Get the free Nebraska Lottery/Raffle Annual Report

Show details

This document provides annual reporting forms for nonprofit organizations in Nebraska that held a lottery/raffle license, requiring detailed accounting of receipts, expenditures, and disbursements

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nebraska lotteryraffle annual report

Edit your nebraska lotteryraffle annual report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nebraska lotteryraffle annual report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nebraska lotteryraffle annual report online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nebraska lotteryraffle annual report. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nebraska lotteryraffle annual report

How to fill out Nebraska Lottery/Raffle Annual Report

01

Gather all necessary financial records related to the lottery/raffle.

02

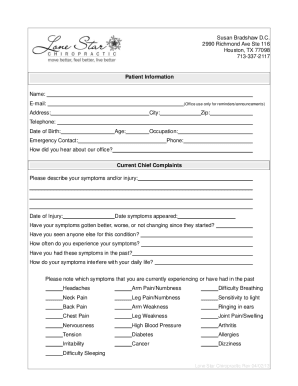

Download or obtain the Nebraska Lottery/Raffle Annual Report form.

03

Fill out the organization’s details including name, address, and contact information.

04

Provide details of the event, including the date, location, and type of raffle.

05

Report the total revenue generated from the raffle and any expenses incurred.

06

Include the distribution of funds and how they will be used.

07

Sign and date the report to certify its accuracy.

08

Submit the completed report by the specified deadline to the Nebraska Lottery.

Who needs Nebraska Lottery/Raffle Annual Report?

01

Organizations that conduct raffles and need to report their activities to remain compliant with state regulations.

02

Non-profit groups looking to demonstrate legal gaming operations and transparency to stakeholders.

Fill

form

: Try Risk Free

People Also Ask about

How much is $100,000 after taxes in Nebraska?

If you make $100,000 a year living in the region of Nebraska, United States of America, you will be taxed $28,201. That means that your net pay will be $71,799 per year, or $5,983 per month.

How are lottery winnings taxed in Nebraska?

The Nebraska Lottery will notify the IRS and the Nebraska Department of Revenue of these prizes. Prizes above $5,000 have state and federal taxes automatically withheld, at 5 and 24 percent, respectively. Map of Grand Island Claim Center: click to enlarge.

Has anyone ever won the lottery in Nebraska?

08/01/2022 - Wendy Donahue of Omaha won $1 million playing Powerball from the Nebraska Lottery.

How much are lottery winnings taxed in Nebraska?

The Nebraska Lottery will notify the IRS and the Nebraska Department of Revenue of these prizes. Prizes above $5,000 have state and federal taxes automatically withheld, at 5 and 24 percent, respectively. Map of Grand Island Claim Center: click to enlarge.

How old do you have to be to buy a lottery ticket in Nebraska?

Nebraska statutes make it a criminal offense to sell Lottery tickets to a person under 19 years of age, or for someone under 19 years of age to purchase Lottery tickets or redeem Lottery tickets for prizes.

Does Nebraska have the lottery?

The Nebraska Lottery is run by the government of Nebraska. It was established by the state legislature in 1993. It is a member of the Multi-State Lottery Association (MUSL).

How much tax do you pay on a $1 000 lottery ticket in Mass?

Prizes received by Massachusetts residents from the Massachusetts lottery or from lotteries, raffles, races, beano or other events of chance, are includible in Massachusetts gross income and are taxable at the rate of five percent (5%) plus surcharge.

What is the Nebraska County and City Lottery Act?

The Nebraska County and City Lottery Act (Act) allows a county, city, or village to conduct a lottery for community betterment purposes. The Nebraska Department of Revenue (Department) is charged with the licensing and regulatory oversight of lottery activities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Nebraska Lottery/Raffle Annual Report?

The Nebraska Lottery/Raffle Annual Report is a document that provides a summary of the activities, financial performance, and operational details of lottery and raffle operations in Nebraska for a specific year.

Who is required to file Nebraska Lottery/Raffle Annual Report?

Organizations that conduct lottery or raffle activities in Nebraska must file the Nebraska Lottery/Raffle Annual Report.

How to fill out Nebraska Lottery/Raffle Annual Report?

To fill out the Nebraska Lottery/Raffle Annual Report, organizations should follow the form's instructions, providing detailed information about their revenue, expenses, number of tickets sold, and overall financial performance related to the lottery or raffle.

What is the purpose of Nebraska Lottery/Raffle Annual Report?

The purpose of the Nebraska Lottery/Raffle Annual Report is to ensure transparency and accountability in the operation of lottery and raffle activities, while providing regulatory authorities with the necessary information to oversee compliance with state laws.

What information must be reported on Nebraska Lottery/Raffle Annual Report?

The Nebraska Lottery/Raffle Annual Report must include information such as total gross receipts, expenses, net profits, number of tickets sold, and the distribution of proceeds, as well as any other relevant details as specified in the reporting guidelines.

Fill out your nebraska lotteryraffle annual report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nebraska Lotteryraffle Annual Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.