Get the free *10.6 Form of Stock Option Agreement (incentive stock options ... - 216 139 227

Show details

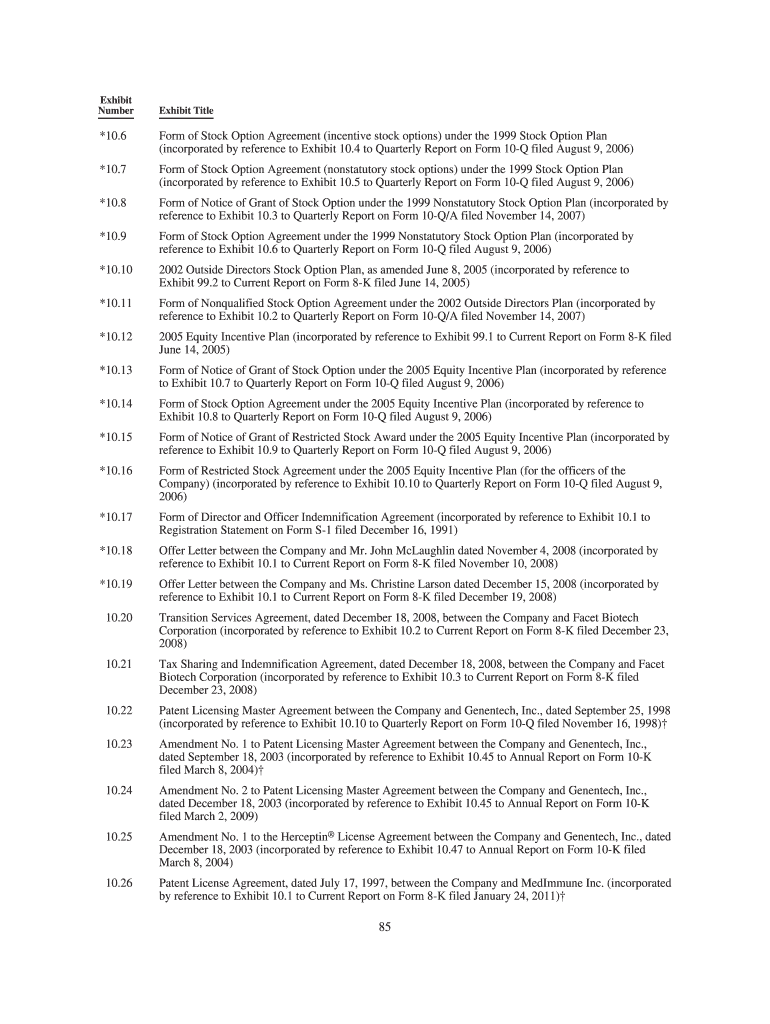

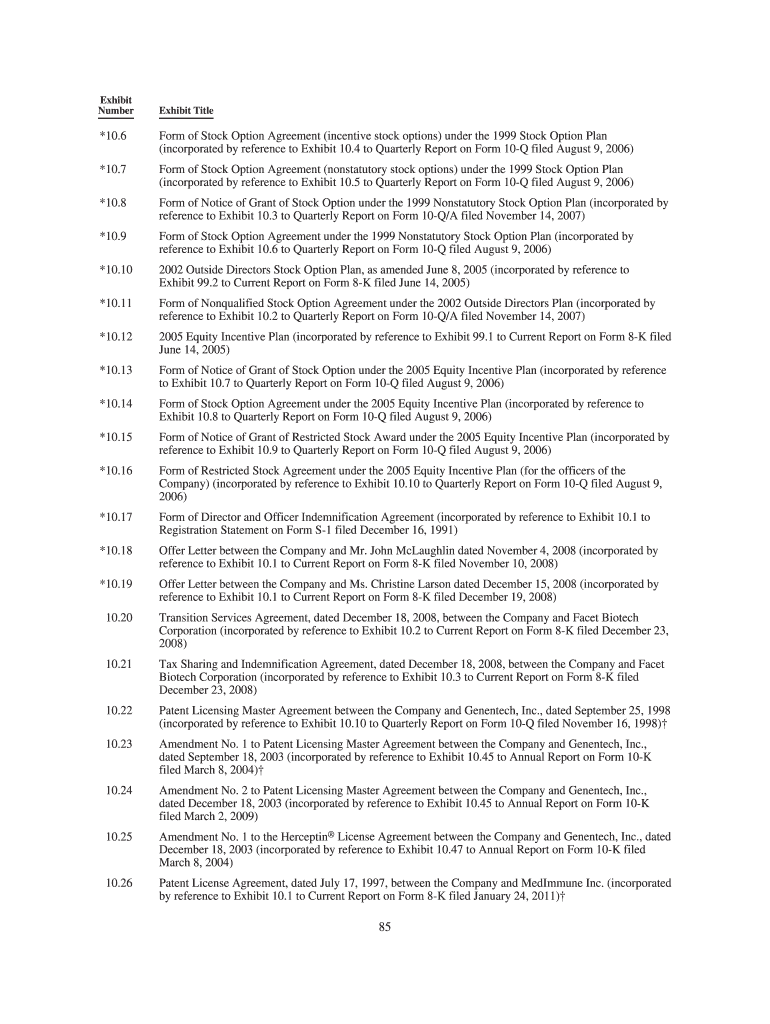

Exhibit Number Exhibit Title *10.6 Form of Stock Option Agreement (incentive stock options) under the 1999 Stock Option Plan (incorporated by reference to Exhibit 10.4 to Quarterly Report on Form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 106 form of stock

Edit your 106 form of stock form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 106 form of stock form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 106 form of stock online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 106 form of stock. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 106 form of stock

How to fill out 106 form of stock:

01

Gather all relevant information: Before starting to fill out the 106 form of stock, make sure you have all the necessary information at hand. This includes details about the stock, such as the company name, stock symbol, purchase date, and cost basis.

02

Identify the purpose of the form: The 106 form of stock, also known as Form 1065, is used for reporting partnerships and S corporations. It is generally used to report income, deductions, gains, and losses related to stock investments.

03

Provide accurate identification details: Fill in the required identification information on the form, such as your name, social security number, and tax year. This will ensure that the form is properly associated with you as the filer.

04

Report the stock investments: In the appropriate sections of the form, provide detailed information about each stock investment. This may include the number of shares, purchase price, sale price, and any associated gains or losses.

05

Calculate and report gains or losses: Based on the information provided for each stock investment, calculate the overall gains or losses. Ensure that you accurately report these figures in the designated sections of the form.

06

Include any additional attachments or schedules: Depending on the complexity of your stock investments, you may need to attach additional schedules or forms to provide more detailed information. This could include schedules for reporting capital gains, partnership transactions, or any other relevant documentation.

Who needs 106 form of stock?

01

Investors in partnerships: The 106 form of stock is commonly used by individuals who are invested in partnerships. This could include limited partners, general partners, or investors in limited liability companies (LLCs) that are treated as partnerships for tax purposes.

02

Shareholders in S corporations: Shareholders in S corporations are also required to use the 106 form of stock to report their stock investments. S corporations are a specific type of corporation that provides pass-through taxation benefits to shareholders.

03

Individuals with stock investments in pass-through entities: In general, anyone who invests in pass-through entities, such as partnerships or S corporations, may need to use the 106 form of stock to report their investments accurately.

Overall, anyone who has invested in stock as part of a partnership or S corporation should carefully consider whether they need to fill out the 106 form of stock. It is essential to consult with a tax professional or refer to the IRS guidelines to determine the specific requirements and ensure compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 106 form of stock to be eSigned by others?

106 form of stock is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I execute 106 form of stock online?

With pdfFiller, you may easily complete and sign 106 form of stock online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit 106 form of stock straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing 106 form of stock.

What is 106 form of stock?

106 form or Form 106 is a document used to report stock transactions for tax purposes.

Who is required to file 106 form of stock?

Any individual or entity who has engaged in stock transactions that meet certain criteria is required to file the 106 form of stock.

How to fill out 106 form of stock?

To fill out the 106 form of stock, you need to provide information about the stock transactions made during the tax year, including the type of transaction, date of acquisition or sale, number of shares, and purchase/sale price.

What is the purpose of 106 form of stock?

The purpose of the 106 form of stock is to report stock transactions to the tax authorities for accurate calculation of taxable gains or losses.

What information must be reported on 106 form of stock?

The 106 form of stock requires reporting of information such as the type of transaction (acquisition or sale), date of acquisition or sale, number of shares, and purchase/sale price.

Fill out your 106 form of stock online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

106 Form Of Stock is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.