Get the free APPLICATION FOR ADVISER LICENSE – CORPORATIONS, PARTNERSHIPS, & LIMITED LIABILITY CO...

Show details

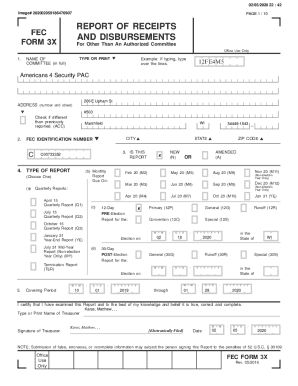

This document is an application form to obtain an Adviser License for corporations, partnerships, and limited liability companies, outlining instructions and necessary information for completion.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for adviser license

Edit your application for adviser license form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for adviser license form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for adviser license online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for adviser license. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for adviser license

How to fill out APPLICATION FOR ADVISER LICENSE – CORPORATIONS, PARTNERSHIPS, & LIMITED LIABILITY COMPANIES

01

Obtain the APPLICATION FOR ADVISER LICENSE from the appropriate regulatory agency's website.

02

Read the instructions carefully to understand the requirements.

03

Fill out the applicant's information, including the legal name of the corporation, partnership, or LLC.

04

Provide details about the business address and contact information.

05

Complete the sections regarding ownership structure and key personnel.

06

Disclose any regulatory history or disciplinary actions, if applicable.

07

Include the necessary documentation, such as proof of business registration and any required financial statements.

08

Review the application thoroughly to ensure accuracy and completeness.

09

Submit the application along with any applicable fees as directed by the regulatory agency.

10

Keep a copy of the submitted application and track its status.

Who needs APPLICATION FOR ADVISER LICENSE – CORPORATIONS, PARTNERSHIPS, & LIMITED LIABILITY COMPANIES?

01

Businesses operating as corporations, partnerships, or limited liability companies seeking to offer advisory services.

02

Entities that wish to provide investment advice or manage client portfolios under a regulated environment.

03

Businesses that need to comply with state or federal licensing requirements for financial advisers.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a limited liability partnership and a limited company?

LLPs, being partnerships, offer flexibility and confidentiality to their members, while Ltd companies have shareholders and directors at the core of their structure. LLPs resemble normal partnerships, with liability limited to the members' investments, making it a fusion of a partnership and a company.

What is the difference between LLP and partnership?

Both LLPs and partnership firms have their own advantages and limitations. While an LLP offers the benefit of limited liability and a flexible management structure, a partnership firm provides simplicity in decision-making. Choosing the right structure depends on the specific needs and goals of the business.

How to become a limited liability partnership?

Forming a Limited Liability Partnership LLPs must be registered with Companies House and have at least two members, with two designated members responsible for meeting legal obligations. They need a registered office address. Information about People with Significant Control (PSCs) must be provided, usually the members.

What is the difference between a limited partnership and a limited liability partnership?

With an LP, limited partners can be added without giving them the right to participate in business decisions. In contrast, while an LLP can also raise funds, any partners added to an LLP will have the right to participate in business decisions and operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR ADVISER LICENSE – CORPORATIONS, PARTNERSHIPS, & LIMITED LIABILITY COMPANIES?

The APPLICATION FOR ADVISER LICENSE – CORPORATIONS, PARTNERSHIPS, & LIMITED LIABILITY COMPANIES is a formal submission required for businesses structured as corporations, partnerships, or limited liability companies to obtain a license to operate as an adviser. It ensures compliance with regulatory requirements in the financial sector.

Who is required to file APPLICATION FOR ADVISER LICENSE – CORPORATIONS, PARTNERSHIPS, & LIMITED LIABILITY COMPANIES?

Corporations, partnerships, and limited liability companies that engage in advisory services and wish to legally operate in that capacity are required to file this application.

How to fill out APPLICATION FOR ADVISER LICENSE – CORPORATIONS, PARTNERSHIPS, & LIMITED LIABILITY COMPANIES?

To fill out the APPLICATION FOR ADVISER LICENSE, applicants should carefully provide accurate information regarding their business structure, ownership, and the services they intend to offer, along with any relevant financial disclosures and supporting documentation as specified by the regulatory authority.

What is the purpose of APPLICATION FOR ADVISER LICENSE – CORPORATIONS, PARTNERSHIPS, & LIMITED LIABILITY COMPANIES?

The purpose of the application is to ensure that advisory firms meet the necessary legal and ethical standards to protect clients and maintain transparency in financial advising services.

What information must be reported on APPLICATION FOR ADVISER LICENSE – CORPORATIONS, PARTNERSHIPS, & LIMITED LIABILITY COMPANIES?

The application generally requires reporting information such as business identification details, ownership structure, the qualifications of key personnel, a description of advisory services offered, financial statements, and any disciplinary history pertaining to the firm or its representatives.

Fill out your application for adviser license online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Adviser License is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.