Get the free PERSONAL FINANCIAL STATEMENT - OMWBE - omwbe wa

Show details

OMB APPROVAL NO. 3245-0188 EXPIRATION DATE: 09/30/2014 PERSONAL FINANCIAL STATEMENT As of U.S. SMALL BUSINESS ADMINISTRATION, Complete this form for: (I) each proprietor; (2) general partner; (3)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal financial statement

Edit your personal financial statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal financial statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal financial statement online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit personal financial statement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal financial statement

How to fill out a personal financial statement:

01

Gather all necessary financial documents such as bank statements, tax returns, investment statements, and loan statements.

02

Start by providing your personal information, including your name, contact information, and social security number.

03

List your assets, including cash, investments, real estate, vehicles, and valuable personal belongings. Include their approximate values.

04

Note your liabilities, such as mortgages, loans, credit card debt, and any other outstanding debts. Include the outstanding balances and monthly payments.

05

Calculate your net worth by subtracting your liabilities from your assets. This gives you a snapshot of your overall financial position.

06

Provide details about your income sources, including salary, business income, rental income, investment income, and any other sources of revenue.

07

List your monthly expenses, including housing costs, transportation expenses, utilities, insurance premiums, loan payments, and any other regular expenditures.

08

Calculate your monthly cash flow by subtracting your monthly expenses from your income. This helps determine whether you have a surplus or a deficit.

09

Complete the personal financial statement form by signing and dating it. Be sure to review the information for accuracy and completeness.

Who needs a personal financial statement?

01

Individuals applying for loans or mortgages may be required to submit a personal financial statement to assess their creditworthiness and ability to repay the loan.

02

Small business owners may need a personal financial statement when applying for business loans to demonstrate their personal financial stability and commitment to their business.

03

High-net-worth individuals, especially those involved in estate planning or wealth management, often need personal financial statements to evaluate their financial standing and make informed decisions about investments, taxes, and estate distribution.

04

Anyone interested in gaining a comprehensive overview of their financial situation can benefit from creating a personal financial statement. It can help individuals assess their financial health, track progress toward financial goals, and identify areas for improvement.

Note: It's always advisable to consult a financial advisor or accounting professional for guidance in completing a personal financial statement accurately and effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my personal financial statement in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your personal financial statement and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I edit personal financial statement from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your personal financial statement into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I edit personal financial statement on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as personal financial statement. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

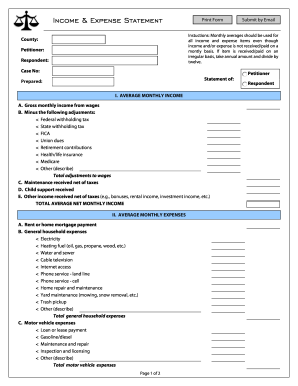

What is personal financial statement?

A personal financial statement is a document that summarizes an individual's financial situation, including their assets, liabilities, expenses, and income.

Who is required to file personal financial statement?

The requirement to file a personal financial statement varies depending on the jurisdiction and specific regulations. Generally, individuals in positions of authority or public office, such as political candidates, government officials, or high-ranking corporate executives, may be required to file a personal financial statement.

How to fill out personal financial statement?

To fill out a personal financial statement, you typically need to provide information on your assets (such as cash, investments, real estate), liabilities (such as loans, credit card debts), expenses, income, and any other relevant financial details. This information is usually organized in designated sections or forms provided by the respective authority or institution.

What is the purpose of personal financial statement?

The purpose of a personal financial statement is to provide a comprehensive snapshot of an individual's financial condition. This document helps assess an individual's net worth, financial stability, and their ability to meet financial obligations. It is often required for loan applications, evaluating creditworthiness, supporting investment decisions, or as part of compliance requirements.

What information must be reported on personal financial statement?

The information reported on a personal financial statement typically includes details of assets (such as cash, investments, real estate, vehicles), liabilities (such as loans, mortgages, credit card debts), income sources, expenses, and any other relevant financial information. Specific requirements may vary based on regulations or the purpose of the statement.

Fill out your personal financial statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Financial Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.