Get the free Chapter 9 Partnership Goodwill - proxy flss edu

Show details

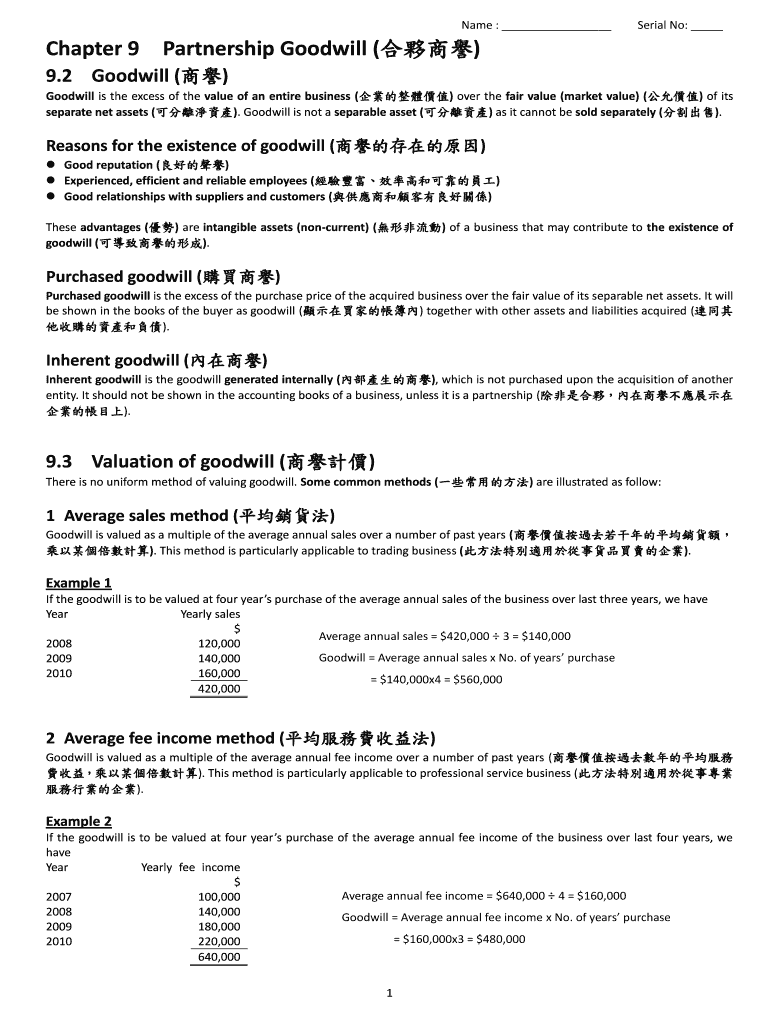

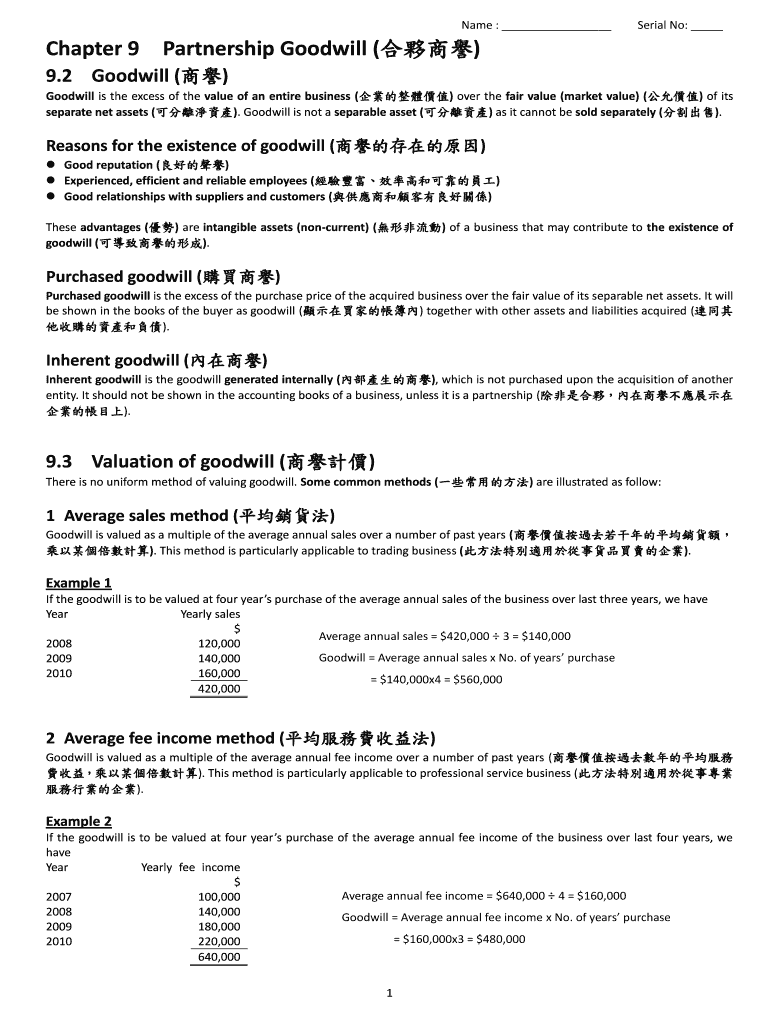

Name : Chapter 9 Serial No: Partnership Goodwill () 9.2 Goodwill () Goodwill is the excess of the value of an entire business () over the fair value (market value) () of its separate net assets ().

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 9 partnership goodwill

Edit your chapter 9 partnership goodwill form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 9 partnership goodwill form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing chapter 9 partnership goodwill online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit chapter 9 partnership goodwill. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 9 partnership goodwill

How to fill out chapter 9 partnership goodwill:

01

Start by gathering all relevant financial information and documents related to the partnership.

02

Review the partnership agreement to understand the terms and conditions regarding the treatment of goodwill.

03

Calculate the partnership's total assets and liabilities to determine the net worth of the partnership.

04

Determine the fair value of the partnership's identifiable tangible and intangible assets.

05

Allocate the net worth of the partnership among the partners based on their respective capital accounts or profit-sharing ratios.

06

Assess if the partnership has any unrecorded or unrecognized intangible assets, such as goodwill.

07

If goodwill exists, calculate its value by subtracting the fair value of the identifiable net tangible assets from the overall net worth of the partnership.

08

Allocate the calculated goodwill among the partners based on their interests in the partnership.

09

Prepare the necessary journal entries to record the allocation of goodwill.

10

Review and reconcile the partnership's balance sheet to ensure that the goodwill allocation is properly reflected.

Who needs chapter 9 partnership goodwill:

01

Partnerships that have significant intangible assets, such as brand reputation, customer relationships, or patents.

02

Partnerships involved in mergers or acquisitions where the value of goodwill needs to be determined.

03

Partnerships undergoing a reorganization or dissolution where the allocation of assets and liabilities, including goodwill, is required.

04

Accountants and financial professionals involved in preparing financial statements or conducting audits for partnerships.

05

Investors, creditors, or other stakeholders who are interested in understanding the financial position and value of a partnership.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my chapter 9 partnership goodwill in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your chapter 9 partnership goodwill along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I get chapter 9 partnership goodwill?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific chapter 9 partnership goodwill and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit chapter 9 partnership goodwill on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share chapter 9 partnership goodwill from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is chapter 9 partnership goodwill?

Chapter 9 partnership goodwill refers to the portion of a partnership's value that exceeds the fair market value of its assets and liabilities.

Who is required to file chapter 9 partnership goodwill?

Partnerships are required to file chapter 9 partnership goodwill if their goodwill exceeds a certain threshold.

How to fill out chapter 9 partnership goodwill?

Chapter 9 partnership goodwill is typically filled out using Form 1065, Schedule K-1.

What is the purpose of chapter 9 partnership goodwill?

The purpose of chapter 9 partnership goodwill is to ensure that partnerships accurately report the value of their goodwill.

What information must be reported on chapter 9 partnership goodwill?

Partnerships must report the calculation of their goodwill, including any adjustments made.

Fill out your chapter 9 partnership goodwill online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 9 Partnership Goodwill is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.