Get the free IRS FORM 1099 - trumbullps

Show details

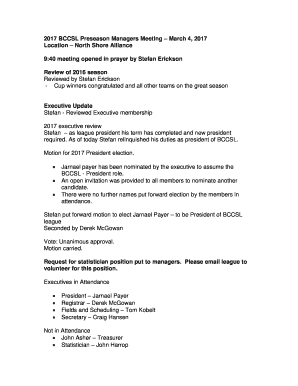

The document informs vendors and independent contractors about the requirement to report compensation in excess of $600 for IRS FORM 1099 issuance and provides instructions for filling out an attached

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs form 1099

Edit your irs form 1099 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form 1099 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs form 1099 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit irs form 1099. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs form 1099

How to fill out IRS FORM 1099

01

Obtain IRS Form 1099 from the IRS website or an authorized distributor.

02

Determine the type of 1099 form you need to fill out (e.g., 1099-MISC, 1099-NEC) based on the type of payment.

03

Fill in the payer's information, including name, address, and taxpayer identification number (TIN).

04

Fill in the recipient's information, including name, address, and taxpayer identification number (TIN).

05

Fill out the appropriate box for the type of payment made to the recipient (e.g., nonemployee compensation, rent, royalties).

06

Check any applicable boxes that apply to the payment, such as for federal income tax withholding.

07

Ensure you have the correct total amount for the payment reported (if applicable).

08

Sign and date the form, if required, to certify the information is correct.

09

Submit copies of the completed form to the IRS and provide a copy to the recipient by the required deadlines.

Who needs IRS FORM 1099?

01

Independent contractors who receive $600 or more in nonemployee compensation.

02

Businesses that pay $600 or more for services rendered by non-corporate entities like freelancers and subcontractors.

03

Landlords who receive rental payments of $600 or more.

04

Financial institutions that pay interest to individuals.

05

Any entity that makes certain types of payments to individuals or businesses that may be taxable.

Fill

form

: Try Risk Free

People Also Ask about

Can I download and print a 1099 form?

Please note that Copy B and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient. If you have 10 or more information returns to file, you may be required to file e-file.

How badly does a 1099 affect my taxes?

When you work on a 1099 contract basis, the IRS considers you to be self-employed. That means that in addition to income tax, you'll need to pay self-employment tax. As of 2024, the self-employment tax is 15.3% of the first $168,600 in net profits, plus 2.9% of anything earned over that amount.

Is there a fillable 1099 form?

You can get hold of a 1099-NEC form from the IRS website or use online platforms that provide fillable tax form templates. Filing information returns electronically is a great way for businesses to report non employee compensation to the IRS quickly and efficiently.

Is there a free 1099 form?

You can attain the forms absolutely for free. No cost. You can order as many forms as you like by calling 1-800-TAX-FORM (800-829-3676), an IRS provided toll-free number. There is no charge for calling, shipping or handling and they will ship up to 100 forms per call.

Can I fill out my own 1099?

You can complete these copies online for furnishing statements to recipients and for retaining in your own files. Trade or business reporting only. Report on Form 1099-MISC or Form 1099-NEC only when payments are made in the course of your trade or business.

Can I manually fill out a 1099?

Yes, you can handwrite a 1099 or W2, but be very cautious when doing so. The handwriting must be completely legible using black ink block letters to avoid processing errors. The IRS says, “Although handwritten forms are acceptable, they must be completely legible and accurate to avoid processing errors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRS FORM 1099?

IRS FORM 1099 is a series of tax forms used to report various types of income other than wages, salaries, and tips. It includes transactions such as interest, dividends, rental income, and payments made to independent contractors.

Who is required to file IRS FORM 1099?

Any business or individual that pays someone $600 or more during the tax year for services, rents, prizes, or other reported income may be required to file an IRS FORM 1099. This includes independent contractors and freelancers.

How to fill out IRS FORM 1099?

To fill out IRS FORM 1099, you need to provide the payer's information, the recipient's information, the total amount paid, and any taxes withheld. You can obtain the form from the IRS website or through tax preparation software.

What is the purpose of IRS FORM 1099?

The purpose of IRS FORM 1099 is to ensure that the IRS receives accurate information about income paid to individuals and businesses, helping to enforce tax compliance and track income that might not be reported on a tax return.

What information must be reported on IRS FORM 1099?

IRS FORM 1099 must report the payer’s name, address, and taxpayer identification number (TIN), the recipient’s name, address, and TIN, the total amount paid, and any federal taxes withheld.

Fill out your irs form 1099 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Form 1099 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.