Liberty National Life Insurance Company R-868-2 2006-2025 free printable template

Show details

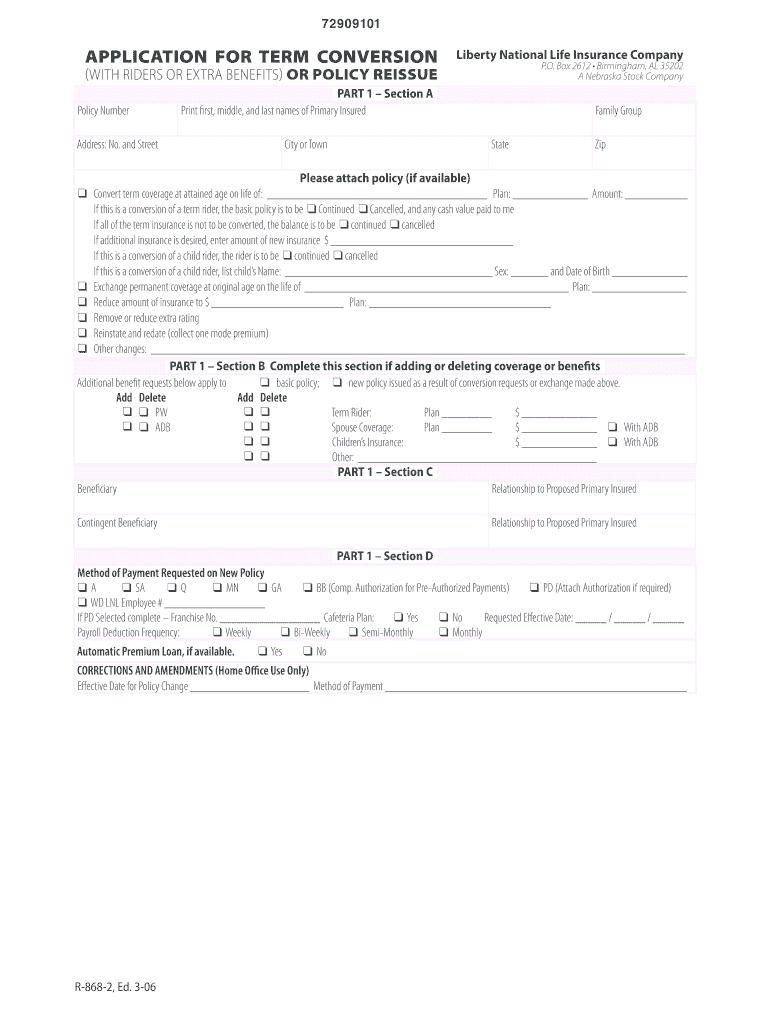

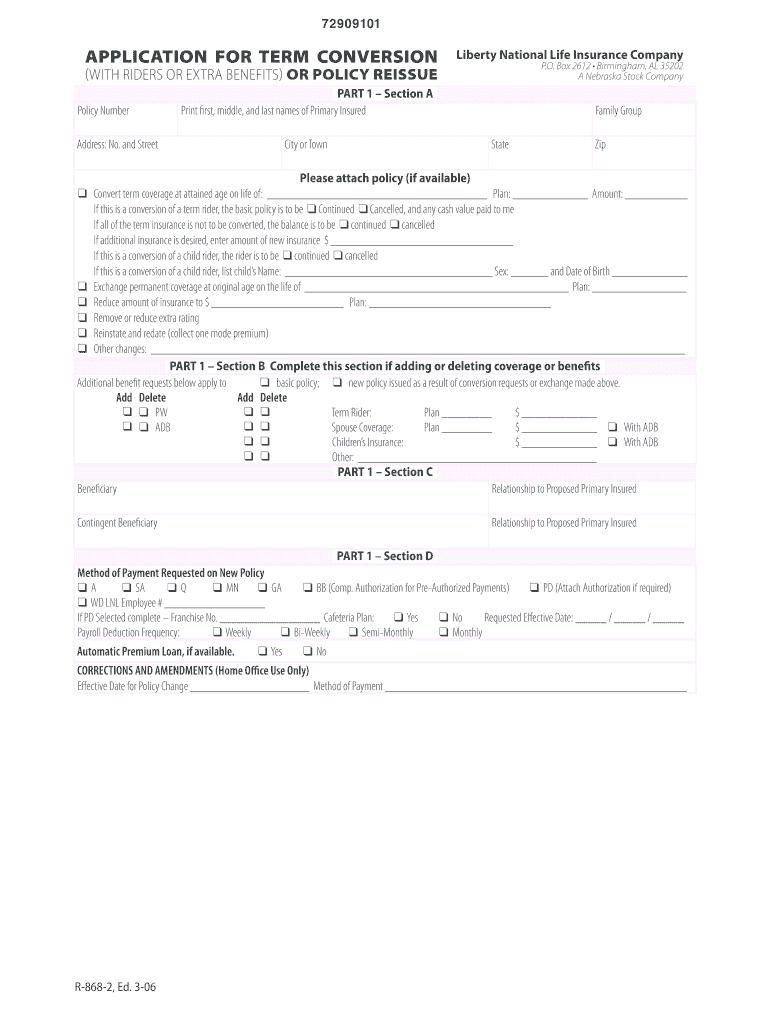

72909101 APPLICATION FOR TERM CONVERSION Liberty National Life Insurance Company P.O. Box 2612 ? Birmingham, AL 35202 A Nebraska Stock Company (with Riders or Extra Benefits) OR POLICY REISSUE Policy

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign r868 2 application conversion printable form

Edit your liberty national policy reissue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 72909101 national company create form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 72909101 company create online

Follow the steps below to take advantage of the professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 72909101 life insurance online form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 72909101 life insurance printable form

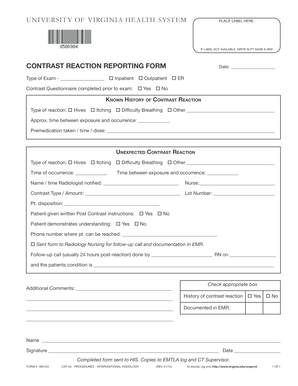

How to fill out Liberty National Life Insurance Company R-868-2

01

Begin by obtaining the Liberty National Life Insurance Company R-868-2 form from an authorized source.

02

Fill out your personal information at the top of the form, including your full name, address, and contact information.

03

Indicate the type of insurance policy you are applying for by selecting the appropriate option.

04

Provide details regarding your beneficiaries, including their names, relationships to you, and any relevant contact information.

05

Complete any health-related questions honestly and accurately, as this information is crucial for underwriting.

06

Sign and date the form at the designated area to validate your application.

07

Review the application for any inaccuracies or missing information before submission.

08

Submit the completed form to Liberty National Life Insurance Company via the specified method (mail, online, etc.).

Who needs Liberty National Life Insurance Company R-868-2?

01

Individuals seeking life insurance coverage for themselves or their families.

02

Parents wanting to secure financial protection for their dependents.

03

People planning for their future and looking for long-term financial security.

04

Individuals with financial responsibilities, such as mortgages or loans, wanting to ensure their debts are covered.

Fill

72909101 life 35202 template

: Try Risk Free

People Also Ask about 72909101 liberty national download

What does term conversion mean in insurance?

A term-to-permanent life insurance conversion, or “term-to-perm” conversion, allows you to extend your life insurance coverage. You may have a 10-,15-, 20- or 30-year term life insurance contract now. Instead of letting it expire, you may be able to exchange it for a permanent policy without needing a new medical exam.

What does term conversion mean?

A term conversion is when you convert your term life insurance policy into a permanent life insurance policy. Most term policies will include a stipulation that allows you to convert some or all of your coverage into a permanent policy within a certain time frame.

What does application for conversion mean?

So what is applicant conversion? At it's most basic level, applicant conversion is when a job candidate performs an “action” on either your careers site or on one of your job ads.

What does conversion mean on a term life insurance policy?

A conversion clause is a section of a life insurance contract that allows policyholders to convert their term life insurance policy to a permanent form of life insurance. Conversion clauses may be valuable because they allow a policyholder to maintain coverage without presenting new evidence of their insurability.

How does the conversion option work on life insurance?

An insurance policy with a conversion privilege allows the insured to switch to another policy without submitting to a physical examination. A conversion privilege guarantees coverage and set premium payments for a certain number of years regardless of the insured's health status.

What does conversion mean in a life insurance policy?

A conversion clause is a section of a life insurance contract that allows policyholders to convert their term life insurance policy to a permanent form of life insurance. Conversion clauses may be valuable because they allow a policyholder to maintain coverage without presenting new evidence of their insurability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send liberty national reissue fillable for eSignature?

When you're ready to share your national insurance r868 2 policy reissue, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I execute 72909101 life insurance make online?

pdfFiller makes it easy to finish and sign national insurance application term reissue online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit 72909101 life o pdf online?

The editing procedure is simple with pdfFiller. Open your life company application conversion reissue in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

What is Liberty National Life Insurance Company R-868-2?

Liberty National Life Insurance Company R-868-2 is a specific form or document related to insurance reporting and compliance for Liberty National Life Insurance Company.

Who is required to file Liberty National Life Insurance Company R-868-2?

The filing of Liberty National Life Insurance Company R-868-2 is typically required by agents and representatives of Liberty National Life Insurance Company who are involved in insurance sales and management.

How to fill out Liberty National Life Insurance Company R-868-2?

To fill out Liberty National Life Insurance Company R-868-2, individuals must provide accurate and complete information as required by the form's guidelines, including personal information, insurance details, and necessary signatures.

What is the purpose of Liberty National Life Insurance Company R-868-2?

The purpose of Liberty National Life Insurance Company R-868-2 is to ensure compliance with insurance regulations and to provide necessary information for the company's operational and financial reporting.

What information must be reported on Liberty National Life Insurance Company R-868-2?

Information that must be reported on Liberty National Life Insurance Company R-868-2 typically includes policyholder details, policy information, premium amounts, and any other relevant insurance data as prescribed by the form.

Fill out your national life r 868 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

72909101 Liberty Box Form is not the form you're looking for?Search for another form here.

Keywords relevant to application term conversion

Related to 72909101 al address

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.