Get the free mortgage leads

Show details

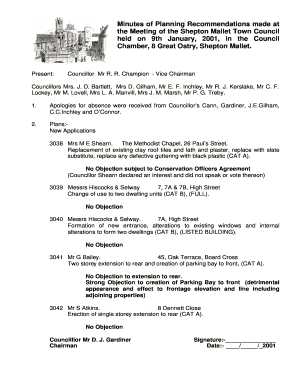

MORTGAGE LEADS ORDER FORM Primary Contact: Sales Person: Company: MAILING LIST: Address: I will supply my own list from a Title Company. I need a mailing list developed. City: State: Zip: Zip Codes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage leads form

Edit your mortgage leads form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage leads form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage leads form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mortgage leads form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage leads form

How to fill out mortgage leads:

01

Research the lead: Before filling out a mortgage lead, it is important to research and gather information about the lead. This may include details such as their financial situation, credit score, employment history, and any existing mortgage or loans.

02

Contact the lead: Once you have gathered all the necessary information, reach out to the lead and initiate contact. This could be done through phone calls, emails, or even in-person meetings, depending on the preference of the lead.

03

Understand their needs: During the initial conversation with the lead, it is essential to listen carefully and understand their specific needs and requirements. Whether they are looking for a new mortgage, refinancing options, or information on home equity loans, tailor your approach accordingly.

04

Provide accurate information: When filling out the mortgage lead, ensure that all the information provided is accurate and up-to-date. This includes details about interest rates, loan options, repayment terms, and any other relevant information that the lead may inquire about.

05

Explain the process: The mortgage process can be complex and overwhelming for many individuals. Take the time to clearly explain each step of the process to the lead, addressing any concerns or questions they may have. This will help build trust and confidence in your services.

Who needs mortgage leads:

01

Mortgage brokers: Mortgage brokers are professionals who connect borrowers with lenders and help facilitate the mortgage process. They often rely on mortgage leads to find potential clients who are in need of mortgage services.

02

Banks and financial institutions: Banks and financial institutions regularly seek mortgage leads as a way to expand their customer base and generate mortgage loan business. These leads allow them to target and connect with individuals who are actively looking for mortgage financing.

03

Real estate agents: Real estate agents often interact with individuals who are in the market for a new home. These potential homebuyers may require mortgage financing, making mortgage leads valuable for agents to connect them with lenders or mortgage brokers.

04

Mortgage lenders: Mortgage lenders, whether large institutions or smaller private lenders, constantly search for mortgage leads to identify qualified borrowers who are seeking financing for their homes. These leads help lenders streamline their marketing efforts and target individuals in need of mortgage services.

05

Homeowners in need of refinancing: Many homeowners may already have a mortgage but are interested in refinancing to secure a better interest rate or adjust their loan terms. These individuals actively seek mortgage leads to explore their refinancing options and find the best deal available.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mortgage leads form from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your mortgage leads form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I edit mortgage leads form on an iOS device?

Create, edit, and share mortgage leads form from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Can I edit mortgage leads form on an Android device?

You can edit, sign, and distribute mortgage leads form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is mortgage leads?

Mortgage leads are potential customers who have expressed interest in obtaining a mortgage loan.

Who is required to file mortgage leads?

Lenders and financial institutions are required to file mortgage leads.

How to fill out mortgage leads?

Mortgage leads can be filled out online or through paper forms provided by the regulatory agency.

What is the purpose of mortgage leads?

The purpose of mortgage leads is to track and monitor potential borrowers in the mortgage lending process.

What information must be reported on mortgage leads?

Information such as borrower's contact details, loan amount, property information, and loan status must be reported on mortgage leads.

Fill out your mortgage leads form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Leads Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.