Get the free PERSONAL LOAN AGREEMENT Provider Capital Group Inc 900

Show details

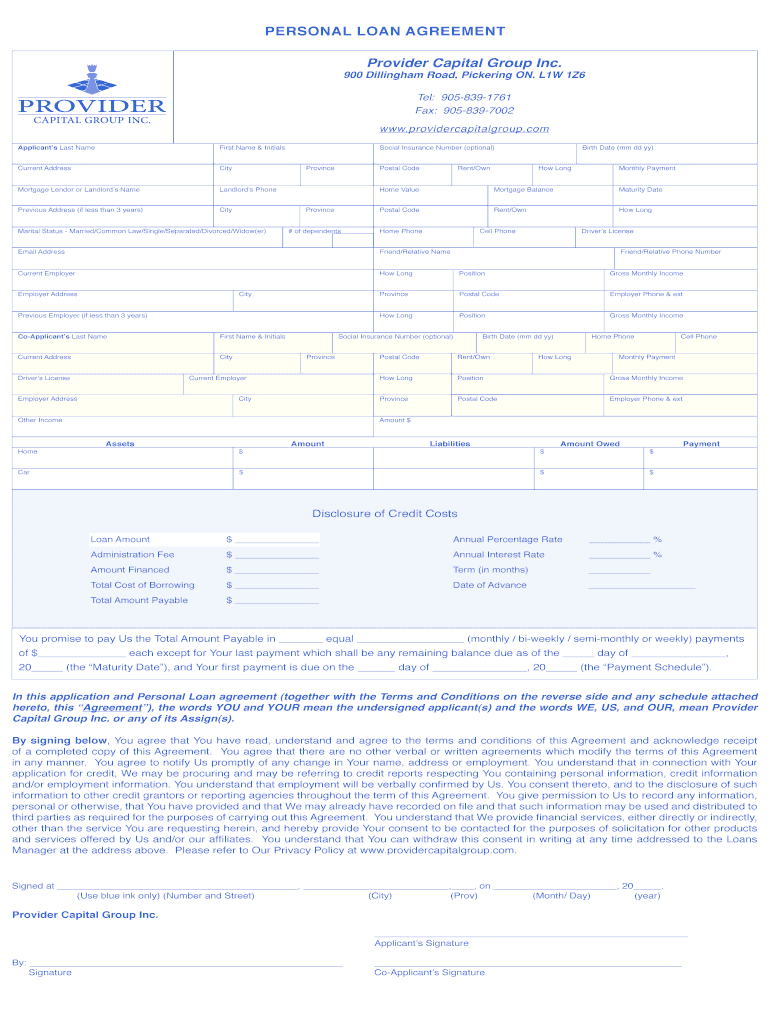

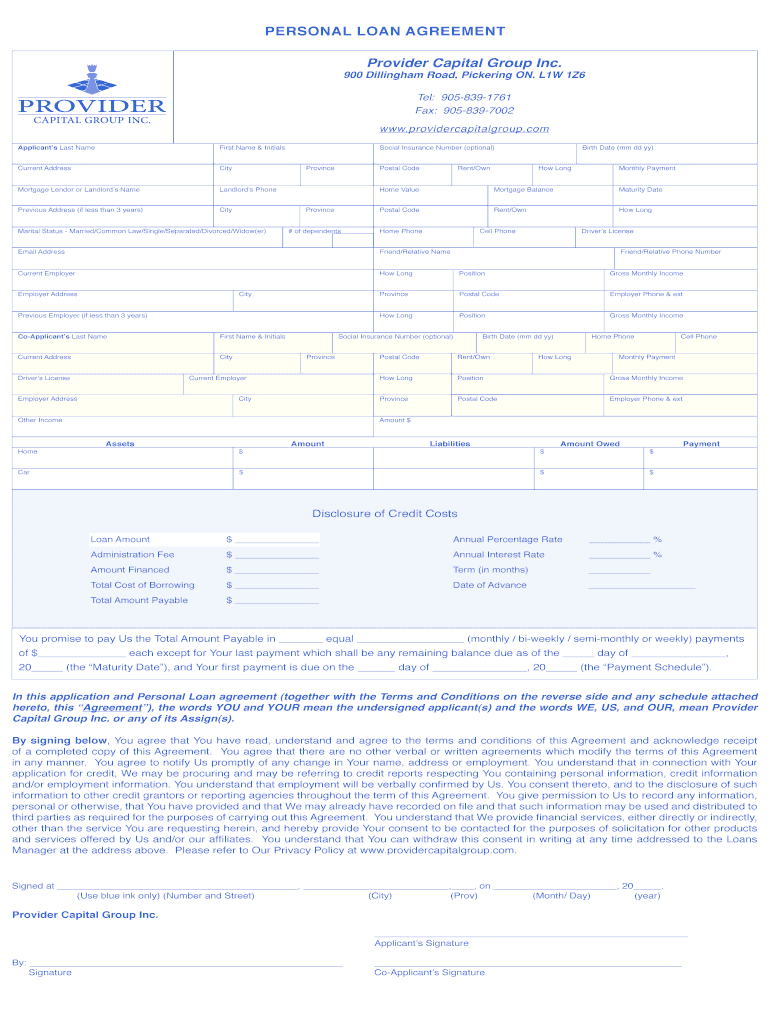

PERSONAL LOAN AGREEMENT Provider Capital Group Inc. 900 Dillingham Road, Pickering ON. L1W 1Z6 Tel: 9058391761 Fax: 9058397002 www.providercapitalgroup.com Applicants Last Name First Name & Initials

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal loan agreement provider

Edit your personal loan agreement provider form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal loan agreement provider form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal loan agreement provider online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit personal loan agreement provider. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal loan agreement provider

How to fill out personal loan agreement provider:

01

Start by gathering all relevant information: Before filling out the personal loan agreement provider, you should gather all the necessary information. This includes your personal details, such as your full name, address, contact information, and identification documents. You will also need to provide details about the loan, such as the loan amount, interest rate, repayment terms, and any collateral involved.

02

Read and understand the terms and conditions: It is crucial to carefully read and understand the terms and conditions of the personal loan agreement provider. This includes understanding the interest rate, repayment schedule, late payment penalties, and any other fees involved. If there are any clauses or terms that you don't fully comprehend, consider seeking legal advice or clarification from the provider.

03

Fill in the required fields: Once you have gathered all the necessary information and understood the terms and conditions, it's time to fill in the required fields of the personal loan agreement provider. These fields typically include your personal information, loan details, repayment schedule, and any additional provisions or agreements. Make sure to provide accurate and complete information to avoid any future disputes or complications.

04

Seek professional guidance if needed: If you are unsure about any aspect of the personal loan agreement provider or if you have complex financial circumstances, it is advisable to seek professional guidance. This could involve consulting with a lawyer or a financial advisor who can review the agreement and provide insights or recommendations.

Who needs personal loan agreement provider?

01

Individuals seeking a personal loan: Anyone who is looking to borrow money for personal reasons, such as funding a vacation, home renovations, or consolidating debts, may need a personal loan agreement provider. This agreement helps establish clear terms and conditions between the borrower and the lender, ensuring both parties understand their rights and responsibilities.

02

Lenders or financial institutions: Lenders or financial institutions offering personal loans can benefit from using a personal loan agreement provider. This document helps protect their interests by outlining the terms of the loan, such as repayment schedule, interest rate, and collateral requirements. It ensures that borrowers are aware of their obligations and helps mitigate potential risks.

03

Legal or financial professionals: Legal or financial professionals may also need a personal loan agreement provider to assist their clients. They can use this document to ensure their clients fully understand the terms and conditions of the loan and to provide legal protection and guidance during the lending process.

In conclusion, filling out a personal loan agreement provider involves gathering relevant information, understanding the terms and conditions, filling in the required fields accurately, and seeking professional guidance if necessary. This agreement is needed by individuals seeking personal loans, lenders or financial institutions offering loans, and legal or financial professionals assisting clients with loan transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify personal loan agreement provider without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including personal loan agreement provider. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an electronic signature for the personal loan agreement provider in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your personal loan agreement provider in minutes.

How do I complete personal loan agreement provider on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your personal loan agreement provider. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is personal loan agreement provider?

A personal loan agreement provider is a financial institution or lender that offers personal loans to individuals.

Who is required to file personal loan agreement provider?

Personal loan agreement providers are required to file their agreements with the appropriate regulatory authorities.

How to fill out personal loan agreement provider?

A personal loan agreement provider can be filled out by including all the necessary details of the loan agreement such as loan amount, interest rate, repayment terms, and borrower's information.

What is the purpose of personal loan agreement provider?

The purpose of a personal loan agreement provider is to establish the terms and conditions of the loan between the lender and the borrower.

What information must be reported on personal loan agreement provider?

The personal loan agreement provider must report all relevant information related to the loan agreement, such as the loan amount, interest rate, repayment schedule, and borrower's details.

Fill out your personal loan agreement provider online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Loan Agreement Provider is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.