Get the free COMPARISON BETWEEN LLP IN SINGAPORE AND LLP IN INDIA

Show details

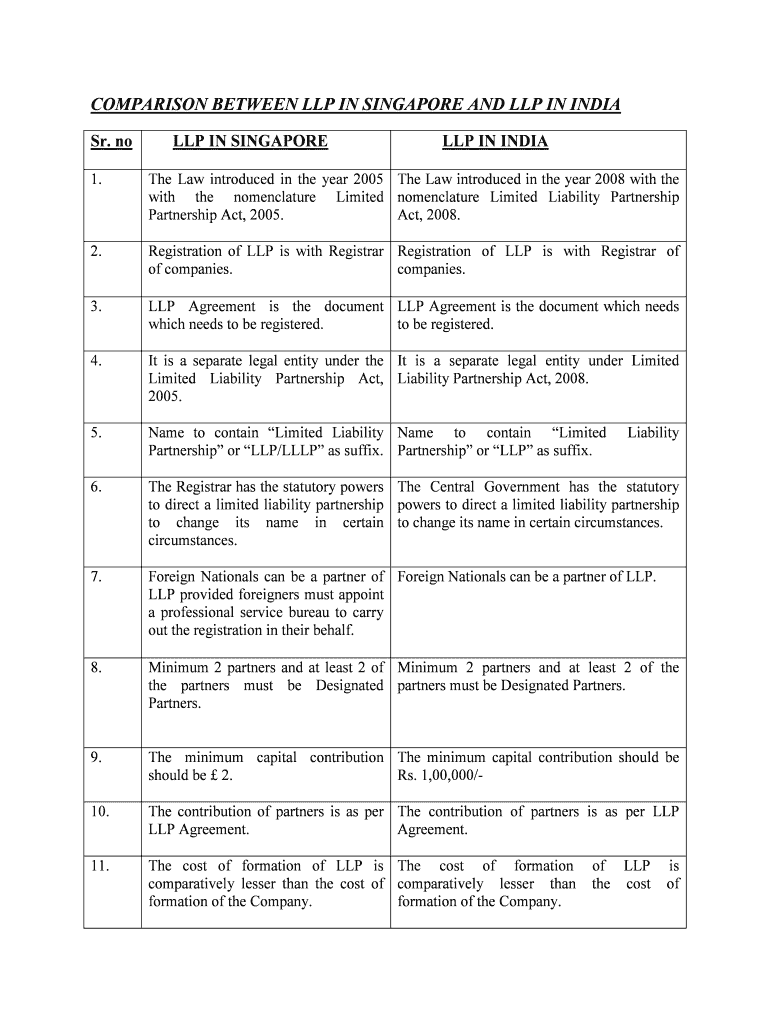

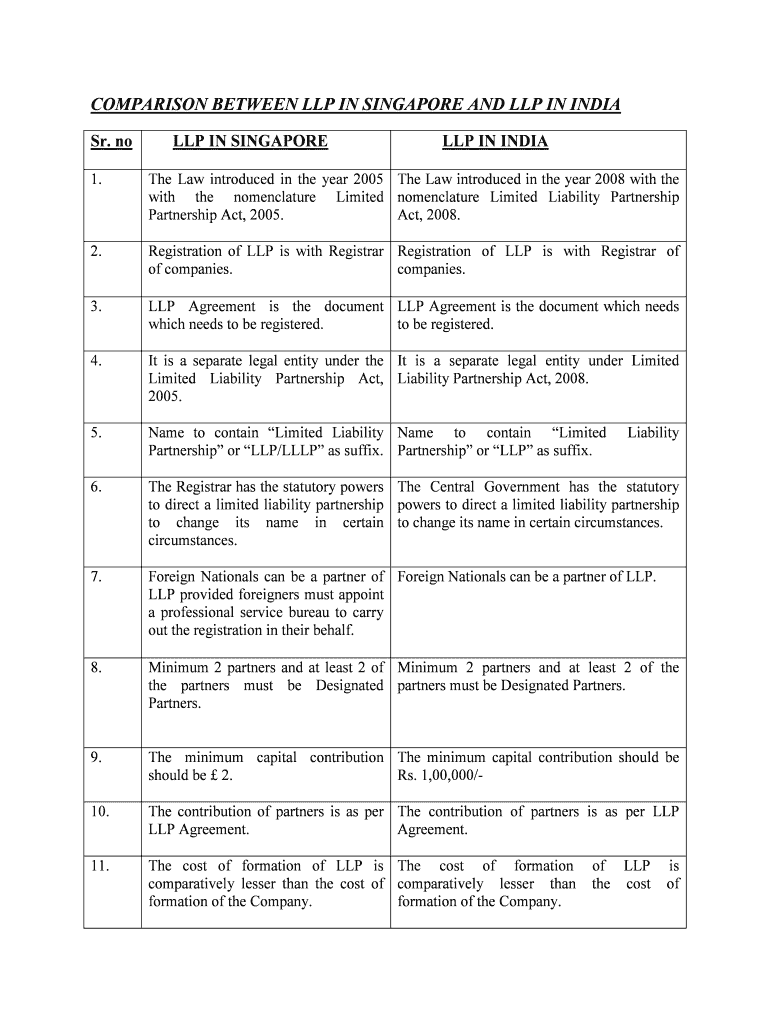

COMPARISON BETWEEN LLP IN SINGAPORE AND LLP IN INDIA

Sr. noble IN SINGAPORE IN INDIA1. The Law introduced in the year 2005 The Law introduced in the year 2008 with the nomenclature Limited Liability

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign comparison between llp in

Edit your comparison between llp in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your comparison between llp in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit comparison between llp in online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit comparison between llp in. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out comparison between llp in

How to Fill Out Comparison Between LLP in:

01

Research and gather information: Start by researching about different LLPs and their features, benefits, and drawbacks. Understand the fundamentals of an LLP, its formation process, liability protection, taxation, management structure, and any other relevant aspects.

02

Identify your needs and goals: Determine why you need to compare LLPs. Are you looking to form an LLP for your business, or do you want to understand the advantages and disadvantages of converting an existing business structure to an LLP? Clearly define your needs and goals so that you can evaluate LLPs accordingly.

03

Create a comparison chart or table: Develop a comparison chart that includes all the key factors that are important to you. This can include factors such as liability protection, tax implications, ease of formation, management structure, flexibility, and so on. Organize the LLPs you are comparing side by side, and fill in the information for each factor.

04

Evaluate individual factors: Go through each factor on your comparison chart and analyze the pros and cons of each LLP based on that factor. Consider the extent to which each LLP meets your requirements and preferences for that particular aspect. This will help you gain a clearer understanding of how each LLP performs in these different areas.

05

Consider specific needs: Take into account any specific needs or industry requirements that may impact your decision. For example, if you plan to operate in multiple states, you might need to evaluate the LLPs' ability to easily expand or register in different jurisdictions. Tailor your evaluation process to suit your unique situation.

06

Prioritize the factors: Based on your research, needs, and goals, rank the importance of each factor in your comparison chart. Some factors may have more weight than others depending on your specific circumstances. Give more consideration to those factors that align closely with your primary objectives.

07

Seek professional advice if needed: If you find the comparison overwhelming or if you are unsure about certain aspects, reach out to a qualified professional such as a lawyer or an accountant who specializes in business structures and formations. They can provide guidance and help you make an informed decision.

Who needs comparison between LLP in?

01

Entrepreneurs and small business owners: Individuals who are planning to start their own business or expand their existing business may find it beneficial to compare LLPs. Understanding the advantages and disadvantages of LLPs can aid in selecting the most suitable structure for their business needs.

02

Existing business owners: Business owners who currently operate under a different legal structure, such as a sole proprietorship or a partnership, may consider comparing LLPs as a potential option for conversion. This allows them to evaluate if an LLP offers better liability protection or tax benefits compared to their current structure.

03

Professionals in regulated industries: Professionals operating in fields such as law, accounting, architecture, or engineering may require additional liability protection. Comparing LLPs can help them assess whether an LLP structure is more suitable for their professional practice due to its limited liability characteristics.

By following these steps and considering the needs of entrepreneurs, existing business owners, and professionals in regulated industries, a comparison between LLPs in can be effectively filled out.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send comparison between llp in for eSignature?

When you're ready to share your comparison between llp in, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete comparison between llp in online?

With pdfFiller, you may easily complete and sign comparison between llp in online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make changes in comparison between llp in?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your comparison between llp in to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is comparison between llp in?

Comparison between LLPs is the process of comparing the financial statements and performance of two or more Limited Liability Partnerships.

Who is required to file comparison between llp in?

LLPs are required to file comparison between LLPs to accurately assess and analyze their financial performance.

How to fill out comparison between llp in?

LLPs can fill out comparison between LLPs by gathering their financial statements, comparing the data, and documenting the results.

What is the purpose of comparison between llp in?

The purpose of comparison between LLPs is to evaluate the financial health and performance of the LLPs, identify areas of improvement, and make informed business decisions.

What information must be reported on comparison between llp in?

Information such as revenue, expenses, profit margins, assets, liabilities, and other financial data must be reported on comparison between LLPs.

Fill out your comparison between llp in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Comparison Between Llp In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.