SBA 160a 1987-2025 free printable template

Show details

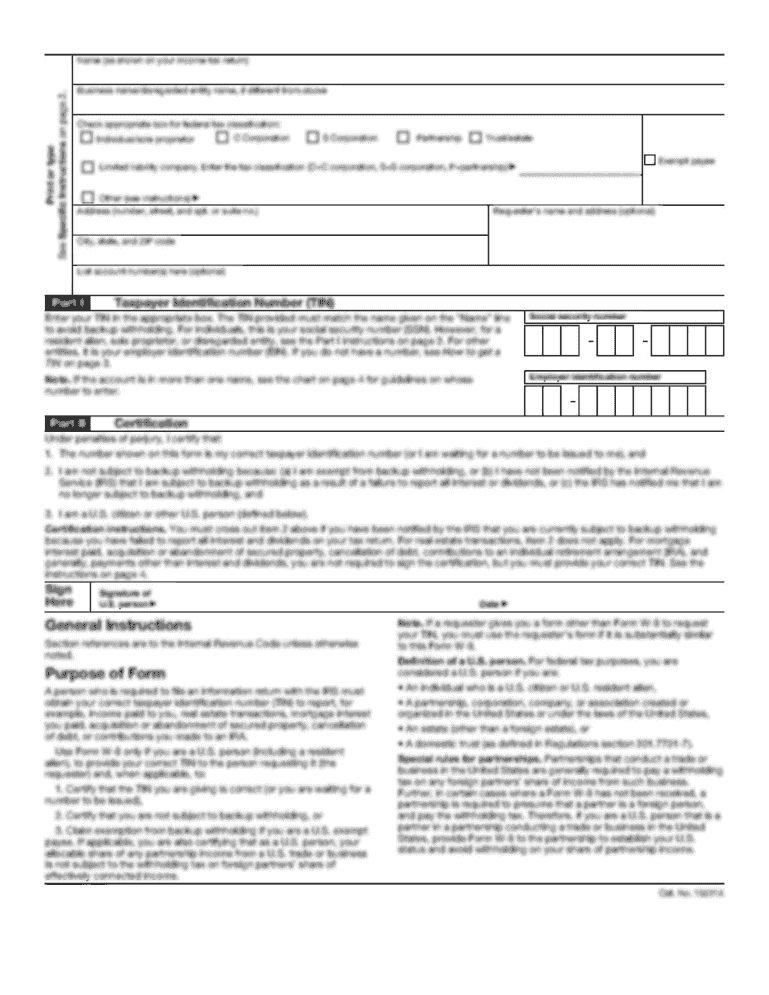

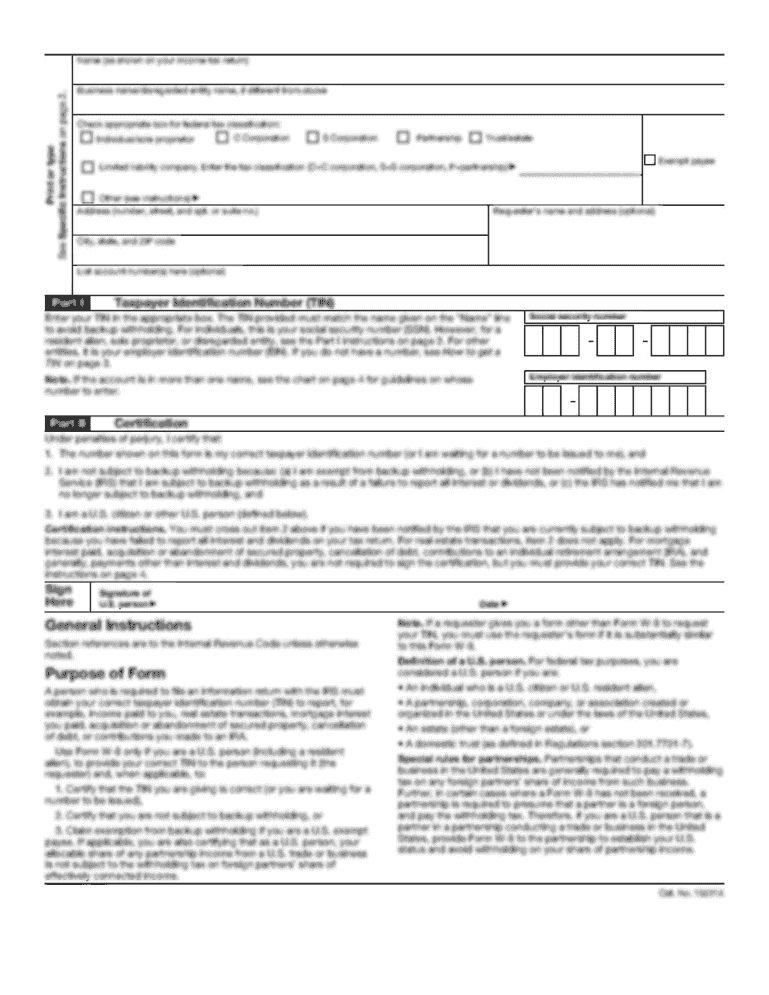

U.S. SMALL BUSINESS ADMINISTRATION CERTIFICATE AS TO PARTNERS SBA Loans NO. We, the undersigned, are general partners doing business under the firm name and style of and constitute all the partners

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign SBA 160a

Edit your SBA 160a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SBA 160a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SBA 160a online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SBA 160a. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out SBA 160a

How to fill out SBA 160a

01

Obtain the SBA Form 160a from the official SBA website or your lender.

02

Review the form instructions carefully before beginning to fill it out.

03

Fill in your name and contact information at the top of the form.

04

Provide your business name, address, and contact details in the appropriate sections.

05

Indicate the type of business entity (e.g., sole proprietorship, LLC, corporation).

06

Complete the financial information section, including assets, liabilities, and net worth.

07

Include details about your business plan, funding requirements, and other relevant information.

08

Review the completed form for accuracy and completeness.

09

Submit the form as directed (typically to your lender or financial institution).

Who needs SBA 160a?

01

Businesses seeking financial assistance from the Small Business Administration (SBA).

02

Entrepreneurs applying for SBA loans or grants.

03

Individuals looking to assess their business's financial position for future funding needs.

Fill

form

: Try Risk Free

People Also Ask about

What is the SBA form 601?

This form must be executed by both the borrower and the construction contractor for any loan involving construction of more than $10,000.

What is a SBA 7a form?

The purpose of this form is to collect information about the Small Business Applicant (“Applicant”) and its principals, the loan request, indebtedness, information about current or previous government financing, and certain other topics.

What is an SBA certificate of resolution?

SBA Form 160, Resolution of Board of Directors is a form issued by the Small Business Administration (SBA) and filed with SBA Business expansion loans including direct, guaranteed or participation loans. It is commonly used with closing documents submitted to a lender during the last stage of a loan application.

What are the eligibility requirements the SBA looks at when determining loan qualification?

Eligibility requirements Operate for profit. Be engaged in, or propose to do business in, the U.S. or its territories. Have reasonable owner equity to invest. Use alternative financial resources, including personal assets, before seeking financial assistance.

What percentage of SBA 7a loans are guaranteed?

Guarantee Portion - Under the 7(a) guaranteed loan program SBA typically guarantees from 50% to 85% of an eligible bank loan up to a maximum guaranty amount of $3,750,000. The exact percentage of the guaranty depends on a variety of factors such as size of loan and which SBA program is to be used.

What is a SBA 7 a borrower information form?

For use with all 7(a) Programs. Purpose of this form: The purpose of this form is to collect information about the Small Business Applicant ("Applicant") and its owners, the loan request, existing indebtedness, information about current or previous government financing, and certain other topics.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in SBA 160a without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing SBA 160a and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I edit SBA 160a on an iOS device?

Use the pdfFiller mobile app to create, edit, and share SBA 160a from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I fill out SBA 160a on an Android device?

Use the pdfFiller Android app to finish your SBA 160a and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is SBA 160a?

SBA 160a is a form used by the U.S. Small Business Administration (SBA) to collect information about businesses seeking assistance in federal contracting programs, particularly in relation to small business status.

Who is required to file SBA 160a?

Businesses that wish to participate in federal contracting programs and are seeking to establish their eligibility as a small business must file SBA 160a.

How to fill out SBA 160a?

To fill out SBA 160a, you need to provide accurate information regarding the business's ownership, size, and operational details, ensuring all sections are completed as per the instructions provided by the SBA.

What is the purpose of SBA 160a?

The purpose of SBA 160a is to help establish a business's qualification as a small business for federal contracting programs, thus allowing them access to specific opportunities and benefits.

What information must be reported on SBA 160a?

Information that must be reported on SBA 160a includes business ownership details, financial data, size standards compliance, and other relevant operational information necessary for assessing eligibility.

Fill out your SBA 160a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SBA 160a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.