Get the free Homeowners Coverage - Part 1 - Insurance Brokers of Maryland

Show details

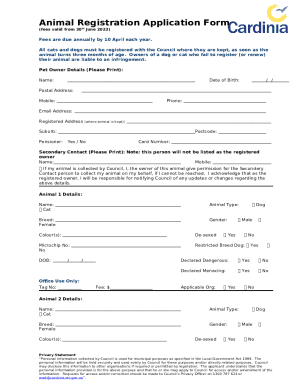

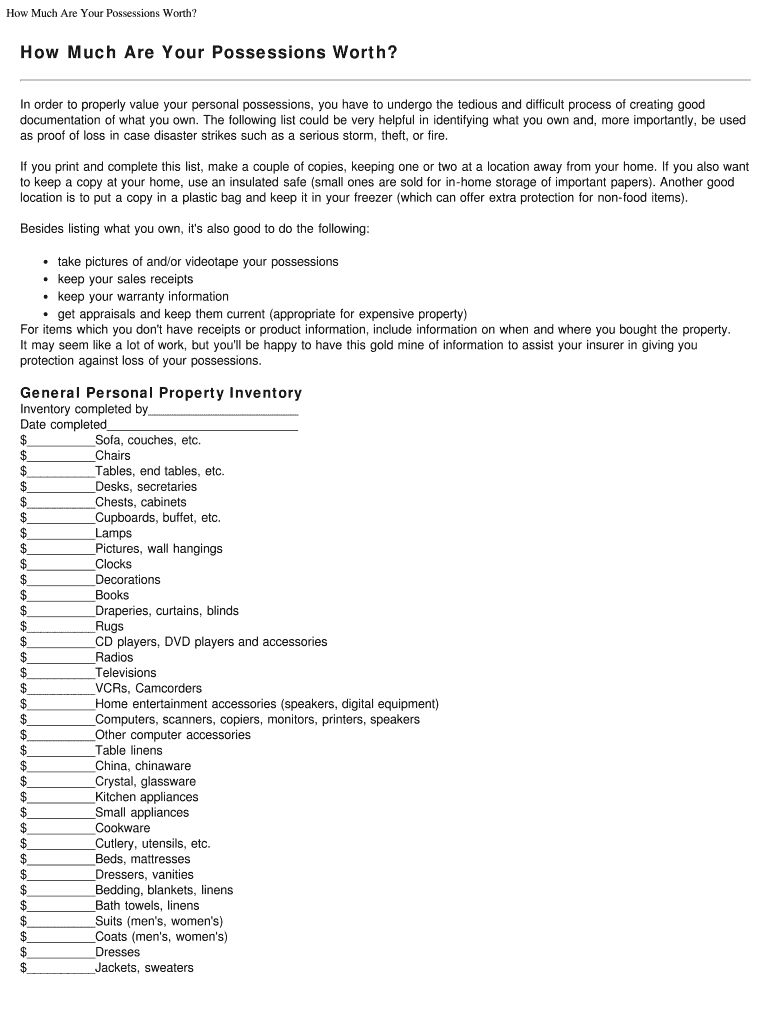

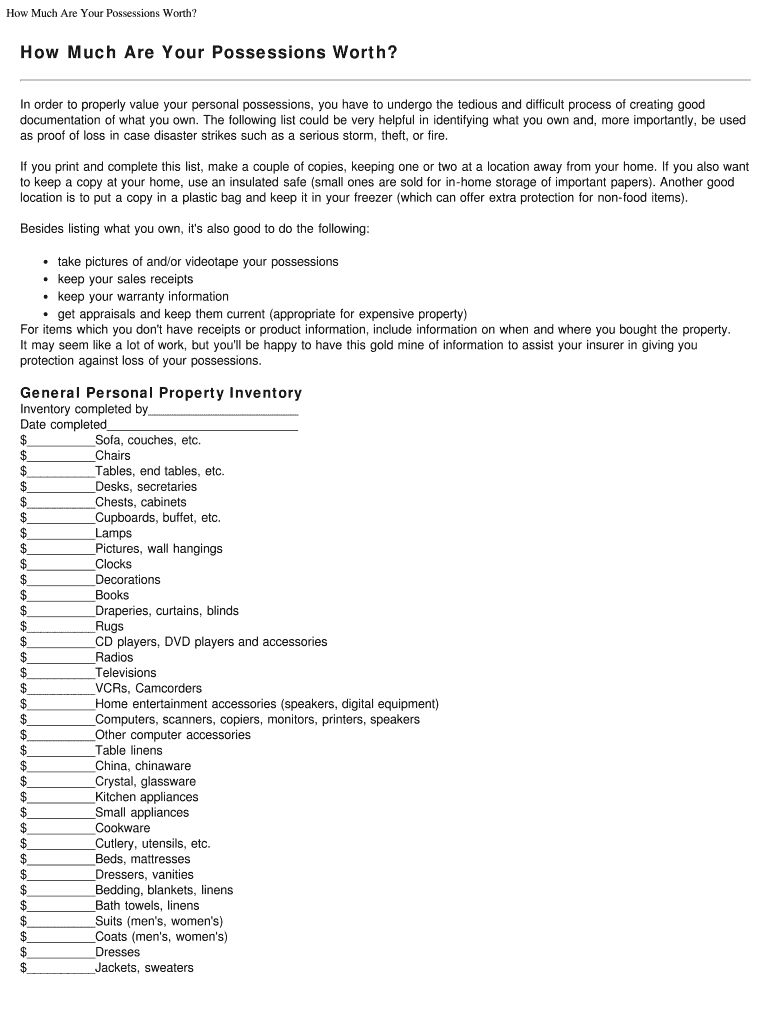

How Much Are Your Possessions Worth? How Much Are Your Possessions Worth? In order to properly value your personal possessions, you have to undergo the tedious and difficult process of creating good

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign homeowners coverage - part

Edit your homeowners coverage - part form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your homeowners coverage - part form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit homeowners coverage - part online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit homeowners coverage - part. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out homeowners coverage - part

How to fill out homeowners coverage - part:

01

Start by gathering all necessary documents, such as your home insurance policy, property details, and any relevant insurance forms.

02

Review your current homeowners coverage and identify any areas that may need to be updated or adjusted. This can include changes in property value, additions or renovations, or changes in personal belongings.

03

Take note of any specific requirements or guidelines provided by your insurance provider.

04

Complete the necessary forms, providing accurate and detailed information about your property, including its value, construction materials, security features, and any additional structures.

05

Consider any endorsements or additional coverage options that may be beneficial for your specific needs, such as flood or earthquake insurance.

06

Double-check all the information filled out on the forms to ensure accuracy and completeness.

07

Submit the completed forms to your insurance provider within the specified timeframe.

08

Keep a copy of all completed forms and documents for your records.

Who needs homeowners coverage - part:

01

Homeowners: Homeowners who own their property and want to protect their investment against potential risks and damages.

02

Renters: Renters who want to protect their personal belongings and liability in case of accidents or damage while renting a property.

03

Mortgage lenders: Most mortgage lenders require homeowners insurance as a condition for approving a mortgage loan, to protect their investment in the property.

04

Landlords: Landlords who rent out their properties may need homeowners insurance to protect their property and liability in case of accidents or damage caused by renters.

05

Condo owners: Condo owners may need homeowners insurance to cover their personal belongings, as well as liability for accidents or damages that occur within their unit.

06

Homeowners' associations: Homeowners' associations may require homeowners insurance for all property owners within their community to protect against collective risks and damages.

Overall, anyone who owns a home or has a financial stake in a property should strongly consider obtaining homeowners coverage to protect themselves from potential risks and liabilities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute homeowners coverage - part online?

pdfFiller has made it simple to fill out and eSign homeowners coverage - part. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the homeowners coverage - part in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your homeowners coverage - part in minutes.

Can I create an eSignature for the homeowners coverage - part in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your homeowners coverage - part and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is homeowners coverage - part?

Homeowners coverage - part typically refers to the section of a homeowners insurance policy that details the specific coverage and limits for the property and personal belongings.

Who is required to file homeowners coverage - part?

Homeowners who have a mortgage on their property are typically required to have homeowners coverage - part.

How to fill out homeowners coverage - part?

To fill out homeowners coverage - part, you will need to provide information about the property, personal belongings, and personal liability coverage.

What is the purpose of homeowners coverage - part?

The purpose of homeowners coverage - part is to protect the homeowner financially in case of damage to the property or personal belongings.

What information must be reported on homeowners coverage - part?

Information such as property address, details of personal belongings, coverage limits, and personal liability limits must be reported on homeowners coverage - part.

Fill out your homeowners coverage - part online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Homeowners Coverage - Part is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.