Get the free Emergency Home Repair Loan Program Selection

Show details

This document is an application for the Emergency Home Repair Program provided by the City of Oakland, offering loan funds for urgent home repairs.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign emergency home repair loan

Edit your emergency home repair loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your emergency home repair loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing emergency home repair loan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

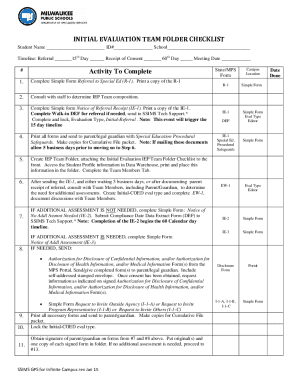

Edit emergency home repair loan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out emergency home repair loan

How to fill out Emergency Home Repair Loan Program Selection

01

Gather necessary documentation including proof of income, identification, and homeownership.

02

Obtain a copy of the Emergency Home Repair Loan Program application form.

03

Fill out the application form with accurate personal information and details about the property needing repairs.

04

Specify the type of repairs needed and provide estimates if available.

05

Review the application for completeness and accuracy.

06

Submit the application along with all required documentation to the designated agency.

Who needs Emergency Home Repair Loan Program Selection?

01

Homeowners who are low-income and require urgent repairs to ensure safety and livability of their home.

02

Individuals or families facing financial hardship and unable to afford necessary home repairs.

03

Residents of areas affected by natural disasters who need funding for repairs.

Fill

form

: Try Risk Free

People Also Ask about

Do grants exist for emergency home repairs?

State, local, and federal governments offer loans to assist various individuals and situations. Home repair grants cater to senior citizens, mobile homeowners, veterans with disabilities, low-income Native Americans, homeowners facing disaster recovery, entire communities, and low-income rural residents.

What if I can't afford my home repairs?

Call your state or county. Many have programs for low income homeowners to get funds for home repair, especially hazardous conditions. They sometimes put a lien on the house that gets paid back when the house is sold but has no interest. Check into it.

What is the hardship grant for homeowners?

Homeowner Assistance Fund. The Homeowner Assistance Fund (HAF) authorized by the American Rescue Plan Act, provides $9.961 billion to support homeowners facing financial hardship associated with COVID-19.

How hard is it to get a home repair loan?

Applying for home improvement loans might seem like a time-intensive process, akin to getting a mortgage. But this financing option — typically advertised as a personal loan — is simpler than you might imagine and is widely available. Compare options from banks, credit unions and online lenders.

What happens if I can't afford to fix my house?

Call your state or county. Many have programs for low income homeowners to get funds for home repair, especially hazardous conditions. They sometimes put a lien on the house that gets paid back when the house is sold but has no interest. Check into it.

What is the Florida $10,000 grant for homeowners?

Homeowner Assistance Fund. The Homeowner Assistance Fund (HAF) authorized by the American Rescue Plan Act, provides $9.961 billion to support homeowners facing financial hardship associated with COVID-19.

What is the hardship grant for homeowners?

If you need money to cover a home repair, here are a few types of loans you may want to consider. Personal loans. Your credit helps determine whether you qualify for a personal loan and the interest rate you may receive. Home equity loans. Home equity lines of credit. Cash-out refinance. Credit cards. Community programs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Emergency Home Repair Loan Program Selection?

The Emergency Home Repair Loan Program Selection refers to the process by which eligible homeowners can select to apply for loans aimed at funding urgent repairs that are necessary to maintain the safety and livability of their homes.

Who is required to file Emergency Home Repair Loan Program Selection?

Homeowners who meet specific income and eligibility criteria set forth by the program, and who need immediate repairs to their homes, are required to file an application for the Emergency Home Repair Loan Program Selection.

How to fill out Emergency Home Repair Loan Program Selection?

To fill out the Emergency Home Repair Loan Program Selection, applicants must complete a designated application form provided by the program. This includes providing personal and financial information, details about the repairs needed, and submitting any required documentation.

What is the purpose of Emergency Home Repair Loan Program Selection?

The purpose of the Emergency Home Repair Loan Program Selection is to assist low-income homeowners in obtaining the necessary financial resources to address urgent home repairs that could pose health or safety risks.

What information must be reported on Emergency Home Repair Loan Program Selection?

Applicants must report personal information such as name, address, income, the specific nature of repairs needed, and any relevant financial documents that support their eligibility for the program.

Fill out your emergency home repair loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Emergency Home Repair Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.