Get the free Discretionary Gift Trust - AXA Wealth - axawealth co

Show details

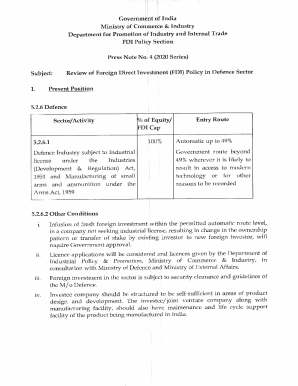

Discretionary Gift Trust Deed Note This document is provided on the strict understanding that it is presented as a draft to be considered by the Settler and their legal advisers. It is based on our

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign discretionary gift trust

Edit your discretionary gift trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your discretionary gift trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit discretionary gift trust online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit discretionary gift trust. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out discretionary gift trust

To fill out a discretionary gift trust, follow these steps:

01

Gather necessary information: Start by collecting all relevant documentation, including the details of the trust property, the names and contact information of the trust beneficiaries, and any specific instructions or preferences.

02

Engage professional assistance: Consider consulting with a qualified attorney or financial advisor who specializes in trust law to ensure that you understand the legal requirements and implications associated with the discretionary gift trust.

03

Identify the trustee: Selecting a trustee is a crucial step in the process. The trustee should be someone trustworthy and capable of managing the trust effectively, making impartial decisions, and distributing the trust assets in accordance with your wishes.

04

Define the purposes and terms: Clearly outline the purpose of the discretionary gift trust, such as providing for the financial needs of beneficiaries or philanthropic endeavors. Determine the terms of the trust, including any conditions, restrictions, and guidelines for distributions.

05

Determine the assets: Decide which assets or property you intend to transfer into the trust. This could include cash, stocks, real estate, or any other valuable belongings. Ensure that you have the legal authority to transfer these assets into the trust.

06

Draft the trust document: Work with the assistance of your attorney to draft the trust document. This legal document outlines the specifics of the trust, including the trustee's powers, beneficiaries' rights, distribution guidelines, and any other provisions.

07

Execute the trust document: Sign and date the trust document in the presence of witnesses or a notary, as required by your jurisdiction's laws. Keep copies of the executed trust document for your records.

08

Fund the trust: Transfer or retitle the chosen assets into the trust's name. This step typically involves changing ownership or beneficiary designations to reflect the trust as the new legal owner.

09

Communicate with beneficiaries: Inform the named beneficiaries about the existence of the discretionary gift trust and provide them with relevant information. It may be helpful to explain how the trust works and what they should expect regarding distributions and their involvement in the trust.

Who needs a discretionary gift trust?

A discretionary gift trust may be suitable for individuals or families who:

01

Seek to provide financial support or asset protection for their loved ones while maintaining control over the distribution of assets.

02

Want to protect beneficiaries from potential creditors, lawsuits, or financial mismanagement.

03

Wish to alleviate concerns about the misuse or squandering of the trust assets by individuals who lack financial responsibility.

04

Desire to leave a legacy or make charitable contributions through the trust, allowing the trustees to distribute funds to various organizations or causes.

05

Have beneficiaries who may require professional guidance for managing or investing their inheritances, particularly in cases involving minors, individuals with disabilities, or those lacking financial experience.

It is essential to consult with a qualified professional to determine if a discretionary gift trust aligns with your specific circumstances and objectives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get discretionary gift trust?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the discretionary gift trust in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make edits in discretionary gift trust without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your discretionary gift trust, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my discretionary gift trust in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your discretionary gift trust and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is discretionary gift trust?

Discretionary gift trust is a legal arrangement in which the trustee has the power to decide how the trust assets are distributed to the beneficiaries, based on the terms of the trust.

Who is required to file discretionary gift trust?

The trustee of the discretionary gift trust is required to file the trust with the relevant tax authorities.

How to fill out discretionary gift trust?

To fill out a discretionary gift trust, the trustee must provide relevant information about the trust assets, beneficiaries, and terms of distribution.

What is the purpose of discretionary gift trust?

The purpose of a discretionary gift trust is to provide flexibility in distributing assets to beneficiaries while also protecting the assets from creditors and unforeseen circumstances.

What information must be reported on discretionary gift trust?

The trustee must report the trust assets, beneficiaries, and terms of distribution in the discretionary gift trust.

Fill out your discretionary gift trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Discretionary Gift Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.