Get the free Annuity and Life Applications Checklist. Used by companies to ensure compliance. - t...

Show details

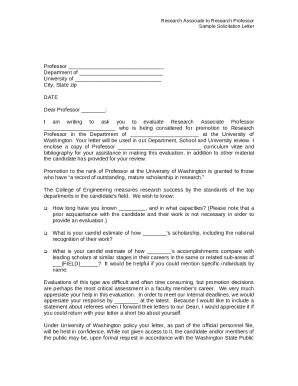

TEXAS DEPARTMENT OF INSURANCE Regulatory Policy Division Life, Annuity, and Credit Program (1061D) LAC013 0715 333 Guadalupe, Austin, Texas 78701 PO Box 149104, Austin, Texas 787149104 ×512× 6766625

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annuity and life applications

Edit your annuity and life applications form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annuity and life applications form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annuity and life applications online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit annuity and life applications. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annuity and life applications

How to fill out annuity and life applications:

01

Begin by gathering all necessary documents and information. This includes personal identification, financial details, and any supporting documentation required by the insurance provider.

02

Carefully read through the application forms, ensuring you understand each section and its requirements. It is crucial to provide accurate and truthful information.

03

Start by filling out the personal information section, including your name, address, date of birth, and contact details.

04

Proceed to the financial information section, where you will need to provide details about your income, assets, debts, and liabilities.

05

If the application includes questions about your health and medical history, answer them honestly and in detail. In some cases, you may be required to undergo a medical examination or provide medical records.

06

Review the completed application form thoroughly to ensure there are no errors or missing information. Any discrepancies or missing details could delay the processing of your application.

07

Sign and date the application form and any required consent forms, acknowledging that all the information provided is accurate to the best of your knowledge.

08

Submit the completed application form to the insurance provider through the designated channels, such as online submission or physical mail.

Who needs annuity and life applications:

01

Individuals who want to secure their future financial stability and provide for their loved ones in the event of their death may consider purchasing life insurance.

02

Those who wish to receive a steady income during their retirement years may opt for annuities, which provide regular payments over a specified period or for life.

03

Individuals who have dependents, such as children or elderly parents, may need life insurance to ensure their loved ones are financially protected in the event of their passing.

04

Business owners and partners may need life insurance to safeguard against the financial implications of a partner's death, ensuring the viability and continuation of the business.

05

Those who anticipate financial hardship or want to create a nest egg for the future may invest in annuities to guarantee a stable income stream.

06

Individuals who want to leave behind a financial legacy or cover potential estate taxes may utilize life insurance policies to pass on wealth to their beneficiaries.

07

People who want to protect their assets and investments from market volatility may choose to invest in annuities as a form of financial security.

08

Individuals who have specific financial goals, such as paying for a child's education or funding a major purchase, may opt for life insurance or annuities as part of their overall financial planning strategy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get annuity and life applications?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the annuity and life applications in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the annuity and life applications electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your annuity and life applications in seconds.

How do I edit annuity and life applications on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share annuity and life applications on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is annuity and life applications?

Annuity and life applications are forms used to apply for annuities and life insurance policies.

Who is required to file annuity and life applications?

Individuals looking to purchase an annuity or a life insurance policy are required to file annuity and life applications.

How to fill out annuity and life applications?

Annuity and life applications can be filled out by providing personal information, financial details, beneficiary information, and selecting the desired coverage options.

What is the purpose of annuity and life applications?

The purpose of annuity and life applications is to gather information needed by insurance companies to underwrite policies and determine coverage and pricing.

What information must be reported on annuity and life applications?

Information such as personal details, medical history, financial information, beneficiary information, and desired coverage options must be reported on annuity and life applications.

Fill out your annuity and life applications online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annuity And Life Applications is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.