Get the free kemba auto refinance

Show details

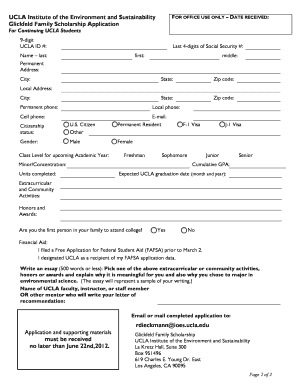

KE MBA Peoria Credit Union Auto Refinance Form Please fill out the following information to see how much money KE MBA can save you. The Loan Department will call you ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kemba auto refinance

Edit your kemba auto refinance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kemba auto refinance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kemba auto refinance online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit kemba auto refinance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out kemba auto refinance

How to fill out kemba auto refinance:

01

Start by gathering all necessary documents: Before starting the kemba auto refinance application, ensure you have important documents ready, such as your identification, proof of income, vehicle information, and current loan details.

02

Visit the Kemba website: Access the Kemba website and navigate to their auto refinance section. This is where you will find the application form and all the necessary information for completing it.

03

Start the application process: Begin the kemba auto refinance application by entering your personal information, including your name, contact details, and social security number. Provide accurate and up-to-date information to avoid any delays or complications.

04

Provide vehicle and loan details: Fill in the necessary fields regarding your vehicle, such as the make, model, year, and mileage. Additionally, provide information about your current loan, including the loan balance and the lender's name.

05

Provide income and employment details: As part of the kemba auto refinance application, you will need to disclose your income and employment information. This helps the lender assess your financial stability and capability to repay the refinanced loan.

06

Review and submit: Once you have filled out all the required fields, double-check all the information you have entered for any errors or omissions. Review the application thoroughly to ensure accuracy. Once you are confident that everything is correct, submit the application.

Who needs kemba auto refinance:

01

Individuals with existing auto loans: Kemba auto refinance is a suitable option for individuals who already have an auto loan. Refinancing can potentially help them lower their interest rate, monthly payments, or even obtain better loan terms, thereby saving them money in the long run.

02

Individuals looking to reduce monthly payments: If the monthly payments on an existing auto loan are causing financial strain, kemba auto refinance may be a solution. By refinancing, borrowers may be able to extend the loan term, thus reducing their monthly payment amount.

03

Individuals seeking better loan terms: Kemba auto refinance may be ideal for those who want to obtain better loan terms, such as a lower interest rate or reducing the loan term. This can lead to savings on interest payments and potentially pay off the loan sooner.

04

Individuals looking to consolidate debt: If you have multiple high-interest loans or debts, kemba auto refinance can be considered as a way to consolidate these debts. By refinancing, borrowers can combine their existing auto loan with other debts, simplifying their payment structure and potentially securing a lower overall interest rate.

Overall, kemba auto refinance is suitable for individuals who aim to save money, improve their loan terms, or simplify their payment structure. It is essential to evaluate individual circumstances and consult with kemba representatives to determine if refinancing is the right choice for each person's specific financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get kemba auto refinance?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific kemba auto refinance and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit kemba auto refinance online?

With pdfFiller, the editing process is straightforward. Open your kemba auto refinance in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I complete kemba auto refinance on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your kemba auto refinance from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is kemba auto refinance?

Kemba auto refinance is a loan program offered by Kemba Credit Union that allows individuals to refinance their existing auto loans for potentially lower interest rates or monthly payments.

Who is required to file kemba auto refinance?

Anyone with an existing auto loan who is looking to potentially save money on their monthly payments or interest rates may be interested in filing for Kemba auto refinance.

How to fill out kemba auto refinance?

To fill out Kemba auto refinance, individuals can contact Kemba Credit Union directly or visit their website to start the application process.

What is the purpose of kemba auto refinance?

The purpose of Kemba auto refinance is to help individuals save money on their existing auto loans by potentially securing lower interest rates or monthly payments.

What information must be reported on kemba auto refinance?

Information such as current loan details, income verification, credit score, and contact information may be required when applying for Kemba auto refinance.

Fill out your kemba auto refinance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kemba Auto Refinance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.