Get the free MORTGAGE BROKER BONDS - Bond Brokers Inc

Show details

MORTGAGE BROKER BONDS

Thank you for giving Bond Brokers the opportunity to consider your account for bonding.

In essence, surety is a credit relationship. Because of this, applying for a bond is similar

to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage broker bonds

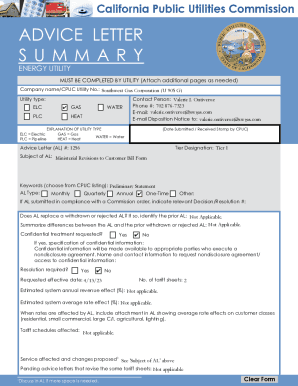

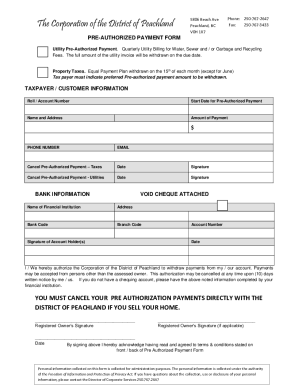

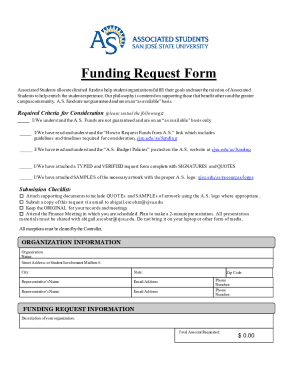

Edit your mortgage broker bonds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage broker bonds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage broker bonds online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mortgage broker bonds. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage broker bonds

How to fill out mortgage broker bonds:

01

Research the requirements: Start by researching the specific requirements for filling out mortgage broker bonds in your jurisdiction. This may include factors such as required bond amounts, specific application forms, and supporting documentation.

02

Choose a reputable surety bond provider: Once you have a clear understanding of the requirements, choose a reputable surety bond provider who can issue the mortgage broker bond. Look for a provider with experience in the industry and who offers competitive rates.

03

Gather necessary documentation: Gather all the necessary documentation required to complete the bond application. This may include personal identification documents, financial statements, credit information, and business licenses.

04

Complete the application: Fill out the bond application accurately and thoroughly. Provide all requested information, ensuring that it aligns with the documentation you have gathered. Double-check for any errors or omissions before submitting the application.

05

Pay the bond premium: Pay the required bond premium to the surety bond provider. The bond premium is typically a percentage of the total bond amount and acts as a fee for the surety's financial guarantee.

06

Submit the application: Submit the completed bond application along with the required documentation and premium payment to the surety bond provider. Depending on the provider, this can usually be done online or through mail.

07

Wait for approval: Once the application is submitted, you will need to wait for the surety bond provider to review and approve your application. This process can take a few days or longer, depending on various factors such as the complexity of your application and the provider's workload.

08

Receive the bond: Once your application is approved, you will receive the issued mortgage broker bond. Make sure to keep a copy for your records and be prepared to provide it as proof of bonding when required.

09

Renew as needed: Mortgage broker bonds typically have an expiration date. Be sure to keep track of this date and renew the bond as needed to ensure continuous compliance with regulatory requirements.

Who needs mortgage broker bonds:

01

Mortgage brokers: Mortgage brokers play a vital role in facilitating loans between borrowers and lenders. They are typically required to obtain a mortgage broker bond as a form of consumer protection and to ensure compliance with industry regulations.

02

Lending institutions: Lending institutions that work with mortgage brokers may also require them to have mortgage broker bonds. This provides an additional layer of protection and guarantees the broker's adherence to certain standards and ethical practices.

03

Regulatory authorities: Regulatory authorities, such as state departments of financial institutions or banking, often mandate mortgage brokers to carry bonds. This requirement helps protect consumers from potential financial harm caused by fraudulent or unethical practices of mortgage brokers.

04

Homebuyers and borrowers: Although not directly responsible for obtaining mortgage broker bonds, homebuyers and borrowers indirectly benefit from the availability of these bonds. It provides them with recourse and financial protection if they suffer losses due to the broker's professional misconduct or negligence.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mortgage broker bonds from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your mortgage broker bonds into a dynamic fillable form that you can manage and eSign from anywhere.

Can I sign the mortgage broker bonds electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your mortgage broker bonds in seconds.

How do I complete mortgage broker bonds on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your mortgage broker bonds, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is mortgage broker bonds?

Mortgage broker bonds are a type of surety bond required for mortgage brokers to obtain a license.

Who is required to file mortgage broker bonds?

Mortgage brokers are required to file mortgage broker bonds.

How to fill out mortgage broker bonds?

To fill out mortgage broker bonds, you need to contact a surety bond company and provide the necessary information.

What is the purpose of mortgage broker bonds?

The purpose of mortgage broker bonds is to protect consumers from fraudulent activities by mortgage brokers.

What information must be reported on mortgage broker bonds?

Mortgage broker bonds must include information such as the broker's name, license number, and bond amount.

Fill out your mortgage broker bonds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Broker Bonds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.