Get the free Bylaw on Refund of Excise Duty

Show details

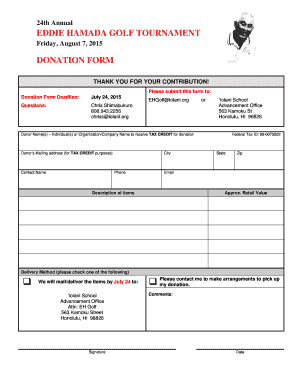

This Bylaw regulates the specific terms, manner and procedures for obtaining refunds on excise duty paid for oil derivatives used for industrial purposes in Serbia.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bylaw on refund of

Edit your bylaw on refund of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bylaw on refund of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bylaw on refund of online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bylaw on refund of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bylaw on refund of

How to fill out Bylaw on Refund of Excise Duty

01

Begin by obtaining the official Bylaw on Refund of Excise Duty document from the relevant authority.

02

Read through the guidelines and eligibility criteria stated in the Bylaw.

03

Fill in your personal details, including full name, address, and contact information in the designated sections.

04

Provide the details of the excise duty you are claiming a refund for, including amounts paid and dates.

05

Attach any required documents, such as receipts, proof of payment, and identification.

06

Review the completed form for any errors or missing information.

07

Submit the form to the appropriate department or office as indicated in the Bylaw.

Who needs Bylaw on Refund of Excise Duty?

01

Individuals or businesses that have paid excise duty and are eligible for a refund.

02

Taxpayers who believe they have overpaid on excise duties.

03

Companies engaged in manufacturing or other activities subject to excise duties.

Fill

form

: Try Risk Free

People Also Ask about

How to get a custom duty refund?

The application should be accompanied by: Original Customs Duty Payment Receipt. Documents supporting the claim, such as invoices, bills of entry, shipping bills, etc. Proof of export or re-export (if applicable). Declaration stating the excess duty paid and the reason for refund.

What is a duty refund?

these refunds allow importers to reclaim duties paid on goods for which the importer overpaid, or, in the case of duty drawbacks, for goods that are subsequently exported, unused, or destroyed. in more rare circumstances, refunds may also be available if a tariff is overturned in court.

How to get a refund from customs?

To claim your tariff refund, you must file with U.S. Customs via the ACE system (Automated Commercial Environment). Paper filing is no longer accepted. Your submission must include detailed and verifiable documentation: CBP Form 7552 (Certificate of Delivery)

How to claim excise duty?

What you need — Customs Declaration Service an EORI number. a Movement Reference Number (MRN) your contact and address details. the bank details of the person receiving the repayment.

What is the meaning of excise duty refund?

1.1 Refund of any duty of excise is governed by Section 11B of the Central Excise Act, 1944. By definition, refund includes rebate of duty paid on goods exported out of India or on materials used in the manufacture of goods exported out of India.

How to get customs money back?

This can be a simple credit note or shipping receipt. You'll need to attach this to the CBSA refund form as well. Once your B2G and supporting documents are prepared, send them by mail to the nearest CBSA Casual Refund Centre. The centre corresponding to your address can be found on the CBSA website.

How do I get a refund on customs duty?

How to get a Canada Customs duty refund. If you want to use the Casual Refund Program, the first thing you'll need is a B2G (CBSA Informal Adjustment Request) form. Go to the CBSA website to find a link to the Customs refund form in PDF format and instructions on filling it out.

How to claim a refund of customs duty?

What you'll need — C285 form the movement reference number (MRN) an EORI number from the importer or agent — Who needs an EORI number. an EORI number if you're making a claim under the Customs Duty Waiver Scheme. your contact and address details. bank details for the person receiving the payment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Bylaw on Refund of Excise Duty?

The Bylaw on Refund of Excise Duty is a set of regulations that outline the procedures and criteria for obtaining refunds for excise duty paid on certain goods or services. It provides taxpayers with the ability to reclaim excise duties under specified conditions.

Who is required to file Bylaw on Refund of Excise Duty?

Entities or individuals who have paid excise duty on goods or services and are eligible for a refund under the applicable laws are required to file the Bylaw on Refund of Excise Duty.

How to fill out Bylaw on Refund of Excise Duty?

To fill out the Bylaw on Refund of Excise Duty, applicants must complete the designated form by providing required information such as the details of the goods, amounts paid, relevant dates, and other identifying information, then submit it to the appropriate tax authority.

What is the purpose of Bylaw on Refund of Excise Duty?

The purpose of the Bylaw on Refund of Excise Duty is to facilitate the process through which taxpayers can reclaim excise duties that were erroneously paid or that qualify for a refund according to established regulations.

What information must be reported on Bylaw on Refund of Excise Duty?

The information that must be reported typically includes the taxpayer's identifying information, details of the excise duty paid, descriptions of the goods or services, amounts being claimed for refund, dates of payment, and any supporting documentation as required by the tax authority.

Fill out your bylaw on refund of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bylaw On Refund Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.