Get the free Tax Document Checklist

Show details

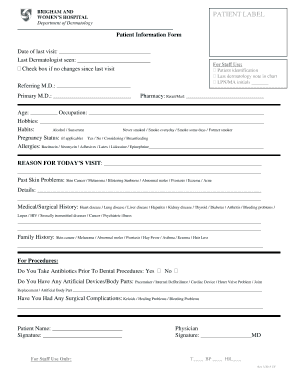

This document serves as a checklist for existing clients to compile necessary tax documents and information required for their tax filings.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax document checklist

Edit your tax document checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax document checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax document checklist online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax document checklist. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax document checklist

How to fill out Tax Document Checklist

01

Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

02

Collect receipts for deductible expenses, such as medical bills, charitable donations, and business expenses.

03

Organize your documents according to the categories listed in the checklist.

04

Fill in your personal information at the top of the checklist.

05

Check off each item as you complete it to ensure nothing is overlooked.

06

Review the completed checklist to confirm all required documents are included.

07

Keep a copy of the checklist for your records.

Who needs Tax Document Checklist?

01

Anyone who is required to file taxes, including individuals with income from various sources, business owners, and freelancers.

02

Tax preparers and accountants who assist clients in filing their tax returns.

03

Organizations and entities that need to report financial information for compliance.

Fill

form

: Try Risk Free

People Also Ask about

What are the biggest tax mistakes people make?

Avoid These Common Tax Mistakes Credits. Deductions. Not Being Aware of Tax Considerations for the Military. Not Keeping Up with Your Paperwork. Not Double Checking Your Forms for Errors. Not Adhering to Filing Deadlines or Not Filing at All. Not Fixing Past Mistakes. Not Planning for Next Year.

What items are needed for a tax return?

Documents from side jobs and self-employment Statements from banks, payment apps, card processors or online marketplaces. Checks paid to you. Receipts and mileage logs for travel, gift and car expenses. Records of deductible office expenses. Estimated tax payments. Other business income and expense records.

What things can I put on my tax return?

Business expenses you can report if you're self-employed Cars, minicabs and other vehicles like vans and motorcycles. Other business travel. Place of business. Tax, National Insurance and pension. Legal and financial costs. Office and equipment costs. Staff expenses. Business expenses when you use your home for business.

What information do I need to complete a tax return?

Tax return checklist Gather all necessary documents: You will need documents for all of your sources of income. This can include a P60 FORM, as well as a P45 and/or P11D if you received one. You will need details of your investment income (and interest), property income, or any income from self-employment.

What is a tax return document in the USA?

A federal tax return is a tax return you send to the IRS each year through Form 1040, U.S. Individual Income Tax Return. It shows how much money you earned in a tax year and how much money you paid in taxes. Its purpose is to display that you met your obligation to pay the U.S. government.

What items do I need for my tax return?

Forms W-2, 1099 or other information returns Form 1099-K for payments from payment cards and online marketplaces. Form 1099-G for government payments such as unemployment benefits. Form 1099-INT from banks and brokers showing interest you received. Form 1099-DIV for dividends and distributions paid to you.

What is needed for my tax return?

an income statement or payment summary showing the amount of money you earned and how much tax you paid. documents showing income from investments, such as a distribution statement. receipts or a logbook for work-related expense deductions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Document Checklist?

A Tax Document Checklist is a list of documents and information that individuals or businesses need to gather and review in order to accurately prepare and file their tax returns.

Who is required to file Tax Document Checklist?

Individuals and businesses who are required to file a tax return must complete a Tax Document Checklist to ensure they have all necessary documentation for reporting their income and expenses.

How to fill out Tax Document Checklist?

To fill out a Tax Document Checklist, list all required documents such as W-2 forms, 1099 forms, receipts for deductions, and any other relevant information needed for your tax return. Ensure that you have the correct information and that all documents are organized.

What is the purpose of Tax Document Checklist?

The purpose of a Tax Document Checklist is to streamline the tax preparation process, helping individuals and businesses ensure they collect all necessary documents to file their taxes accurately and efficiently.

What information must be reported on Tax Document Checklist?

The Tax Document Checklist should include personal identification information, income statements, records of expenses, tax deduction documents, investment income data, and any other relevant financial documents needed for tax filing.

Fill out your tax document checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Document Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.