Get the free US Financial Invoice Factoring Application

Show details

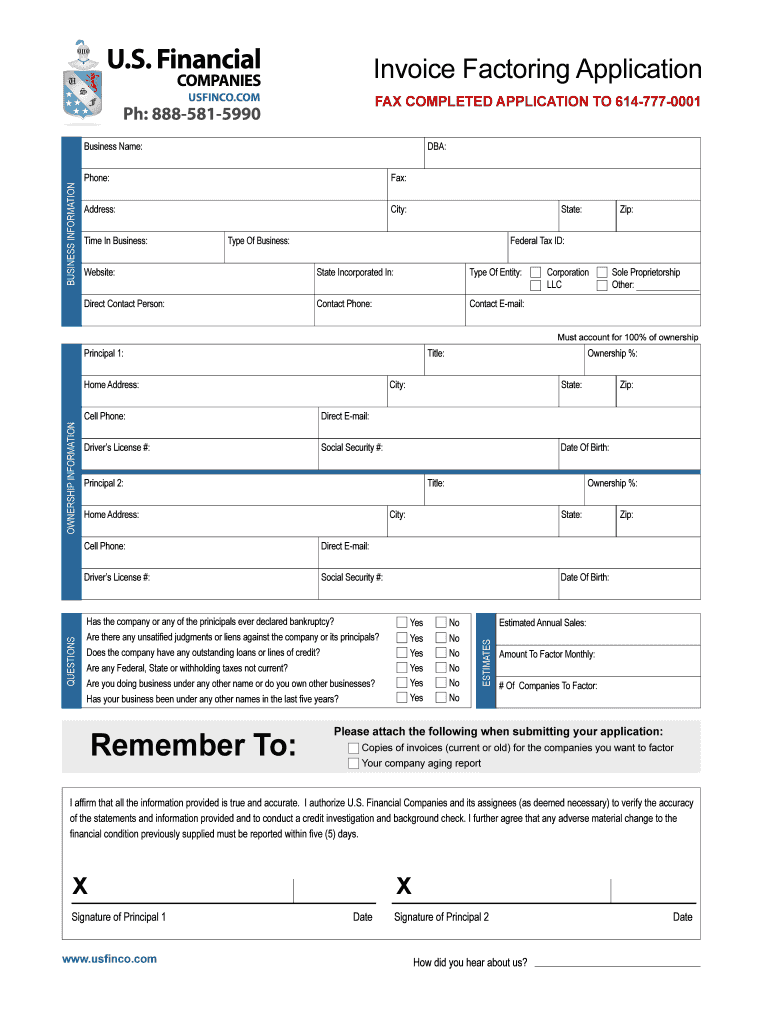

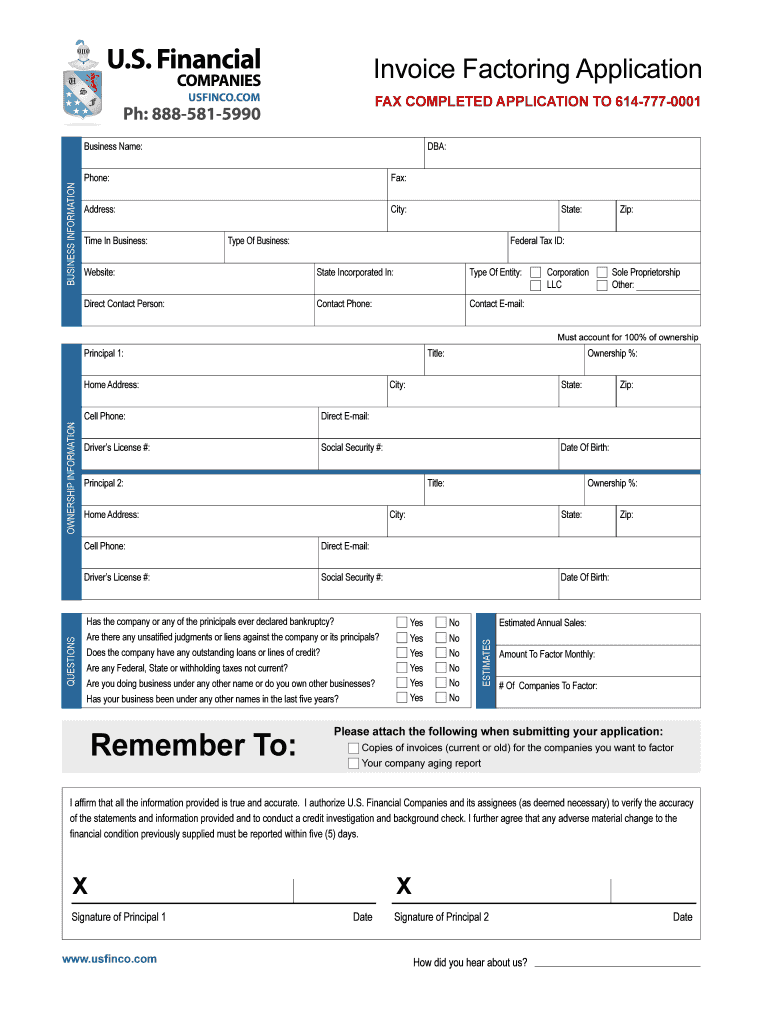

U.S. Financial Invoice Factoring Application COMPANIES USFINCO.COM FAX COMPLETED APPLICATION TO 6147770001 pH: 8885815990 BUSINESS INFORMATION Business Name: DBA: Phone: Fax: Address: City: Time In

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us financial invoice factoring

Edit your us financial invoice factoring form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us financial invoice factoring form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing us financial invoice factoring online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit us financial invoice factoring. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out us financial invoice factoring

How to fill out US financial invoice factoring:

01

Start by gathering all the necessary information and documents related to your invoices. This includes the copies of the invoices you plan to factor, any supporting documents like proof of delivery or signed contracts, and your company's financial statements.

02

Identify a reliable and reputable factoring company that offers US financial invoice factoring services. Research different providers and compare their terms, fees, and customer reviews to find the best fit for your business.

03

Contact the chosen factoring company and express your interest in utilizing their services for invoice factoring. They will provide you with an application form that needs to be filled out.

04

Carefully complete the application form, ensuring that all required fields are accurately filled in. These fields may include your company's name, contact information, federal tax identification number, annual revenue, and details about the invoices you wish to factor.

05

Attach the necessary supporting documents to your application. Make sure all documents are organized and legible to avoid any delays or complications during the processing of your application.

06

Submit the completed application and supporting documents to the factoring company. This can usually be done online, through email, or by mail, depending on the preferred method of the factoring company.

07

Await the factoring company's response. They will assess your application and review the provided documents. If everything meets their criteria, they will offer you a factoring agreement.

08

Review the terms and conditions of the factoring agreement carefully. Pay close attention to the fees involved, the percentage of advance you will receive, and any additional requirements or restrictions.

09

If you agree with the terms, sign the factoring agreement and return it to the factoring company as per their instructions. This formalizes your agreement to utilize their invoice factoring services.

10

Once the factoring company has received the signed agreement, they will typically verify the validity of the invoices and conduct credit checks on your customers. This is to ensure that they are creditworthy and can make timely payments.

Who needs US financial invoice factoring:

01

Small and medium-sized businesses that experience cash flow issues due to lengthy payment terms or slow-paying customers can benefit from US financial invoice factoring. It provides them with immediate funding and helps improve cash flow.

02

Businesses that are unable to obtain traditional bank financing or have been turned down by banks due to credit issues can turn to US financial invoice factoring as an alternative financing solution.

03

Startups and businesses in their early stages that have minimal operating history or credit may find it challenging to secure funding from traditional sources. US financial invoice factoring offers them a viable option to access capital based on their account receivables.

04

Companies that are experiencing rapid growth and need additional funds to support their expansion can use US financial invoice factoring as a flexible and scalable financing tool.

05

Businesses that want to focus on their core operations instead of chasing after overdue invoices can benefit from US financial invoice factoring. By outsourcing the management of accounts receivable to the factoring company, they can save time and resources.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find us financial invoice factoring?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the us financial invoice factoring in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit us financial invoice factoring straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit us financial invoice factoring.

Can I edit us financial invoice factoring on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign us financial invoice factoring. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is us financial invoice factoring?

US financial invoice factoring is a process where a business sells its accounts receivable to a third party at a discount in order to free up cash flow.

Who is required to file us financial invoice factoring?

Businesses who utilize invoice factoring as a financing tool are required to file for US financial invoice factoring.

How to fill out us financial invoice factoring?

To fill out US financial invoice factoring, businesses need to provide details of the invoices being sold, including invoice number, amount, and payment terms.

What is the purpose of us financial invoice factoring?

The purpose of US financial invoice factoring is to provide businesses with immediate cash flow by selling their accounts receivable.

What information must be reported on us financial invoice factoring?

The information reported on US financial invoice factoring includes details of the invoices being sold, the discount rate applied, and the payment terms.

Fill out your us financial invoice factoring online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Financial Invoice Factoring is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.