Get the free Understanding CHESS Depositary Interests

Show details

The document provides information to issuers about the services of CHESS Depositary Nominees Pty Ltd and explains the CHESS Depositary Interests (CDIs), their features, and the rights of CDI holders.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign understanding chess depositary interests

Edit your understanding chess depositary interests form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding chess depositary interests form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit understanding chess depositary interests online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit understanding chess depositary interests. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out understanding chess depositary interests

How to fill out Understanding CHESS Depositary Interests

01

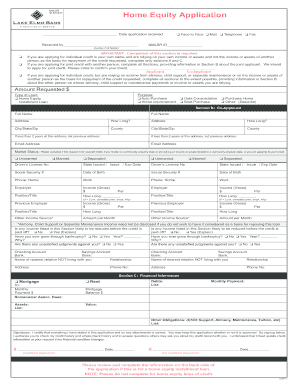

Obtain your CHESS Depositary Interest (CDI) form from your broker or financial institution.

02

Read the instructions provided on the form carefully.

03

Fill in your personal details, including your name, address, and contact information.

04

Specify the number of shares or units you wish to acquire through the CDI.

05

Provide any required identification documents or evidence of ownership.

06

Review the terms and conditions related to CDIs.

07

Sign and date the form where indicated.

08

Submit the completed form to your broker or financial institution for processing.

Who needs Understanding CHESS Depositary Interests?

01

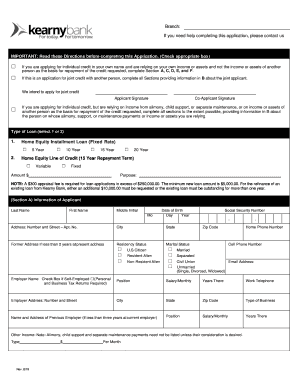

Investors wishing to trade shares of foreign companies listed on the Australian Securities Exchange (ASX).

02

Individuals requiring a clear understanding of their rights and entitlements related to CDIs.

03

Financial advisors or brokers assisting clients in understanding the CDI process.

04

Regulatory bodies monitoring compliance with investment and trading laws.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between CDIs and shares?

One CDI represents one Share. CDIs are quoted and tradeable on the . CDIs cannot be traded on the Toronto Stock Exchange (“TSX”) or OTCQX (a tier of the over-the-counter stock market of OTC Markets Group Inc.), unless first converted into Shares.

What is a CDI holding?

A CDI is the instrument developed by a subsidiary of that gives investors the same beneficial interests in foreign companies and funds as holding these shares and funds directly on their foreign exchange.

How do depositary interests work?

CDIs are issued by CREST, and one CDI is the equivalent of one share of an eligible foreign stock. Under UK law, actual international shares cannot be dealt directly through CREST, and so the CDIs allow investors to trade in some foreign stocks. CDIs can be settled through CREST like a regular UK share.

What are CHESS depositary interests?

Chess Depositary Interests or CDIs are instruments traded on the Australian Stock Exchange () that allow non-Australian companies to list their shares on the exchange and use the exchange's settlement systems.

What is a CHESS depositary instrument?

To overcome this difficulty, developed a type of depositary receipt known as a CHESS Depositary Interest (“CDI”). CDIs allow Investors to obtain all the economic benefits of foreign financial products and Australian Government Bonds without actually holding legal title to those financial products.

What are depositary interests?

A CREST Depository Interest (CDI) is a UK investment that represents an investment listed on an international exchange. CREST (a securities depository for UK shares) issues CDIs and each of these is the equivalent of one share of the underlying company.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Understanding CHESS Depositary Interests?

Understanding CHESS Depositary Interests refers to the knowledge of how the Clearing House Electronic Subregister System (CHESS) operates in relation to depositary interests, which represent ownership of underlying securities.

Who is required to file Understanding CHESS Depositary Interests?

Entities that hold or manage depositary interests on behalf of investors are typically required to file Understanding CHESS Depositary Interests, including brokers, custodians, and issuers.

How to fill out Understanding CHESS Depositary Interests?

To fill out Understanding CHESS Depositary Interests, one must provide accurate details about the depositary interests held, including the quantity, issuing company, and the identification of the beneficial owner.

What is the purpose of Understanding CHESS Depositary Interests?

The purpose of Understanding CHESS Depositary Interests is to provide a transparent mechanism for tracking and managing ownership of interests in underlying securities within the CHESS system.

What information must be reported on Understanding CHESS Depositary Interests?

The information that must be reported includes the identity of the depositary interest holders, the amount of interests held, transaction details, and any changes in ownership.

Fill out your understanding chess depositary interests online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Understanding Chess Depositary Interests is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.