Get the free Your Payslip Explained

Show details

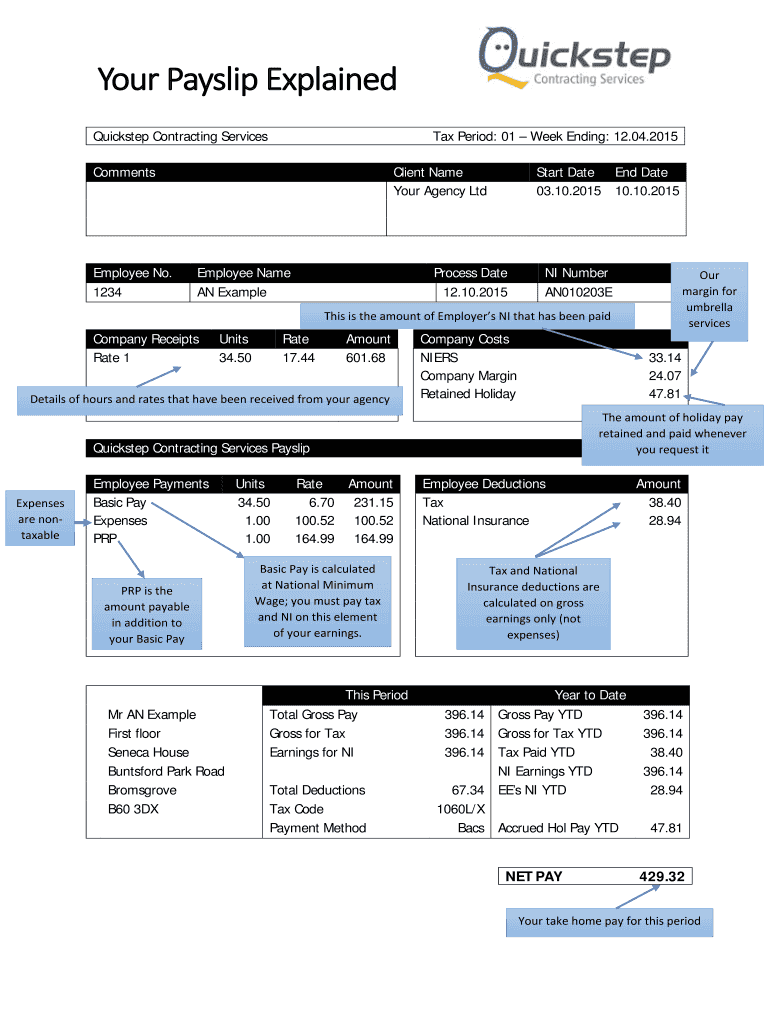

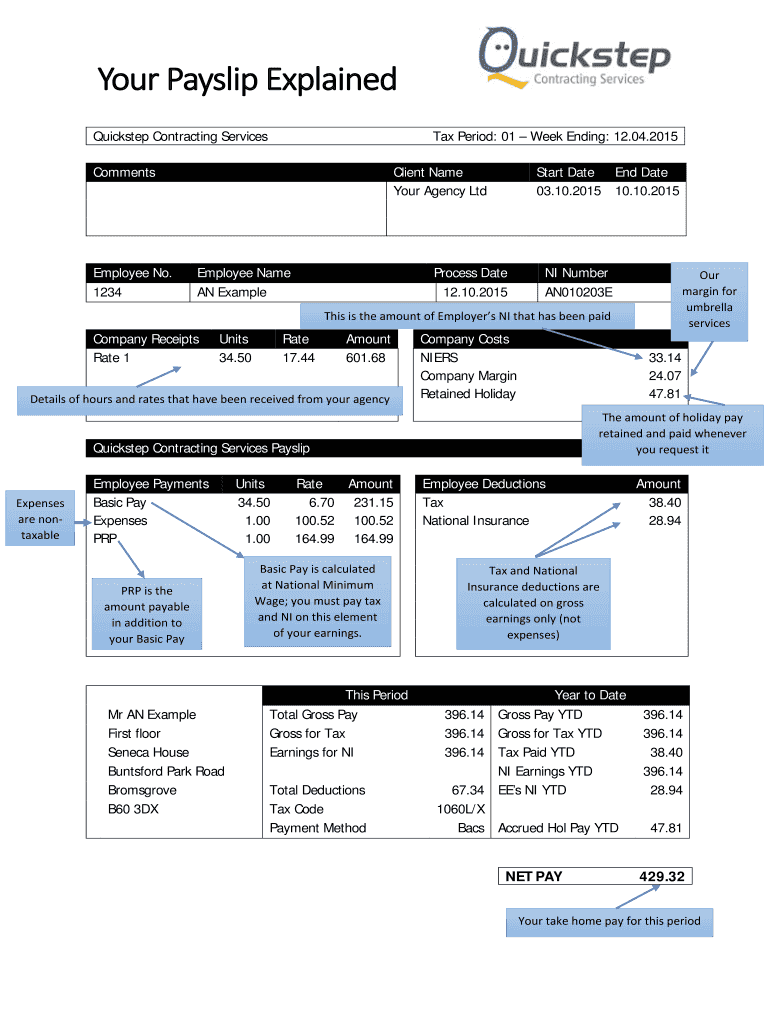

Your Payslip Explained Quickstep Contracting Services Period: 01 Week Ending: 12.04.2015CommentsEmployee No. 1234Client Name Your Agency Employee Name AN Example Start Date End Date 03.10.2015 10.10.2015Process

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign your payslip explained

Edit your your payslip explained form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your your payslip explained form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing your payslip explained online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit your payslip explained. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out your payslip explained

How to fill out your payslip explained:

01

Understand the sections: Familiarize yourself with the different sections of your payslip, such as the employee information, pay period, income details, deductions, and net pay. Each section serves a specific purpose and provides important information about your salary.

02

Enter your personal information: Start by entering your personal details, including your full name, employee ID, address, and contact information. Make sure this information is accurate and up to date.

03

Fill in the pay period: Indicate the start and end dates of the pay period for which you are receiving the payslip. This helps keep track of your earnings for that specific period.

04

Provide income details: This section includes information about your earnings. Fill in details such as your gross salary, hourly rate (if applicable), and the number of hours worked (if applicable). Ensure that all these figures are accurate to calculate your total income correctly.

05

Deductions: Deductions are expenses or withholdings that reduce your net pay. Common deductions include taxes, insurance premiums, retirement contributions, and any loan repayments. Follow the instructions on your payslip to accurately enter any deductions.

06

Calculate your net pay: Your net pay is the amount you will receive after all deductions. It is crucial to calculate this accurately as it reflects the actual amount that will be deposited into your bank account. Double-check your calculations to avoid any mistakes.

07

Review and validate: Before submitting your payslip, review all the information entered to make sure everything is correct. Check for any spelling errors, incorrect figures, or missing information. Rectify any mistakes to ensure accurate record-keeping.

Who needs your payslip explained?

01

New employees: Employees who are unfamiliar with the payslip format and its components may require guidance on how to fill out their payslip accurately.

02

Individuals changing jobs: Those transitioning from one job to another may encounter payslips with different formats or additional sections. They may need their payslip explained to understand the changes and ensure accurate completion.

03

People dealing with salary discrepancies: Employees who notice differences between their expected salary and what is stated on their payslip may need assistance to understand the various components and calculations. Explaining their payslip can help identify any errors or discrepancies.

04

Individuals seeking financial advice: People looking for financial guidance, such as budgeting or tax planning, may benefit from understanding their payslip. By comprehending the breakdown of their income and deductions, they can make informed decisions about their finances.

05

Employers or HR personnel: Employers or HR personnel may need to explain payslips to their employees, particularly during the onboarding process or when employees have questions or concerns. Providing clear explanations can foster better transparency and employee satisfaction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my your payslip explained in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your your payslip explained and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit your payslip explained on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign your payslip explained. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Can I edit your payslip explained on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share your payslip explained on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is your payslip explained?

Your payslip is a document provided by your employer that outlines the details of your salary, deductions, and any additional payments or bonuses.

Who is required to file your payslip explained?

You, as an employee, are not required to file your payslip. Your employer is responsible for providing you with the payslip each pay period.

How to fill out your payslip explained?

You do not need to fill out your payslip. Your employer will fill out the payslip with the necessary information such as your earnings, deductions, and any other relevant details.

What is the purpose of your payslip explained?

The purpose of your payslip is to provide you with a detailed breakdown of your salary, including any deductions and taxes withheld. It also serves as a record of your earnings for a specific pay period.

What information must be reported on your payslip explained?

Your payslip should include details such as your gross salary, any deductions for taxes, retirement contributions, health insurance, and any additional payments or bonuses.

Fill out your your payslip explained online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Your Payslip Explained is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.