CA BOE-571-L (P1) 2016 free printable template

Show details

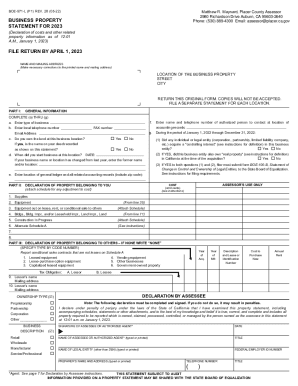

FORM BOE571L (P1) REV. 21 ×0515) BUSINESS PROPERTY STATEMENT 571L 2016 MARK CHURCH COUNTY OF SAN MATEO ASSESSOR COUNTY CLERK RECORDER & CHIEF ELECTIONS OFFICER 555 COUNTY CENTER, REDWOOD CITY, CA

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA BOE-571-L P1

Edit your CA BOE-571-L P1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA BOE-571-L P1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA BOE-571-L P1 online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA BOE-571-L P1. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA BOE-571-L (P1) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA BOE-571-L P1

How to fill out CA BOE-571-L (P1)

01

Obtain the CA BOE-571-L (P1) form from the California State Board of Equalization website or your local office.

02

Read the instructions carefully to ensure you understand the purpose of the form.

03

Fill in your name and contact information at the top of the form.

04

Provide details regarding the property in question, including its location and description.

05

Indicate the reason for the change or the request being made.

06

Include any relevant documentation or evidence that supports your claim.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form at the bottom.

09

Submit the form according to the provided submission guidelines, either by mail or electronically.

Who needs CA BOE-571-L (P1)?

01

Property owners who are seeking to make changes to their property tax assessments.

02

Individuals or entities contesting their assessed value on their property for tax purposes.

03

Those applying for property tax exemptions or exclusions in California.

Fill

form

: Try Risk Free

People Also Ask about

Does California have a business personal property tax?

In California, business personal property is subject to annual property taxes, which are calculated based on the value of the property. The amount of tax owed will vary based on the location of the property, the type of property, and other factors.

What is Form 571 L used for?

The Form 571L or 571A constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled or managed on the tax lien date. The form is approved by the State Board of Equalization (BOE) but forms are administered by the county.

What is the business personal property tax rate in California?

California's property tax rate is 1% of assessed value (also applies to real property) plus any bonded indebtedness voted in by the taxpayers.

What is a 571 R form?

The 571-R is a State of California tax form required to be completed by rental businesses, including Short-Term Rental businesses.

What is property tax for commercial property in California?

The general property tax rate for California commercial and industrial properties has been capped at 1% of assessed value since voters approved Prop. 13 in 1978.

Where can I find state and local personal property taxes?

Your local tax assessor's office (or its website) should be able to supply information on the personal property tax rate (if any) that you're subject to and what types of property are included.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the CA BOE-571-L P1 in Gmail?

Create your eSignature using pdfFiller and then eSign your CA BOE-571-L P1 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete CA BOE-571-L P1 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your CA BOE-571-L P1, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I complete CA BOE-571-L P1 on an Android device?

Use the pdfFiller mobile app and complete your CA BOE-571-L P1 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is CA BOE-571-L (P1)?

CA BOE-571-L (P1) is a form used by business owners in California to report personal property such as equipment and fixtures for tax purposes.

Who is required to file CA BOE-571-L (P1)?

Any business owner in California who owns personal property that is used in their business and is subject to property tax must file CA BOE-571-L (P1).

How to fill out CA BOE-571-L (P1)?

To fill out CA BOE-571-L (P1), business owners need to provide their business information, a detailed list of personal property, its location, and the estimated value of each item.

What is the purpose of CA BOE-571-L (P1)?

The purpose of CA BOE-571-L (P1) is to assess personal property for taxation by the county tax assessor.

What information must be reported on CA BOE-571-L (P1)?

Information that must be reported includes the business name, the property location, a description of the personal property, its acquisition date, and the estimated cost or value of the property.

Fill out your CA BOE-571-L P1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA BOE-571-L p1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.