Get the free Putting Your Money to Work A Simple Guide to Financial Education - floridaliteracy

Show details

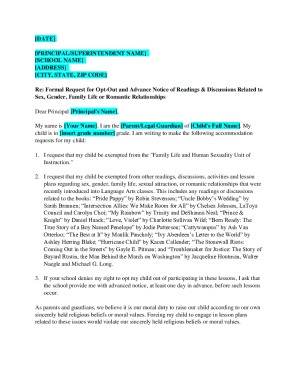

Putting your money to work: A simple guide to financial education 1 Putting your money to work: A simple guide to financial education This booklet is meant to provide general financial information;

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign putting your money to

Edit your putting your money to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your putting your money to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

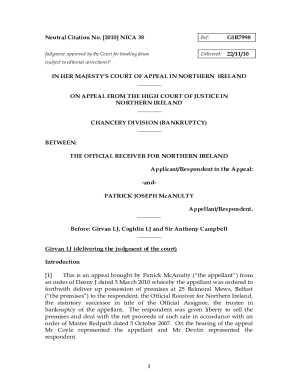

How to edit putting your money to online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit putting your money to. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out putting your money to

How to fill out putting your money to:

01

Start by setting clear financial goals. Determine why you want to invest your money and what you hope to achieve in the long run. This could include saving for retirement, funding your child's education, or purchasing a house.

02

Educate yourself about different investment options. Research various investment vehicles such as stocks, bonds, mutual funds, real estate, or starting your own business. Understand the risks and potential returns associated with each option.

03

Assess your risk tolerance. Some investments come with higher risks but also offer the potential for higher returns, while others may be more conservative with lower potential returns. Consider your comfort level with risk and align your investments accordingly.

04

Create a diversified portfolio. Spreading your investments across different asset classes and industries can help reduce risk and enhance potential returns. Diversification can involve investing in stocks, bonds, real estate, and other assets to minimize the impact of any single investment.

05

Consult with a financial advisor. Seeking professional guidance can be beneficial, especially if you are new to investing. A financial advisor can help assess your financial situation, design an investment plan tailored to your goals, and provide ongoing advice and support.

06

Monitor and review your investments regularly. Keep a close eye on your investments and make adjustments as needed. Economic conditions, market trends, and personal circumstances may warrant reallocating your portfolio or making other investment decisions.

07

Stay informed and stay patient. Investing is a long-term game, and it's important to stay informed about market trends and developments. However, avoid making impulsive decisions based on short-term fluctuations. Patience and a long-term perspective can lead to greater investment success.

Who needs putting your money to:

01

Individuals who want to grow their wealth over time and secure their financial future

02

Those who have specific financial goals such as saving for retirement, funding a child's education, or purchasing a home

03

People looking to diversify their income streams and build passive income

04

Entrepreneurs who want to invest in their business or start a new venture

05

Individuals who want to take advantage of investment opportunities to earn higher returns than traditional savings accounts or certificates of deposit (CDs)

06

Anyone seeking financial independence and the ability to reach their financial goals faster through smart investing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my putting your money to directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign putting your money to and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit putting your money to from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your putting your money to into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send putting your money to to be eSigned by others?

putting your money to is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

What is putting your money to?

Putting your money to refers to the act of investing or allocating your funds into various financial instruments, such as stocks, bonds, mutual funds, or real estate.

Who is required to file putting your money to?

Individuals or entities who have income from investments and meet the filing requirements set by the tax authorities are required to file putting your money to.

How to fill out putting your money to?

To fill out putting your money to, you will need to report your investment income, including any capital gains or dividends, on the appropriate tax forms provided by your local tax authority. You may also need to provide details of the specific investments made and any related expenses.

What is the purpose of putting your money to?

The purpose of putting your money to is to grow your wealth by investing in various financial instruments that have the potential to generate returns or income over time.

What information must be reported on putting your money to?

When filing putting your money to, you will typically need to report details of your investment income, including the source and amount of income, any gains or losses from the sale of investments, and any expenses related to the investments.

Fill out your putting your money to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Putting Your Money To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.