Get the free Arizona Schedule A(PYN) Itemized Deductions 2014

Instructions and Help about arizona schedule apyn itemized

How to edit arizona schedule apyn itemized

How to fill out arizona schedule apyn itemized

Latest updates to arizona schedule apyn itemized

All You Need to Know About arizona schedule apyn itemized

What is arizona schedule apyn itemized?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

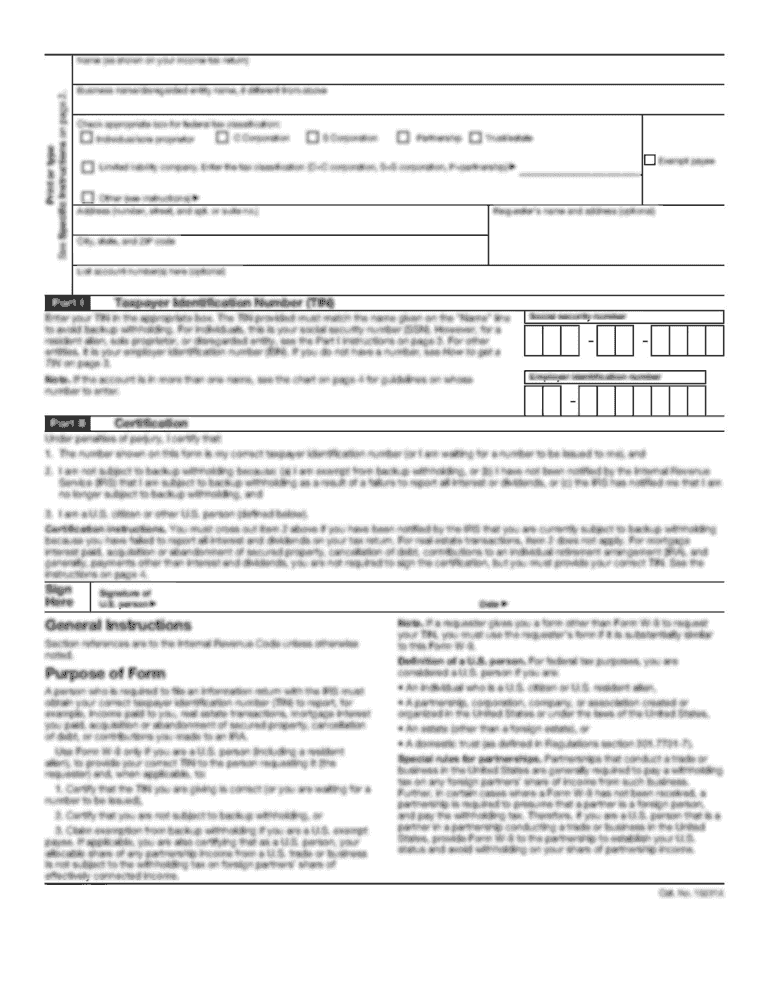

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about arizona schedule apyn itemized

How do I correct mistakes on my Arizona Schedule APYN Itemized after filing?

If you discover errors after submitting your Arizona Schedule APYN Itemized, you need to file an amended return. This typically involves using the same form, marking it as amended, and providing the correct information. Ensure to keep a record of all correspondence and documentation associated with the correction for future reference.

How can I verify the status of my Arizona Schedule APYN Itemized submission?

To verify the receipt and processing of your Arizona Schedule APYN Itemized, you can use the state’s online tracking system, where you need to provide your personal details. Alternatively, you can contact the relevant state department for assistance. Be aware of common e-file rejection codes to avoid complications.

What should I do if I receive a notice or audit regarding my Arizona Schedule APYN Itemized?

If you receive a notice or are subject to an audit concerning your Arizona Schedule APYN Itemized, respond promptly and gather all relevant documentation to support your submission. It's advisable to consult with a tax professional to ensure that you address any issues accurately and efficiently.

Are there any common errors to avoid when submitting the Arizona Schedule APYN Itemized?

Common errors include incorrect identification numbers, mismatched amounts with supporting documents, and failing to sign the form where necessary. Reviewing your entries carefully can help minimize these mistakes and ensure your Arizona Schedule APYN Itemized is processed smoothly.

What are the technical requirements for e-filing the Arizona Schedule APYN Itemized?

When e-filing your Arizona Schedule APYN Itemized, ensure your software meets state specifications. Check for compatibility with popular browsers and updates required by the e-filing platform to facilitate a seamless submission experience without technical issues.