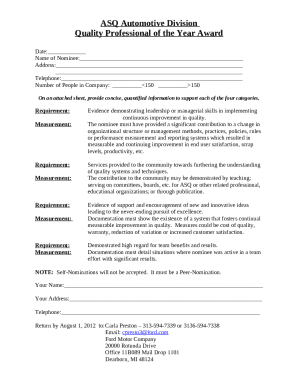

Get the free Intygande om skattskyldighet - nordnetse

Show details

Intygande on skattskyldighet Juridic person Var for Du beaver phyla i Donna blanket Vi p WordNet r enlist lag Sylvia ATT identifier Kenton some ideas av under med skatterttslig chemist Steiner Average,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign intygande om skattskyldighet

Edit your intygande om skattskyldighet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your intygande om skattskyldighet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit intygande om skattskyldighet online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit intygande om skattskyldighet. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out intygande om skattskyldighet

How to fill out intygande om skattskyldighet:

01

Begin by obtaining the form "Intygande om skattskyldighet" from the appropriate government agency or tax authority.

02

Fill in your personal information accurately, including your full name, address, social security number or personal identification number, and contact details.

03

Provide your tax identification number and any other relevant identification numbers requested on the form.

04

Specify the tax year or period for which the form is being filled out.

05

Indicate your tax status by selecting the relevant option. This may include options such as self-employed, employed, retired, or unemployed.

06

If you have multiple sources of income, provide details of each source and the corresponding income received. This may include income from employment, self-employment, investments, rental properties, or other sources.

07

Include any deductions or allowances that apply to you, such as business expenses or tax credits.

08

If you have received any type of financial support or benefits during the tax year, disclose this information accurately.

09

Sign and date the intygande om skattskyldighet form to confirm the authenticity of the information provided.

10

Submit the completed form to the designated tax authority or government agency before the specified deadline.

Who needs intygande om skattskyldighet:

01

Individuals who are required to file a tax return in accordance with the tax laws and regulations of their country.

02

Self-employed individuals who need to report their income and expenses for tax purposes.

03

Employees who have received income from multiple employers or additional sources, and need to declare this income to the tax authorities.

04

Individuals who have received financial support or benefits that are taxable.

05

Individuals who have any other tax-related obligations that require them to provide a declaration of their tax liability.

06

Companies or organizations that are mandated to provide information about their employees' tax liabilities.

07

Anyone who is unsure whether they need to provide the intygande om skattskyldighet form should consult with a tax professional or contact the relevant tax authority for guidance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in intygande om skattskyldighet?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your intygande om skattskyldighet to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I sign the intygande om skattskyldighet electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your intygande om skattskyldighet and you'll be done in minutes.

How do I edit intygande om skattskyldighet straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing intygande om skattskyldighet right away.

What is intygande om skattskyldighet?

Intygande om skattskyldighet is a declaration of taxable status in Sweden.

Who is required to file intygande om skattskyldighet?

Individuals or entities who are liable to pay tax in Sweden must file intygande om skattskyldighet.

How to fill out intygande om skattskyldighet?

Intygande om skattskyldighet can be filled out online on the tax authority's website or submitted in paper form.

What is the purpose of intygande om skattskyldighet?

The purpose of intygande om skattskyldighet is to inform the tax authority about the taxpayer's taxable status.

What information must be reported on intygande om skattskyldighet?

Intygande om skattskyldighet must include information about the taxpayer's income, deductions, and any tax credits.

Fill out your intygande om skattskyldighet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Intygande Om Skattskyldighet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.