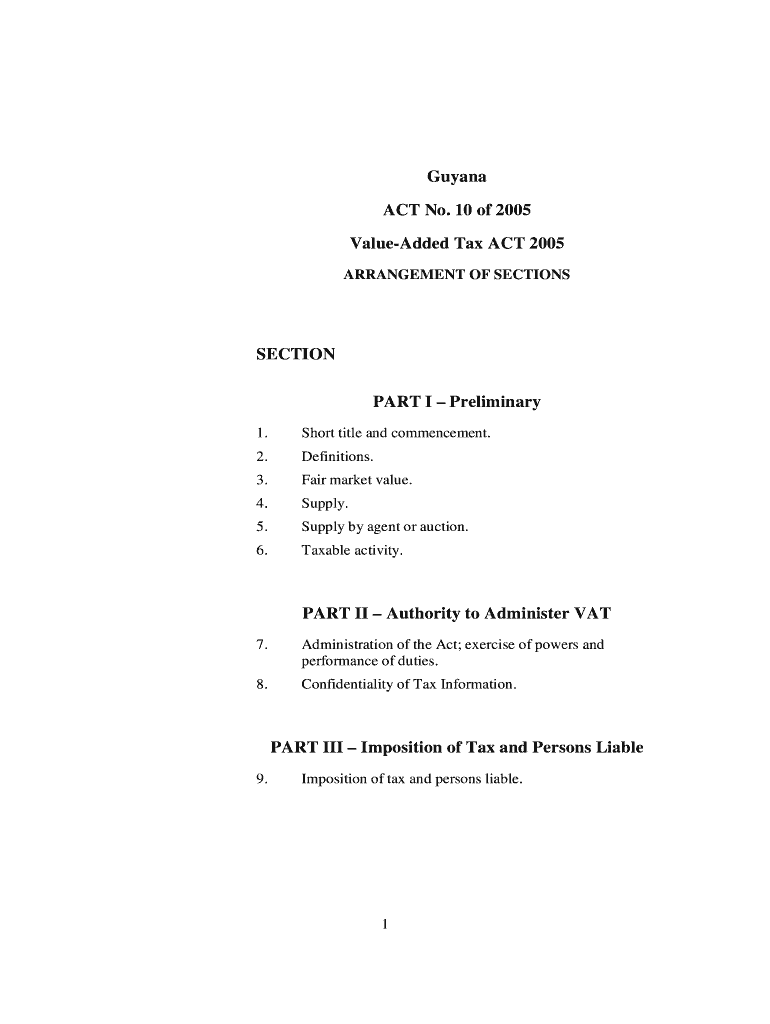

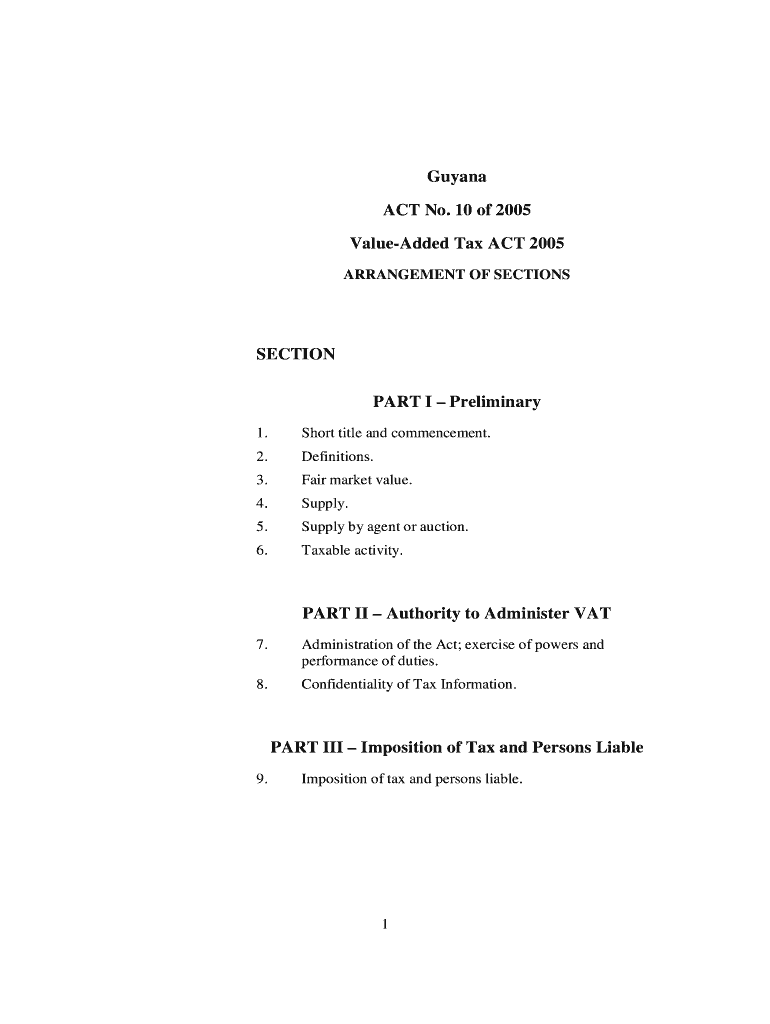

Get the free Value-Added Tax Act 2005

Show details

This document provides the legislative framework for the imposition, administration, and regulation of Value-Added Tax (VAT) in Guyana, detailing responsibilities, procedures, penalties, and exemptions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign value-added tax act 2005

Edit your value-added tax act 2005 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your value-added tax act 2005 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit value-added tax act 2005 online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit value-added tax act 2005. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

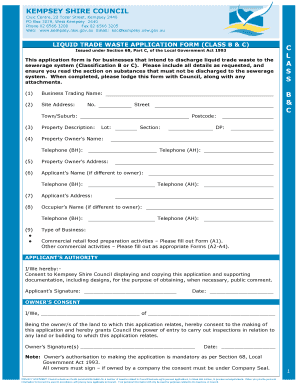

How to fill out value-added tax act 2005

How to fill out Value-Added Tax Act 2005

01

Obtain a copy of the Value-Added Tax Act 2005 from the official government website or legally registered source.

02

Review the key sections of the Act to understand the requirements and obligations.

03

Gather relevant financial information and documentation that pertains to your business operations.

04

Identify the goods and services you offer that may be subject to VAT.

05

Calculate the VAT you owe based on your sales and purchases as outlined in the Act.

06

Complete the VAT return forms as specified under the Act, ensuring accuracy.

07

Submit the completed forms to the tax authority by the deadline provided in the legislation.

08

Keep accurate records of your VAT transactions, including invoices and receipts, for future reference and compliance.

Who needs Value-Added Tax Act 2005?

01

Businesses and individuals that sell goods or provide services that are subject to VAT.

02

Registered VAT taxpayers who must comply with the regulations set out in the Act.

03

Importers of goods into the country who may need to account for VAT.

04

Businesses that exceed the VAT registration threshold and must register for VAT.

Fill

form

: Try Risk Free

People Also Ask about

What are the new VAT amendments 2025?

The latest amendments to the VAT Act include: Introduction of 18% VAT on services supplied by a nonresident person via electronic platforms — effective October 1, 2025. Repeal of the simplified VAT (SVAT) scheme and replacement with VAT refund scheme — effective October 1, 2025.

What does 20% VAT mean?

A value-added tax (VAT or goods and services tax (GST), general consumption tax (GCT)) is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared with, a sales tax.

Who pays the VAT tax?

Using invoices, each seller pays VAT on their sales and passes the buyer an invoice that indicates the amount of tax paid excluding deductions (input tax). Buyers who themselves add value and resell the product pay VAT on their own sales (output tax).

What is a VAT in simple terms?

VAT (Value Added Tax) is a tax added to most products and services sold by VAT -registered businesses.

What is the main purpose of VAT?

The purpose of VAT is to generate revenue for the government to fund public services like education, healthcare, and infrastructure. Unlike income tax, which is levied on a person's earnings, VAT is applied at each stage of production and distribution, from raw materials to the final product you purchase.

What does it mean when it says +VAT?

Value Added Tax (VAT) is a consumption tax on the value added to nearly all goods and services bought and sold in and into the European Union. VAT is an important own resource for the EU budget.

What is the simple definition of VAT?

A value-added tax (VAT) is not a tariff, it is a consumption tax assessed on the value added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption.

How does VAT work for dummies?

The VAT you pay when you buy goods and services is called 'input tax'. If the output tax exceeds the input tax on your VAT return you will have to pay the difference to HMRC. If the input tax is the higher number then you will be due a repayment from HMRC.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Value-Added Tax Act 2005?

The Value-Added Tax Act 2005 is legislation that establishes the framework for the operation and collection of Value-Added Tax (VAT) on goods and services in a jurisdiction, outlining how VAT is to be implemented and administered.

Who is required to file Value-Added Tax Act 2005?

Businesses and individuals that are registered for VAT and operate above a certain turnover threshold are required to file under the Value-Added Tax Act 2005.

How to fill out Value-Added Tax Act 2005?

To fill out the Value-Added Tax Act 2005, entities must gather relevant sales and purchase data, complete the VAT return form specifying sales, purchases, and the amount of VAT collected and paid, and submit it to the tax authority.

What is the purpose of Value-Added Tax Act 2005?

The purpose of the Value-Added Tax Act 2005 is to outline the process for the assessment, collection, and payment of VAT, thus ensuring compliance among taxable entities and generating revenue for the government.

What information must be reported on Value-Added Tax Act 2005?

Information that must be reported includes total sales revenue, VAT collected on sales, total purchases, VAT paid on purchases, and any adjustments or deductions applicable for the reporting period.

Fill out your value-added tax act 2005 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Value-Added Tax Act 2005 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.