings direct transfer account, individuals can build up a dedicated medical savings fund that can be used to cover qualified healthcare expenses both in the present and in the future.

05

Individuals interested in financial planning: Opening a tax savings direct transfer account can be a part of a comprehensive financial plan, helping individuals effectively manage their healthcare expenses and potentially save money in the long run.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find tax savings direct transfer?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific tax savings direct transfer and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I execute tax savings direct transfer online?

Filling out and eSigning tax savings direct transfer is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the tax savings direct transfer electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your tax savings direct transfer in minutes.

What is tax savings direct transfer?

Tax savings direct transfer is a method used to transfer funds from one tax advantaged account to another without generating a taxable event.

Who is required to file tax savings direct transfer?

Individuals who want to transfer funds between tax advantaged accounts without incurring taxes on the transfer.

How to fill out tax savings direct transfer?

To fill out a tax savings direct transfer, you will need to provide information about the accounts involved in the transfer and ensure that the transaction meets the requirements for a tax-free transfer.

What is the purpose of tax savings direct transfer?

The purpose of tax savings direct transfer is to allow individuals to move funds between tax advantaged accounts without incurring taxes, helping them maximize their savings.

What information must be reported on tax savings direct transfer?

The information required for tax savings direct transfer includes details about the accounts involved, the amount transferred, and any relevant tax forms.

Fill out your tax savings direct transfer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Savings Direct Transfer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.