Get the free SJC Low Income Worksheet - sanjac

Show details

This document is a financial aid worksheet for San Jacinto College, requiring the student and spouse to report their income and additional resources for the year 2011, along with an explanation of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sjc low income worksheet

Edit your sjc low income worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sjc low income worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sjc low income worksheet online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sjc low income worksheet. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sjc low income worksheet

How to fill out SJC Low Income Worksheet

01

Gather your income documents, including pay stubs, tax returns, and any other income sources.

02

Download the SJC Low Income Worksheet from the relevant website or obtain a physical copy.

03

Fill in your personal information at the top of the worksheet, including your name, address, and contact information.

04

List all sources of income for you and your household members in the designated sections.

05

Calculate your total monthly income by summing all the individual sources listed.

06

Fill in your household expenses in the corresponding section to provide a clear understanding of your financial situation.

07

Review the completed worksheet for accuracy and ensure no information is missing.

08

Submit the completed worksheet to the appropriate authority or department as indicated in the instructions.

Who needs SJC Low Income Worksheet?

01

Individuals and families with low income who are seeking financial assistance or benefits.

02

Residents in the jurisdiction of SJC who need to demonstrate their financial need for specific programs.

Fill

form

: Try Risk Free

People Also Ask about

What qualifies you for low income in California?

You are considered low income if you make $49,000. Or less in the Sanwaqin. County $60,000 or lessMoreYou are considered low income if you make $49,000. Or less in the Sanwaqin. County $60,000 or less in Plaster County or Sacramento. County or $14,000 in San Francisco. And other Bay Area counties.

Is $100,000 considered low income in California?

$100K is 'low income' in even more CA counties Earning a six-figure salary as a single person without dependents is considered “low income” in five counties — all in Northern California.

What's considered low income near San Jose, CA?

What is AMI? Santa Clara County 2025 Area Median Income: $195,200 Number of People in Household17 Extremely Low $42,200 $74,750 Very Low Income $70,350 $124,600 Low Income $111,700 $197,8504 more rows

What's considered low income in San Mateo County?

Residents making an annual income of up to $109,700 who are living in Marin, San Francisco, San Mateo, Santa Clara and Santa Cruz counties are considered low income, according to the California Department of Housing & Community Development.

What is considered low income in Bay Area, California?

And still be classified as lowincome nowhere is that more pronounced than in Santa Clara. CountyMoreAnd still be classified as lowincome nowhere is that more pronounced than in Santa Clara. County where people making under $111,700. A year are now defined. As low income. If you make $111,000.

What qualifies as low income in San Jose?

Nowhere is that more pronounced than in Santa Clara County, where people making under $111,700 a year are now defined as “low income.” “If you make $111,000 a year, you'll still have a hard time getting a spot here,” said San Jose resident Samuel Carbajal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

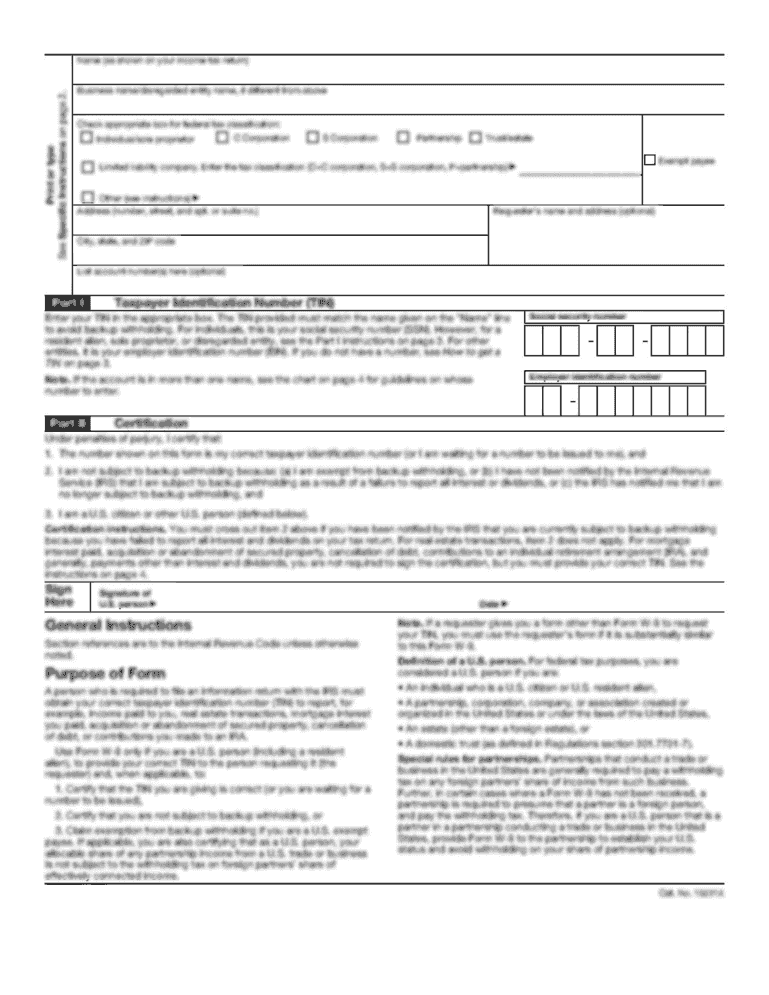

What is SJC Low Income Worksheet?

The SJC Low Income Worksheet is a financial document used to determine eligibility for certain assistance programs based on low income levels.

Who is required to file SJC Low Income Worksheet?

Individuals or families whose income falls below a specified threshold and are seeking assistance or benefits that require income verification must file the SJC Low Income Worksheet.

How to fill out SJC Low Income Worksheet?

To fill out the SJC Low Income Worksheet, individuals should gather necessary financial documents, accurately report their income, household size, and any applicable deductions, and submit the completed form to the appropriate agency or organization.

What is the purpose of SJC Low Income Worksheet?

The purpose of the SJC Low Income Worksheet is to assess an applicant's financial situation to determine their eligibility for various low income assistance programs and services.

What information must be reported on SJC Low Income Worksheet?

The SJC Low Income Worksheet requires reporting of total income, household size, types of income sources, and any relevant deductions or exemptions that impact total household income.

Fill out your sjc low income worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sjc Low Income Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.