Get the free Department of the Treasury Internal Revenue Service 2013 Instructions for Schedule H...

Show details

Get HTTP Headers Ping Trace Route DNS HTTP Get ... PDF 2013 Instruction 1040 Schedule A Internal Revenue Service ... Itemized Deductions Federal Tax Guide 1040.com File. .... www.esmarttax.com/uploadedfiles/media/

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign department of form treasury

Edit your department of form treasury form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your department of form treasury form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing department of form treasury online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit department of form treasury. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

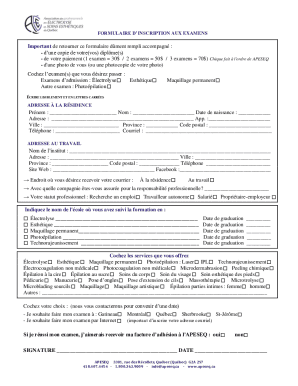

How to fill out department of form treasury

How to fill out Department of the Treasury:

01

Gather all necessary documents: Before starting to fill out the Department of the Treasury forms, ensure that you have all the required documents ready. This may include identification documents, tax forms, financial records, and any other supporting documents.

02

Understand the purpose of the form: Different forms from the Department of the Treasury serve various purposes. Make sure you have a clear understanding of the form you are filling out and its intended use. Read the instructions carefully to ensure accurate completion.

03

Provide accurate personal information: Fill out the form with your correct personal information, including name, address, social security number, and other relevant details. Be cautious about providing accurate information to avoid any issues or delays.

04

Include necessary financial details: Depending on the form, you may be required to disclose financial information such as income, assets, liabilities, or tax-related details. Double-check the instructions to ensure you provide the required financial information accurately.

05

Keep copies of completed forms: Once you have filled out the Department of the Treasury forms, make copies of each document for your records. It's essential to have backups in case any issues arise or if you need to reference the information in the future.

Who needs Department of the Treasury:

01

Individuals: If you are an individual taxpayer, you may need to interact with the Department of the Treasury for various purposes, such as filing taxes, claiming tax refunds, or applying for government benefits.

02

Businesses: Businesses, regardless of their size, may need to engage with the Department of the Treasury for various reasons. These can include tax-related matters, payroll processing, compliance with financial regulations, or seeking assistance or grants from government programs.

03

Financial institutions: Banks, credit unions, and other financial institutions often need to work closely with the Department of the Treasury to ensure compliance with regulations, report financial activities, or participate in government programs.

04

Government agencies: Different government agencies at the federal, state, or local levels may require coordination and interaction with the Department of the Treasury for financial matters, budgeting, or policy-related purposes.

05

International entities: Foreign governments, organizations, or entities engaged in international trade and finance may also need to engage with the Department of the Treasury for matters such as sanctions, trade agreements, or regulatory compliance.

Remember, while this provides a general understanding of who may need to interact with the Department of the Treasury, the specific circumstances and individuals involved can vary. It is best to consult the official Department of the Treasury resources or seek professional advice to determine your specific needs and obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is department of the treasury?

The Department of the Treasury is a government agency responsible for managing and overseeing the finances and economic policies of the United States.

Who is required to file department of the treasury?

Various individuals and entities such as businesses, taxpayers, and financial institutions may be required to file forms and documents with the Department of the Treasury based on their specific obligations and requirements.

How to fill out department of the treasury?

The process of filling out forms and documents for the Department of the Treasury depends on the specific form or document being filed. It typically involves providing accurate and complete information, following the instructions provided, and submitting the form or document through the appropriate channels.

What is the purpose of department of the treasury?

The Department of the Treasury's primary purpose is to promote economic prosperity and financial stability in the United States. It achieves this through managing the government's finances, collecting taxes, enforcing tax laws, regulating financial institutions, and formulating economic policies.

What information must be reported on department of the treasury?

The specific information required to be reported on forms and documents for the Department of the Treasury varies depending on the form or document being filed. Generally, it may include personal and financial information, transaction details, tax-related information, and other relevant data.

How can I send department of form treasury for eSignature?

Once your department of form treasury is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit department of form treasury in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your department of form treasury, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out department of form treasury on an Android device?

Complete your department of form treasury and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your department of form treasury online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Department Of Form Treasury is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.