Get the free 2012 REVISIONS: CONSTRUCTION LIEN AND BOND LAWS

Show details

This document discusses the changes made by the Florida Legislature in 2012 regarding construction lien and bond laws, including amendments to public payment bonds, private project liens, and the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012 revisions construction lien

Edit your 2012 revisions construction lien form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 revisions construction lien form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2012 revisions construction lien online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2012 revisions construction lien. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012 revisions construction lien

How to fill out 2012 REVISIONS: CONSTRUCTION LIEN AND BOND LAWS

01

Obtain the official document for the 2012 Revisions: Construction Lien and Bond Laws from a credible source.

02

Read through the entire document to understand its structure and requirements.

03

Gather all necessary information related to the construction project, including parties involved, property details, and payment information.

04

Fill in the required fields carefully, ensuring that all information is accurate and complete.

05

Review the completed form for any errors or omissions.

06

Sign the document where indicated, ensuring that all signatures are properly executed.

07

Submit the filled document to the appropriate governing body or agency as specified in the guidelines.

Who needs 2012 REVISIONS: CONSTRUCTION LIEN AND BOND LAWS?

01

Contractors needing to secure payment for their work on a construction project.

02

Subcontractors requiring protection for their labor and materials supplied.

03

Property owners wanting to understand their rights and responsibilities related to construction liens.

04

Suppliers of materials looking to enforce their claims in the event of non-payment.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take for a mechanic's lien to expire?

In California: General Contractors: 90 days after project completion, but only 60 days after a Notice of Completion or Cessation is recorded. Subcontractors and Suppliers: 90 days after project completion, but only 30 days after a Notice of Completion or Cessation is recorded.

How to fight a mechanic's lien in Georgia?

You must file with the county clerk within 90 days of the completion of the work for which you are disputing payment. If you wait longer than 90 days, you may not be able to collect. This is why it's important to consult an attorney experienced in Georgia mechanics lien law if you think you may be owed unpaid wages.

Can you file a mechanics lien after 90 days in California?

The potential lien claimant must record the mechanics lien within 90 days of: Completion of work, • When the owner began using the improvement, or • When the owner accepted the improvement. If the potential lien claimant fails to record the mechanics lien within the appropriate time frame, the lien isn't valid.

How do I get rid of a lien on my property in Georgia?

Pay Off the Lien – Once you determine that the lien is valid, the simplest method for removing it is to pay it off. Even if you need to borrow the funds from family or friends, satisfying your debt will allow the property to become unencumbered, sold, and closed.

How long do you have to file a lien in VA?

This means that a lien: Can be filed at any time after the claimant has commenced work, but not before. Must be filed within 90 days of the last day of the month in which the claimant last performs labor or furnishes material.

How long does a mechanic's lien last in Georgia?

Georgia Liens are Valid for One Year: In Georgia, a Claim of Lien is valid for one year from the date that the lien is filed. If the lien claimant files a materialmen's lien and then doesn't enforce its lien rights within the year, then the mechanics or materialmen's lien will automatically expire.

How long does a mechanics lien last before either expiring or being enforced with a foreclosure suit in Georgia?

Georgia Liens are Valid for One Year: In Georgia, a Claim of Lien is valid for one year from the date that the lien is filed. If the lien claimant files a materialmen's lien and then doesn't enforce its lien rights within the year, then the mechanics or materialmen's lien will automatically expire.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

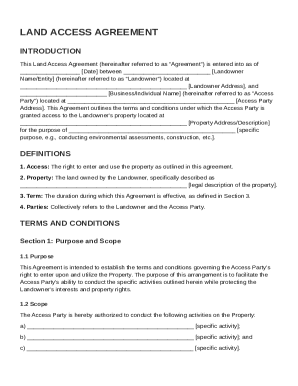

What is 2012 REVISIONS: CONSTRUCTION LIEN AND BOND LAWS?

The 2012 revisions to construction lien and bond laws primarily concern the legal framework governing the rights and obligations of parties involved in construction projects, including mechanics' liens and payment bonds.

Who is required to file 2012 REVISIONS: CONSTRUCTION LIEN AND BOND LAWS?

Parties involved in construction projects, including contractors, subcontractors, and suppliers who wish to secure payment, are typically required to file under the 2012 revisions.

How to fill out 2012 REVISIONS: CONSTRUCTION LIEN AND BOND LAWS?

To fill out the revisions, parties must provide accurate project details, including property description, the amount claimed, the date services were provided, and must ensure compliance with specific state requirements.

What is the purpose of 2012 REVISIONS: CONSTRUCTION LIEN AND BOND LAWS?

The purpose of these revisions is to protect the rights of those who provide labor or materials for construction projects by establishing clear rules on how liens can be filed and enforced.

What information must be reported on 2012 REVISIONS: CONSTRUCTION LIEN AND BOND LAWS?

The information that must be reported includes the name and address of the party filing the lien, the property owner's details, a description of the work or materials provided, and the total amount owed.

Fill out your 2012 revisions construction lien online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012 Revisions Construction Lien is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.