Get the free Partnership comprehensive ltc policy form 211560102 - insurance ca

Show details

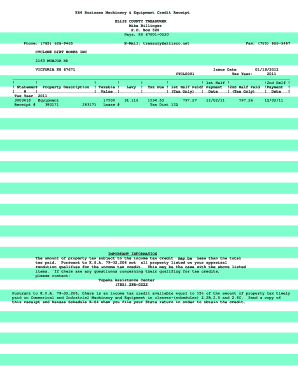

NEW YORK LIFE INSURANCE COMPANY NAIL 66915 LTC Partnership Comprehensive Tax Qualified POLICY FORM: 21156×0112) 1. Maximum Policy Benefit (MPH) In year’s). Enter the number of days in Company Notes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign partnership comprehensive ltc policy

Edit your partnership comprehensive ltc policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your partnership comprehensive ltc policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing partnership comprehensive ltc policy online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit partnership comprehensive ltc policy. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out partnership comprehensive ltc policy

How to fill out partnership comprehensive ltc policy:

01

Gather necessary information: Start by collecting all relevant personal information, such as your full name, address, and contact details. You will also need the same information for your partner if you are applying for a joint policy.

02

Understand the policy terms: Take the time to carefully read and understand the terms and conditions of the partnership comprehensive LTC policy. This will ensure that you know what is covered, the benefit amounts, and any limitations or exclusions.

03

Determine coverage needs: Assess your long-term care needs and determine the level of coverage required. Consider factors such as your age, health condition, and financial resources. You may want to consult with a licensed insurance agent who specializes in long-term care policies to help you determine the appropriate coverage.

04

Complete the application form: Fill out the application form accurately and thoroughly. Provide all the requested information, including details about your health history and any pre-existing conditions. Be honest and transparent as any discrepancies may result in a denial of coverage or cancellation of the policy.

05

Submit required documentation: In addition to the application form, you may need to provide additional documentation, such as medical records or proof of income. Ensure that you have all the necessary documents ready to submit along with your application.

06

Review and sign the policy: Once the application is complete, carefully review the partnership comprehensive LTC policy. Make sure it reflects your desired coverage and that all information is accurate. If you have any questions or concerns, reach out to the insurance provider or agent for clarification.

Who needs partnership comprehensive ltc policy:

01

Individuals planning for long-term care: Anyone who wants to ensure their financial security and protect their assets in the event of needing long-term care services should consider a partnership comprehensive LTC policy. This type of policy can provide coverage for various services, such as nursing home care, home healthcare, and assisted living facilities.

02

Couples or partners: Partnership comprehensive LTC policies can also be beneficial for couples or partners who want to secure coverage together. Joint policies often offer discounts and can provide coverage for both individuals under a single policy.

03

Those with financial concerns: Long-term care services can be expensive, and without appropriate coverage, the costs can quickly deplete savings and assets. A partnership comprehensive LTC policy can provide peace of mind and protect against the financial burden of long-term care expenses.

Note: It is important to consult with a financial advisor or insurance professional to determine if a partnership comprehensive LTC policy is the right choice for your specific needs and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send partnership comprehensive ltc policy to be eSigned by others?

Once your partnership comprehensive ltc policy is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit partnership comprehensive ltc policy in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing partnership comprehensive ltc policy and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the partnership comprehensive ltc policy electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your partnership comprehensive ltc policy in seconds.

What is partnership comprehensive ltc policy?

Partnership comprehensive long-term care (LTC) insurance policies are designed to provide coverage for long-term care services while also allowing policyholders to protect some of their assets.

Who is required to file partnership comprehensive ltc policy?

Individuals who are interested in protecting their assets while also having coverage for long-term care services are required to file for a partnership comprehensive LTC policy.

How to fill out partnership comprehensive ltc policy?

To fill out a partnership comprehensive LTC policy, individuals can contact an insurance provider that offers such policies and work with an agent to complete the necessary paperwork.

What is the purpose of partnership comprehensive ltc policy?

The purpose of a partnership comprehensive LTC policy is to provide coverage for long-term care services while also helping individuals protect some of their assets from being spent on care expenses.

What information must be reported on partnership comprehensive ltc policy?

Information such as personal details of the policyholder, coverage details, premium payments, and any changes in policy terms must be reported on a partnership comprehensive LTC policy.

Fill out your partnership comprehensive ltc policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Partnership Comprehensive Ltc Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.