Get the free Are Property Taxes Forcing the Elderly Out of their Homes - minds wisconsin

Show details

Robert M. La Follette School of Public Affairs at the University of Wisconsin-Madison Working Paper Series La Follette School Working Paper No. 2009-026 HTTP:/ / www.lafollette.wisc.edu/ publications/

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign are property taxes forcing

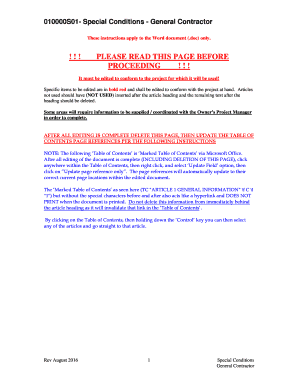

Edit your are property taxes forcing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your are property taxes forcing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit are property taxes forcing online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit are property taxes forcing. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

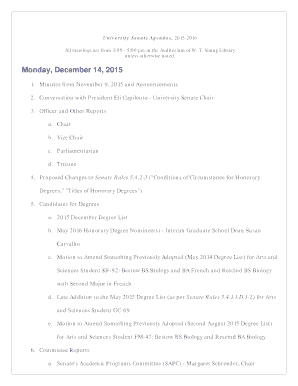

How to fill out are property taxes forcing

How to fill out are property taxes forcing?

01

Determine the current market value of your property: Research the value of comparable properties in your area to estimate the market value of your property accurately. This information is essential for calculating property taxes.

02

Understand the local tax assessment process: Familiarize yourself with the criteria used by your local tax assessment office to determine property values and tax rates. This includes understanding any exemptions or deductions that may apply to your property.

03

Gather necessary documentation: Collect all relevant documents, including property deeds, past tax statements, and any documentation of recent renovations or changes in property value.

04

Complete the property tax assessment form: Fill out the property tax assessment form provided by your local tax assessment office. Provide accurate information about the property's condition, size, amenities, and any changes or improvements made.

05

Include supporting documents: Attach supporting documents, such as appraisal reports, property surveys, and renovation permits, to substantiate the information provided in the assessment form.

06

Submit the completed form and supporting documents: Submit the filled-out assessment form and accompanying documents to your local tax assessment office within the specified deadline. Ensure you retain copies for your records.

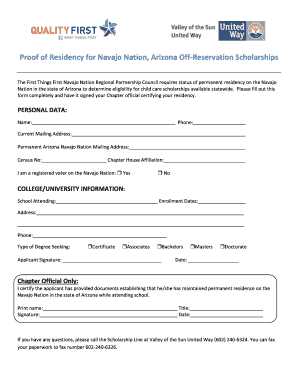

Who needs are property taxes forcing?

01

Homeowners: Property taxes are primarily imposed on homeowners to fund local government services and infrastructure development. Anyone who owns residential property is subject to property taxes.

02

Business owners: Commercial property owners, including business owners, also bear the burden of property taxes. These taxes contribute to funding local services and maintaining community infrastructure.

03

Property investors: Individuals or companies who invest in real estate properties for rental income or future sale also need to be aware of property taxes. Understanding these taxes is crucial for setting rental prices or calculating investment returns accurately.

04

Real estate professionals: Real estate agents, brokers, and property managers should have a thorough understanding of property taxes to provide accurate information and guidance to their clients. They play a crucial role in ensuring property value assessments are fair and accurate.

In summary, filling out property tax assessments requires understanding the local assessment process, gathering necessary documentation, completing the assessment form accurately, and submitting it along with supporting documents. Property taxes impact homeowners, business owners, property investors, and real estate professionals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is are property taxes forcing?

Property taxes are forcing individuals and businesses to pay a percentage of the assessed value of their property to the government.

Who is required to file are property taxes forcing?

Property owners are typically required to file property taxes.

How to fill out are property taxes forcing?

To fill out property taxes, property owners need to obtain the necessary forms from their local government, properly assess the value of their property, and provide accurate information regarding ownership and other relevant details.

What is the purpose of are property taxes forcing?

The purpose of property taxes is to generate revenue for local governments to fund public services and infrastructure.

What information must be reported on are property taxes forcing?

Property owners must report details such as the assessed value of their property, ownership information, and any relevant exemptions or deductions.

How do I edit are property taxes forcing online?

The editing procedure is simple with pdfFiller. Open your are property taxes forcing in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the are property taxes forcing in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I edit are property taxes forcing on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share are property taxes forcing from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your are property taxes forcing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Are Property Taxes Forcing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.