Get the free Retail Bond Issuance Programme

Show details

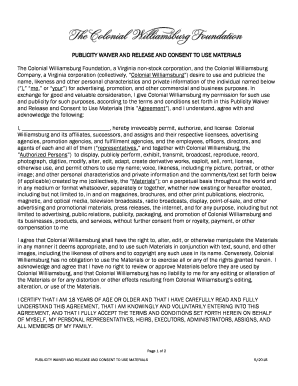

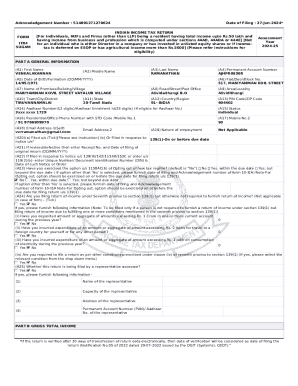

The Government of the Hong Kong Special Administrative Region of the Peoples Republic of ChinaRetail Bond Issuance Program bond Series HK×10,000,000,000 Retail Bonds Due 2018Subscription Period 9:00

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retail bond issuance programme

Edit your retail bond issuance programme form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retail bond issuance programme form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing retail bond issuance programme online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit retail bond issuance programme. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retail bond issuance programme

How to fill out a retail bond issuance programme:

01

Research and understand the requirements: Before starting the process, it is important to thoroughly research and understand the requirements for a retail bond issuance programme. This may include understanding the regulatory framework, documentation requirements, and eligibility criteria.

02

Identify the purpose and goals: Determine the purpose and goals of the issuance programme. Is it to raise capital, diversify funding sources, or finance specific projects? Clearly defining the purpose will help in structuring the programme and setting realistic targets.

03

Prepare the necessary documentation: Gather and prepare all the relevant documentation required for the issuance programme. This may include legal documentation, financial statements, offering memorandums, and prospectuses. It is crucial to ensure that all documentation complies with the regulatory guidelines.

04

Engage legal and financial advisors: Consider engaging legal and financial advisors who specialize in bond issuances. They can provide valuable guidance and expertise throughout the process, ensuring compliance with regulations and optimizing the terms of the bond issuance.

05

Determine the bond structure and terms: Decide on the structure and terms of the bond issuance. This includes determining the maturity date, interest rate or coupon, issuance size, and any additional features such as call or put options. Consider market conditions, investor preferences, and regulatory requirements when determining the terms.

06

Obtain necessary approvals: Depending on the jurisdiction, obtaining necessary approvals from regulatory bodies or exchanges may be required. Ensure compliance with all applicable rules and regulations before proceeding with the issuance programme.

07

Marketing and investor outreach: Develop a comprehensive marketing plan to attract potential investors. This may involve roadshows, investor presentations, and engaging with financial institutions and brokerage firms. Consider the target investors and tailor the marketing strategy accordingly.

08

Launch and manage the issuance: Once all necessary preparations are complete, launch the issuance programme. Monitor the progress and manage the issuance process carefully, including coordinating with relevant parties, tracking investor subscriptions, and ensuring timely delivery of the bonds to the investors.

Who needs a retail bond issuance programme?

01

Companies seeking capital: Companies that are looking to raise capital for various purposes, such as expansion, acquisitions, or debt refinancing, may need a retail bond issuance programme. It provides an avenue to access funding from individual investors.

02

Governments and municipalities: Governments and municipalities also utilize retail bond issuance programmes as a means to finance public infrastructure projects, social welfare programs, or to address budget deficits. These issuances allow individuals to invest in the development of their communities.

03

Financial institutions: Financial institutions may opt for retail bond issuance programmes to raise funds to support their lending activities, strengthen their capital base, or diversify their funding sources.

Overall, a retail bond issuance programme serves as a tool for entities to access capital from individual investors and diversify their funding base while providing investment opportunities for individuals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute retail bond issuance programme online?

pdfFiller makes it easy to finish and sign retail bond issuance programme online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit retail bond issuance programme online?

With pdfFiller, it's easy to make changes. Open your retail bond issuance programme in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit retail bond issuance programme on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign retail bond issuance programme on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is retail bond issuance programme?

Retail bond issuance programme is a program through which companies can issue bonds to individual investors.

Who is required to file retail bond issuance programme?

Companies looking to issue bonds to individual investors are required to file the retail bond issuance programme.

How to fill out retail bond issuance programme?

To fill out a retail bond issuance programme, companies must provide detailed information about the bond offering, such as the terms, risks, and financial information.

What is the purpose of retail bond issuance programme?

The purpose of a retail bond issuance programme is to raise funds from individual investors through the issuance of bonds.

What information must be reported on retail bond issuance programme?

The retail bond issuance programme must include information about the terms of the bond, the company issuing the bond, risks associated with the bond, and financial information.

Fill out your retail bond issuance programme online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retail Bond Issuance Programme is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.