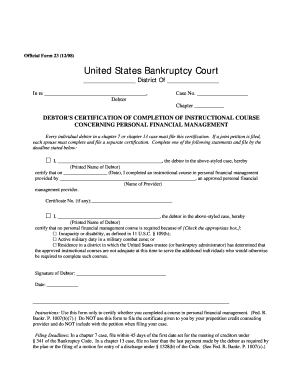

Get the free Supplemental Tax Organizers--Truckers

Show details

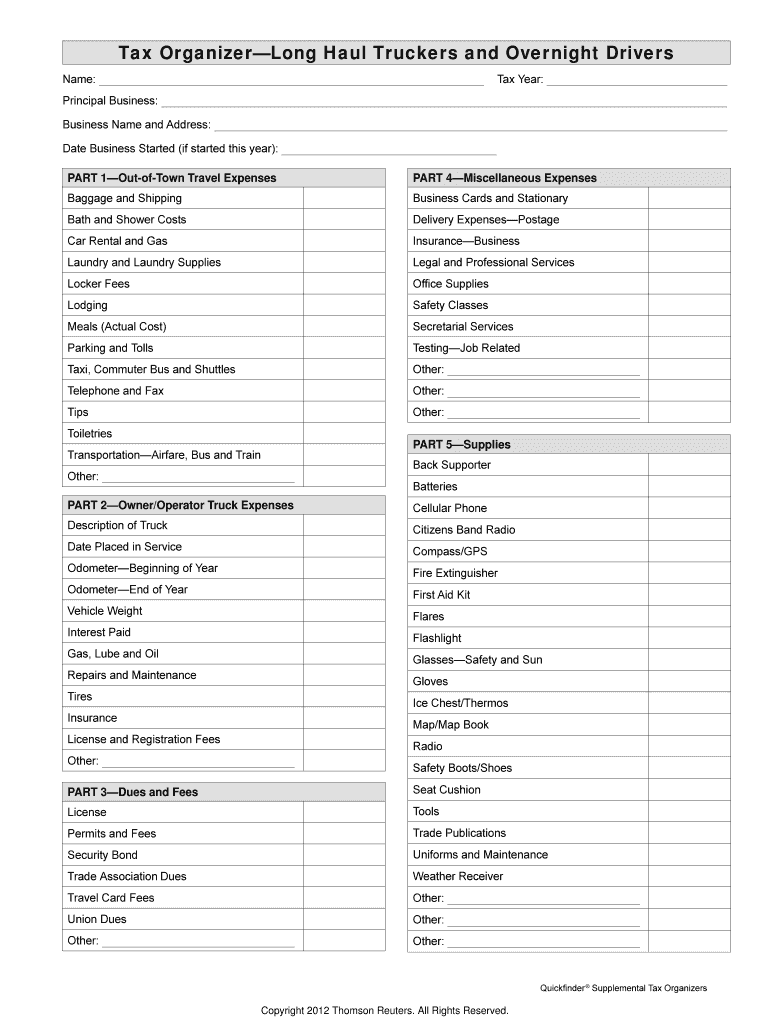

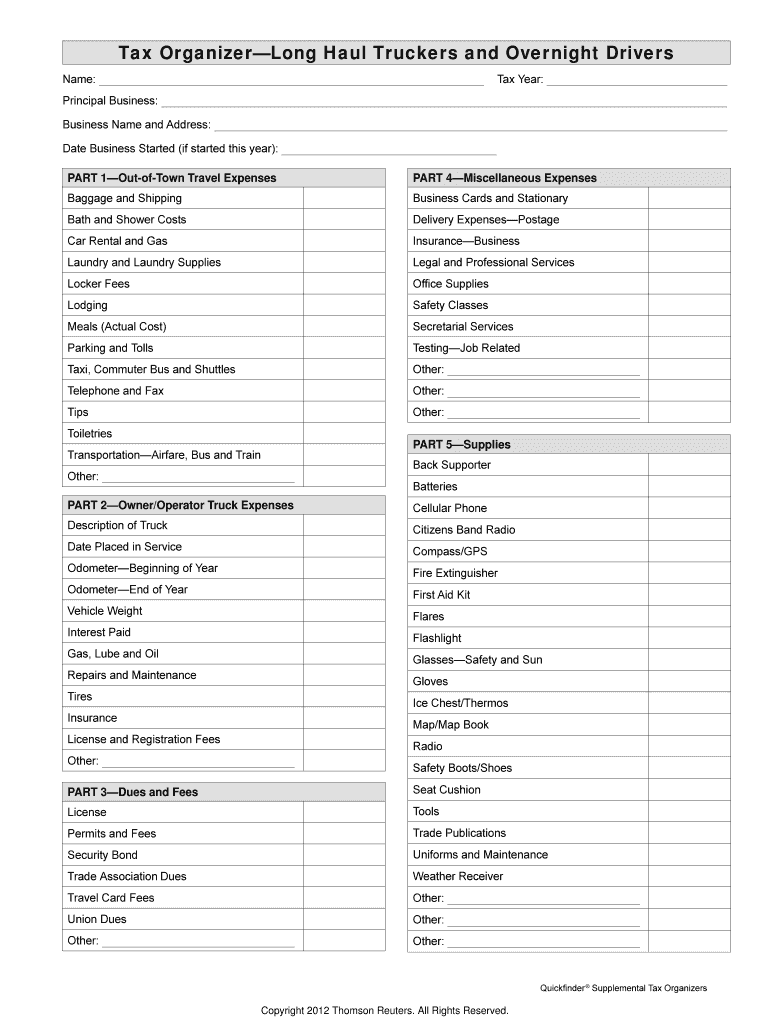

Tax Organizer Long Haul Truckers and Overnight Drivers Name: Tax Year: Principal Business: Business Name and Address:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supplemental tax organizers--truckers

Edit your supplemental tax organizers--truckers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supplemental tax organizers--truckers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing supplemental tax organizers--truckers online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit supplemental tax organizers--truckers. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out supplemental tax organizers--truckers

How to fill out supplemental tax organizers--truckers:

01

Gather all necessary documents: Before filling out the supplemental tax organizers, gather all relevant documents such as your trucking income statements, receipts for expenses, and any other supporting financial documents.

02

Organize your income: Begin by entering your trucking income on the supplemental tax organizers. This should include any income earned from hauling loads, fuel surcharges, and any other sources related to your trucking business. Be sure to accurately report all income earned during the tax year.

03

Enter deductible expenses: Truckers have a variety of deductible expenses that can help lower their tax liability. When filling out the tax organizers, include deductions such as fuel costs, vehicle maintenance expenses, tolls and parking fees, insurance premiums, licensing fees, and other business-related expenses. Consult with a tax professional or refer to the IRS guidelines to ensure you are properly claiming all eligible deductions.

04

Keep track of per diem expenses: Truckers who are away from home for extended periods may qualify for per diem expenses. These are daily allowances for meals, lodging, and incidental expenses while on the road. Make sure to properly track and enter per diem expenses on the tax organizers, as they can provide significant tax savings.

05

Note any equipment purchases: If you have purchased any new equipment for your trucking business, such as a new truck or trailer, make sure to include this information on the tax organizers. Equipment purchases may be eligible for depreciation or Section 179 deductions, so accurately reporting these expenses is crucial.

Who needs supplemental tax organizers--truckers?

01

Truckers who are self-employed: Supplemental tax organizers are particularly relevant for truckers who are self-employed or independent contractors. These individuals are responsible for reporting their own income and expenses to the IRS and need to accurately complete tax organizers to ensure proper reporting.

02

Truckers with business-related expenses: If you have significant business-related expenses as a trucker, such as fuel costs, maintenance expenses, and other deductions, you may benefit from using supplemental tax organizers. These organizers provide a structured format for documenting and reporting these expenses.

03

Truckers looking to maximize deductions: By accurately filling out supplemental tax organizers, truckers can ensure they are claiming all eligible deductions and maximizing their tax benefits. This is especially important for truckers who have significant business-related expenses and want to minimize their overall tax liability.

In summary, filling out supplemental tax organizers for truckers involves gathering all necessary documents, organizing income and expenses, tracking per diem expenses, noting equipment purchases, and accurately reporting all information to maximize deductions. These tax organizers are essential for truckers who are self-employed, have business-related expenses, and want to ensure proper reporting and maximum tax benefits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send supplemental tax organizers--truckers for eSignature?

When you're ready to share your supplemental tax organizers--truckers, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I get supplemental tax organizers--truckers?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the supplemental tax organizers--truckers in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I edit supplemental tax organizers--truckers on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign supplemental tax organizers--truckers right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is supplemental tax organizers--truckers?

Supplemental tax organizers for truckers are forms used to report additional tax information related to trucking income and expenses.

Who is required to file supplemental tax organizers--truckers?

Truckers who earn income from trucking activities are required to file supplemental tax organizers.

How to fill out supplemental tax organizers--truckers?

Supplemental tax organizers for truckers can be filled out by providing detailed information about trucking income, expenses, and any applicable deductions.

What is the purpose of supplemental tax organizers--truckers?

The purpose of supplemental tax organizers for truckers is to ensure accurate reporting of trucking income and expenses for tax purposes.

What information must be reported on supplemental tax organizers--truckers?

Information such as trucking income, expenses, deductions, and any other relevant tax information must be reported on supplemental tax organizers for truckers.

Fill out your supplemental tax organizers--truckers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supplemental Tax Organizers--Truckers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.