Get the free NEW HIRE INFO - Toledo Payroll Service Payroll Solutions

Show details

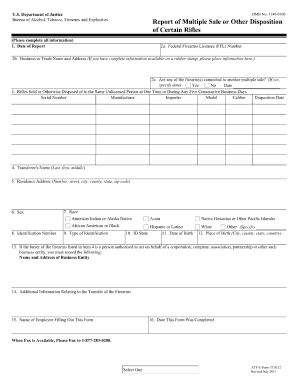

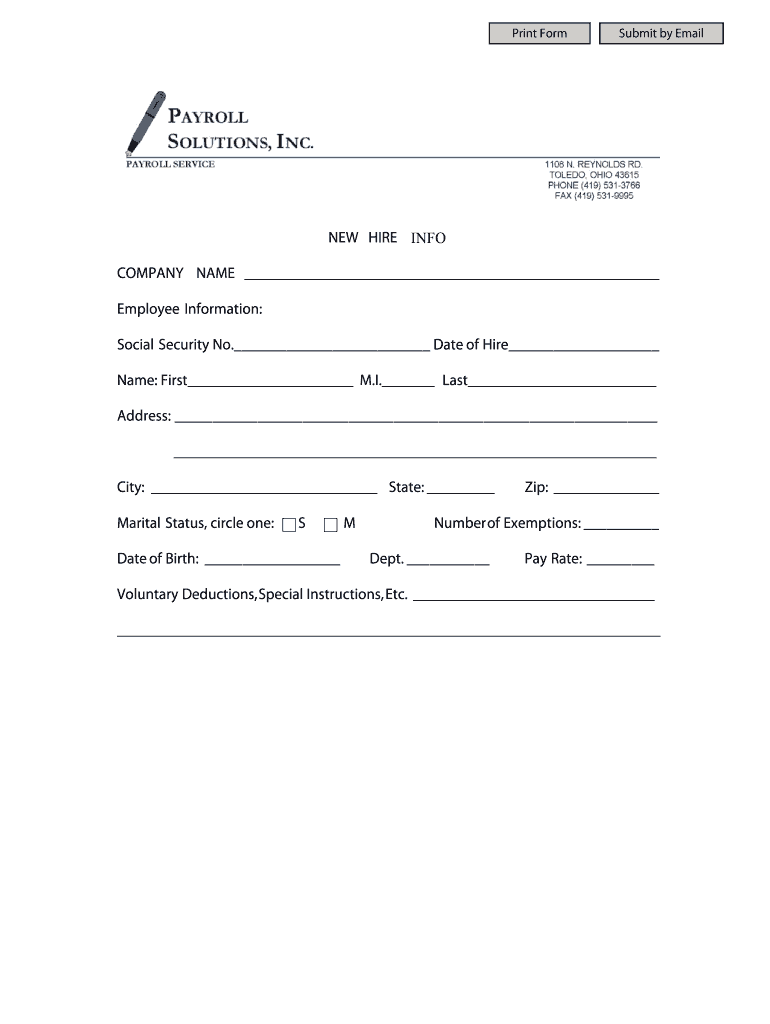

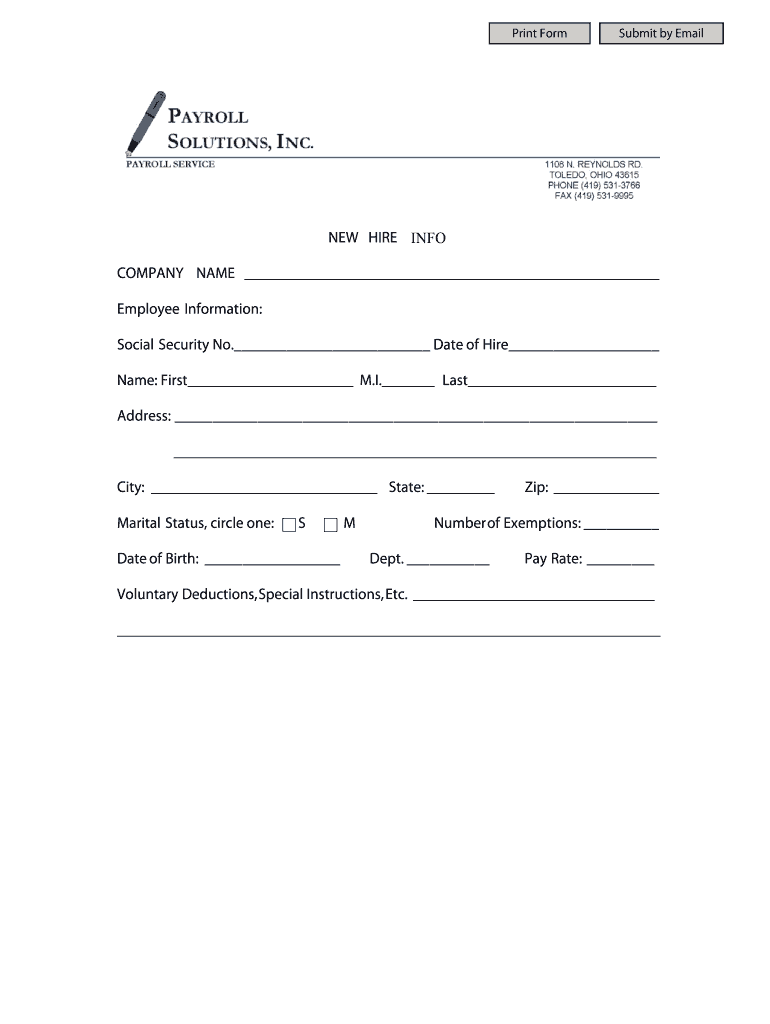

Print Form Submit by Email NEW HIRE INFO COMPANY NAME Employee Information: Social Security No. Date of Hire Name: First M.I. Last Address: City: State: Marital Status, circle one: S Date of Birth:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new hire info

Edit your new hire info form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new hire info form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new hire info online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit new hire info. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new hire info

How to fill out new hire info:

01

Start by gathering all the necessary documents and information required for new hire paperwork. This may include the employee's identification documents, Social Security number, tax information, and contact details.

02

Begin by filling out the employee's personal information section, which usually includes their full name, address, phone number, and emergency contact details. It's important to ensure accuracy and double-check all the provided information.

03

Proceed to the employment section, where you will indicate the employee's start date, position, and any relevant job details. This section may also require documentation such as an offer letter or employment contract.

04

Move on to the tax information section, where the employee will need to fill out their tax withholding details, including their filing status and allowances. It's vital to correctly complete this section to ensure accurate payroll processing.

05

If applicable, fill out the employee's direct deposit information, providing the necessary bank account details for salary payment. Alternatively, information for issuing physical paychecks can be entered if direct deposit is not available.

06

Next, review any benefits or insurance options offered to the employee and complete the respective sections. This may include health, dental, vision, retirement plans, and other relevant benefits.

07

Additionally, include any necessary legal disclosures or consent forms that may be mandated by law or company policies. Examples of such forms include employee handbooks, confidentiality agreements, and non-disclosure agreements.

08

Finally, ensure that all the information provided is accurate and complete. Double-check for any errors or missing information, as these inaccuracies can cause administrative issues later on.

Who needs new hire info:

01

HR Department: The human resources team is responsible for managing the onboarding process and maintaining accurate records of all employees. They require new hire information to initiate the employee's employment, set up payroll, enroll in benefits, and update the company's personnel database.

02

Payroll Department: The payroll department needs new hire information to accurately process the employee's salary payments, calculate taxes and deductions, and ensure compliance with labor and tax laws.

03

Managers and Supervisors: Managers and supervisors may also require new hire information to effectively integrate the employee into the team and assign appropriate tasks. This information can also help them understand the employee's background and qualifications.

04

Compliance and Legal Departments: The compliance and legal departments may need new hire information for legal and regulatory compliance purposes, such as verifying the employee's eligibility to work in the country, conducting background checks if required, and maintaining necessary documentation.

05

IT Department: The IT department may require new hire information to set up the employee's access to various systems, network resources, email accounts, and other technology tools necessary for their job.

06

Benefits Providers: If the employee is eligible for company-sponsored benefits, the benefits providers require access to new hire information to enroll the employee in the appropriate benefit programs, such as health insurance or retirement plans.

07

Administrative Personnel: Administrative personnel involved in various aspects of the onboarding process, such as scheduling and organizing orientation sessions, may also require new hire information to ensure a smooth transition for the employee.

By providing new hire information accurately and promptly, not only do you facilitate a seamless onboarding experience for the employee, but you also assist different departments in carrying out their respective responsibilities efficiently.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my new hire info in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign new hire info and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit new hire info online?

With pdfFiller, it's easy to make changes. Open your new hire info in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I make edits in new hire info without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing new hire info and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is new hire info?

New hire info is information about a newly hired employee that must be reported to the appropriate state agency.

Who is required to file new hire info?

Employers are required to file new hire info for any newly hired employee.

How to fill out new hire info?

New hire info can be filled out online through the state's designated website or by submitting a paper form.

What is the purpose of new hire info?

The purpose of new hire info is to help state agencies enforce child support orders and detect fraudulent claims for public assistance.

What information must be reported on new hire info?

Information such as the employee's name, address, social security number, and start date must be reported on new hire info.

Fill out your new hire info online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Hire Info is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.