Get the free Request for Alien Information for Miscellaneous Income Payments - portal rfsuny

Show details

This form is used to obtain basic taxpayer information for aliens and to determine residency for tax purposes through a two-part process.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for alien information

Edit your request for alien information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for alien information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request for alien information online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit request for alien information. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for alien information

How to fill out Request for Alien Information for Miscellaneous Income Payments

01

Obtain the Request for Alien Information form from the relevant authority or download it from the official website.

02

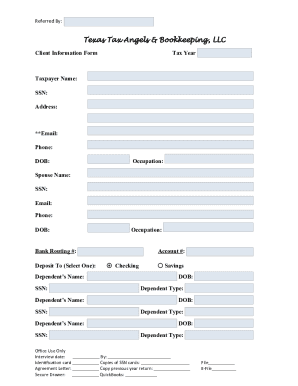

Fill out the identification section with your name, address, and any relevant identification numbers.

03

Provide the purpose for requesting alien information in the designated section.

04

Include details of the miscellaneous income payments that require alien information.

05

Verify that all provided information is accurate and complete.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate agency or office, following their submission guidelines.

Who needs Request for Alien Information for Miscellaneous Income Payments?

01

Individuals or entities making miscellaneous income payments that need to confirm the alien status of the payee.

02

Tax professionals responsible for ensuring compliance with IRS regulations regarding alien taxpayers.

03

Organizations that need to report payments to non-residents for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do I know if I'm a resident alien?

You're considered a resident alien for a calendar year if you meet the green card test or the substantial presence test for the year.

What income is taxable for non-resident aliens?

If you are considered a nonresident alien, you will only be taxed on income you earned from US sources. The US-source income which is considered “effectively connected” with a US business or trade, such as salary or any other type of compensation is taxed at graduated rates.

How do I know if I am a resident alien for tax purposes?

If you are not a U.S. citizen, you are considered a nonresident of the United States for U.S. tax purposes unless you meet one of two tests. You are a resident of the United States for tax purposes if you meet either the green card test or the substantial presence test for the calendar year (January 1 – December 31).

How do non-resident aliens file taxes?

Non-resident taxes When you prepare your U.S. tax return, you'll use Form 1040NR. Regardless of the form you use, you will only report amounts that are considered US-source income. Just like resident aliens and U.S. citizens, there are deductions and credits you can claim to reduce your taxable income.

How do you know if you are a resident for tax purposes?

Generally, you are an Australian resident for tax purposes if you: have always lived in Australia or you have come to Australia and live here permanently. have been in Australia continuously for 6 months or more, and for most of that time you worked in the one job and lived at the same place.

Can a non-resident alien get a refund?

If we determine that you meet the substantial presence test for a year in which SSA has withheld nonresident alien tax, you may request a refund. SSA can refund taxes erroneously withheld in the current tax year. Generally, IRS can refund taxes erroneously withheld for the previous three tax years.

Who is a resident alien for tax purposes?

Aliens who are Immigrants are Resident Aliens of the United States for tax purposes, under the condition that they spend at least one day in the United States.

How do you determine if you are a resident for tax purposes?

The “Green Card” Test You are a 'resident for tax purposes' if you were a legal permanent resident of the United States any time during the past calendar year. The Substantial Presence Test. You will be considered a 'resident for tax purposes' if you meet the Substantial Presence Test for the previous calendar year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Request for Alien Information for Miscellaneous Income Payments?

The Request for Alien Information for Miscellaneous Income Payments is a form used by employers and other payers to collect information from non-resident aliens who have received miscellaneous income payments. This form helps to ensure accurate tax reporting and compliance with IRS requirements.

Who is required to file Request for Alien Information for Miscellaneous Income Payments?

Individuals or entities making payments to non-resident aliens for services, fees, or other miscellaneous income are required to file this request. This includes employers, businesses, and other payers who are subject to U.S. tax regulations.

How to fill out Request for Alien Information for Miscellaneous Income Payments?

To fill out the Request for Alien Information for Miscellaneous Income Payments, payers must provide their name, address, and taxpayer identification number, along with the payee's information, including their name, address, and foreign tax identification number if available. Additional information regarding the nature of the income and the tax treaty benefits claimed may also be included.

What is the purpose of Request for Alien Information for Miscellaneous Income Payments?

The purpose of the Request for Alien Information for Miscellaneous Income Payments is to gather necessary information for accurate tax withholding and reporting. It helps ensure compliance with U.S. tax laws for payments made to non-resident aliens.

What information must be reported on Request for Alien Information for Miscellaneous Income Payments?

The information that must be reported includes the name and address of the payee, their taxpayer identification number (if applicable), the type of payment being made, and any applicable foreign tax identification number or details regarding tax treaty claims.

Fill out your request for alien information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Alien Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.