Get the free BrownfieldGrayfield Redevelopment bTaxb Credit bApplicationb

Show details

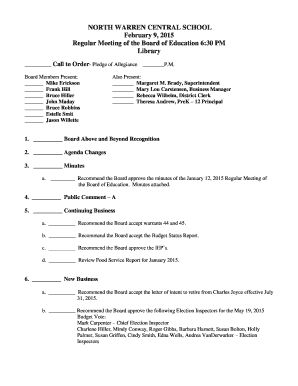

Deborah V. Durham, Director Iowa Economic Development Authority PLEASE NOTE: Complete hard copy applications must be signed and received by the Iowa Economic Development Authority no later than 4:30pm

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign brownfieldgrayfield redevelopment btaxb credit

Edit your brownfieldgrayfield redevelopment btaxb credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your brownfieldgrayfield redevelopment btaxb credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing brownfieldgrayfield redevelopment btaxb credit online

In order to make advantage of the professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit brownfieldgrayfield redevelopment btaxb credit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out brownfieldgrayfield redevelopment btaxb credit

How to fill out the brownfield/grayfield redevelopment tax credit:

01

Identify the applicable brownfield/grayfield site: Determine if the property meets the criteria for either a brownfield or a grayfield site. Brownfield sites are typically contaminated and require cleanup, while grayfield sites are previously developed but under-utilized properties.

02

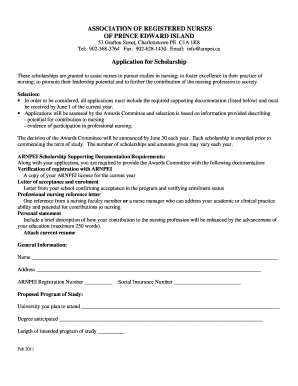

Gather necessary documentation: Collect all relevant documentation, such as environmental reports, site assessment reports, and any other supporting evidence that demonstrates the eligibility for the tax credit.

03

Determine the eligible expenses: Determine the eligible expenses incurred during the redevelopment process, such as environmental remediation costs, demolition expenses, infrastructure improvements, and other qualified expenses.

04

Calculate the tax credit: Once you have identified the eligible expenses, follow the guidelines provided by the tax credit program to calculate the amount of tax credit you may be entitled to. This may involve applying a percentage to the eligible expenses or using a specific formula.

05

Complete the application: Fill out the required application forms for the brownfield/grayfield redevelopment tax credit program. Provide accurate and detailed information about the property and the redevelopment activities that were undertaken.

06

Submit the application: Submit the completed application along with all supporting documentation to the appropriate governing agency or organization responsible for administering the tax credit program. Ensure that you meet all deadlines and requirements for submission.

07

Await review and approval: The governing agency or organization will review your application and determine if you are eligible for the brownfield/grayfield redevelopment tax credit. This may involve site visits, additional documentation requests, or other verification processes.

08

Utilize the tax credit: If approved, the tax credit can be applied towards your tax liability for the designated period specified by the program. Consult with a tax professional or accountant to ensure the appropriate use and reporting of the tax credit.

09

Maintain compliance: Once you have received the tax credit, ensure that you comply with any ongoing reporting requirements, documentation requests, or other obligations associated with the program. Failure to comply may result in the recapture or forfeiture of the tax credit.

Who needs the brownfield/grayfield redevelopment tax credit?

01

Developers and property owners: Individuals or organizations looking to redevelop brownfield or grayfield sites can benefit from the tax credit. It provides a financial incentive to undertake the often costly and complex process of revitalizing contaminated or under-utilized properties.

02

Local governments and communities: Brownfield/grayfield redevelopment tax credits can encourage economic growth, job creation, and environmental improvement within communities. Local governments may implement these programs to attract developers, stimulate development in blighted areas, and promote sustainable land use practices.

03

Environmental advocates: The tax credit promotes the cleanup and rehabilitation of contaminated or under-utilized sites, which can have significant environmental benefits. By incentivizing the redevelopment of brownfield and grayfield sites, the tax credit helps reduce pollution, protect natural resources, and promote sustainable development practices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is brownfieldgrayfield redevelopment btaxb credit?

The Brownfield/Grayfield Redevelopment BTaxB Credit is a tax credit designed to incentivize the redevelopment of contaminated or underutilized properties.

Who is required to file brownfieldgrayfield redevelopment btaxb credit?

Property owners who are looking to redevelop brownfield or grayfield sites may be eligible to file for the BTaxB Credit.

How to fill out brownfieldgrayfield redevelopment btaxb credit?

To fill out the Brownfield/Grayfield Redevelopment BTaxB Credit, property owners must provide information about the site, the redevelopment plans, and any environmental remediation efforts.

What is the purpose of brownfieldgrayfield redevelopment btaxb credit?

The purpose of the Brownfield/Grayfield Redevelopment BTaxB Credit is to encourage the cleanup and redevelopment of contaminated or underutilized properties, ultimately leading to economic and environmental benefits.

What information must be reported on brownfieldgrayfield redevelopment btaxb credit?

Information such as details about the property, the proposed redevelopment plans, and any environmental remediation activities must be reported on the BTaxB Credit application.

How do I modify my brownfieldgrayfield redevelopment btaxb credit in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your brownfieldgrayfield redevelopment btaxb credit and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I fill out brownfieldgrayfield redevelopment btaxb credit using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign brownfieldgrayfield redevelopment btaxb credit and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit brownfieldgrayfield redevelopment btaxb credit on an Android device?

You can make any changes to PDF files, like brownfieldgrayfield redevelopment btaxb credit, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your brownfieldgrayfield redevelopment btaxb credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Brownfieldgrayfield Redevelopment Btaxb Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.