CRS Small Business Administration 7(a) Loan Guaranty Program 2013 free printable template

Show details

Small Business Administration 7(a) Loan Guaranty Program Robert Jay Digger Senior Specialist in American National Government November 8, 2011, Congressional Research Service 7-5700 www.crs.gov R41146

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CRS Small Business Administration 7a Loan

Edit your CRS Small Business Administration 7a Loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CRS Small Business Administration 7a Loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CRS Small Business Administration 7a Loan online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CRS Small Business Administration 7a Loan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CRS Small Business Administration 7(a) Loan Guaranty Program Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CRS Small Business Administration 7a Loan

How to fill out CRS Small Business Administration 7(a) Loan Guaranty

01

Determine eligibility based on business size, type, and purpose of the loan.

02

Gather necessary documents, including business financial statements, personal financial statements, and tax returns.

03

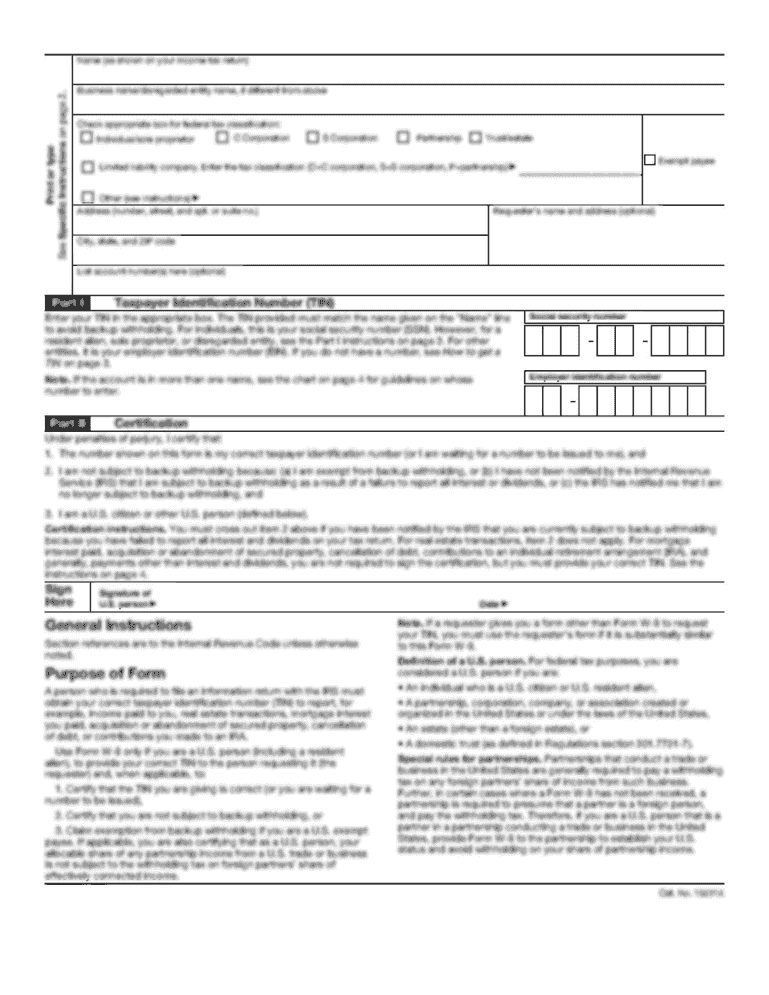

Complete the SBA Form 1919 (Borrower Information Form) accurately.

04

Prepare a detailed business plan outlining your objectives, market analysis, and financial projections.

05

Fill out the SBA loan application, including all required personal and business information.

06

Submit the completed application along with all supporting documents to an SBA-approved lender.

07

Wait for the lender to review your application and provide necessary feedback or requests for additional information.

08

If approved, review the loan terms and conditions before signing the agreement.

09

Utilize the funds according to the agreed purposes outlined in your business plan.

Who needs CRS Small Business Administration 7(a) Loan Guaranty?

01

Small business owners seeking financing for working capital, equipment, or real estate.

02

Entrepreneurs looking to start or expand a business with limited access to traditional financing.

03

Businesses aiming to improve cash flow without sacrificing ownership equity.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit CRS Small Business Administration 7a Loan from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including CRS Small Business Administration 7a Loan, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I edit CRS Small Business Administration 7a Loan on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing CRS Small Business Administration 7a Loan, you need to install and log in to the app.

How can I fill out CRS Small Business Administration 7a Loan on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your CRS Small Business Administration 7a Loan by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is CRS Small Business Administration 7(a) Loan Guaranty?

The CRS Small Business Administration 7(a) Loan Guaranty is a financial product designed to help small businesses obtain funding by providing a guarantee to lenders, thus reducing the risk associated with lending to small businesses.

Who is required to file CRS Small Business Administration 7(a) Loan Guaranty?

Small business owners seeking loans that fall under the SBA 7(a) program are typically required to file the necessary documentation for the loan guaranty.

How to fill out CRS Small Business Administration 7(a) Loan Guaranty?

To fill out the CRS Small Business Administration 7(a) Loan Guaranty, applicants must complete the SBA loan application forms, provide financial statements, business plans, and any other required documentation as specified by the lending institution.

What is the purpose of CRS Small Business Administration 7(a) Loan Guaranty?

The purpose of the CRS Small Business Administration 7(a) Loan Guaranty is to provide small businesses with access to capital, promote growth and job creation, and reduce the financial risk for lenders.

What information must be reported on CRS Small Business Administration 7(a) Loan Guaranty?

Information that must be reported includes the loan amount, borrower details, loan purpose, repayment terms, and performance metrics to ensure compliance with the SBA's requirements.

Fill out your CRS Small Business Administration 7a Loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CRS Small Business Administration 7a Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.