Get the free Compound Interest Formula - Proof

Show details

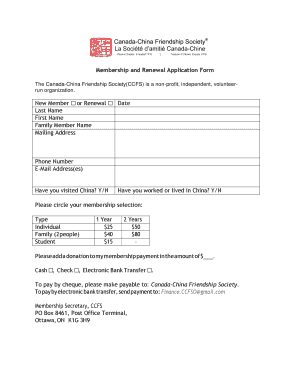

Compound Interest Formula Proof Simple Interest:I PRT I P r 1TimeBalance Principal + Interest0 years:A using t 1 year N Principal1 year:A Interest P + P r1 1P + P Ra P ×1 + r) factored Interest Principal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign compound interest formula

Edit your compound interest formula form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your compound interest formula form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit compound interest formula online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit compound interest formula. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out compound interest formula

How to fill out compound interest formula:

01

Determine the principal amount: This is the initial amount of money that you are investing or borrowing. It is essential to know the exact value of your principal.

02

Determine the interest rate: The interest rate is the percentage that is charged on the principal amount. It is usually given as an annual rate. Make sure to convert it to a decimal if it is given in percentage form.

03

Determine the number of periods: The compound interest formula requires you to know the number of times the interest is compounded or the number of periods. It could be annually, semi-annually, quarterly, or even monthly.

04

Calculate the compound interest: Use the formula A = P (1 + r/n)^(nt) to calculate the final amount of money (A) including the compound interest. Where P is the principal amount, r is the interest rate, n is the number of compounding periods in a year, and t is the total number of years.

05

Subtract the principal amount: To find the compound interest only, subtract the principal amount from the final amount calculated. The result will be the compound interest earned.

Who needs compound interest formula?

01

Investors: Investors often use the compound interest formula to assess the potential growth of their investments over time. It helps them understand how their money can grow significantly if it is reinvested.

02

Borrowers and lenders: Borrowers and lenders need to understand compound interest to calculate the total amount to be paid back or received. It allows them to determine the true cost of borrowing or the interest earned on lending.

03

Financial analysts: Professionals working in the financial industry, such as financial analysts or advisors, rely on the compound interest formula to analyze investment opportunities and advise their clients accordingly. It helps in making informed decisions about investing or borrowing.

04

Students: Students studying finance, economics, or related fields benefit from understanding compound interest. It helps them grasp the concept of money growth over time and its practical applications in the financial world.

In conclusion, anyone who wants to calculate the growth of their investments, the cost of borrowing, or the interest earned on lending can benefit from using the compound interest formula. It is particularly useful for investors, borrowers and lenders, financial analysts, and students studying finance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find compound interest formula?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the compound interest formula in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out the compound interest formula form on my smartphone?

Use the pdfFiller mobile app to fill out and sign compound interest formula on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How can I fill out compound interest formula on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your compound interest formula. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is compound interest formula?

The compound interest formula is A = P(1 + r/n)^(nt), where A is the amount of money accumulated after n years, including interest, P is the principal amount (initial investment), r is the annual interest rate (in decimal form), n is the number of times that interest is compounded per year, and t is the time the money is invested for.

Who is required to file compound interest formula?

Any individual or entity that is earning interest on an investment and wants to calculate the total amount of money accumulated over time.

How to fill out compound interest formula?

To fill out the compound interest formula, you need to input the principal amount, annual interest rate, number of times interest is compounded per year, and the time the money is invested for. Then, calculate the final amount accumulated.

What is the purpose of compound interest formula?

The purpose of the compound interest formula is to calculate the total amount of money accumulated on an investment over time, taking into account the power of compounding.

What information must be reported on compound interest formula?

The principal amount invested, the annual interest rate, the number of times the interest is compounded per year, and the time period the money is invested for.

Fill out your compound interest formula online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Compound Interest Formula is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.