Get the free FORM 603 Corporations Act 2001 Section 671B ... - Transpacific

Show details

F-1675 FORM 603 Corporations Act 2001 Section 671B Notice of initial substantial holder To: Company Name/Scheme: TRANSPACIFIC INDUSTRIES GROUP LTD ACN/ARSON: 101 155 220 1. Details of substantial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 603 corporations act

Edit your form 603 corporations act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 603 corporations act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 603 corporations act online

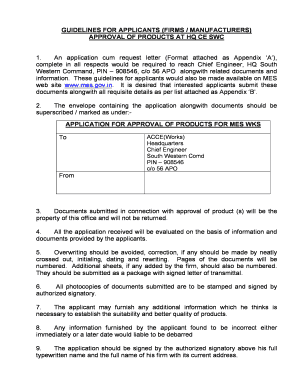

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 603 corporations act. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

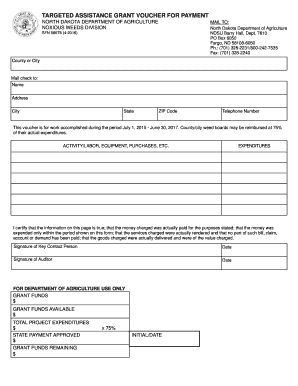

How to fill out form 603 corporations act

How to Fill Out Form 603 Corporations Act:

01

Start by obtaining the Form: You can download Form 603 Corporations Act from the official website of the relevant regulatory authority or request a copy from your company's legal department.

02

Provide the necessary details: The form will require you to provide specific information about your company, such as the company name, ACN (Australian Company Number), and any previous names the company may have had.

03

Complete Section A: This section requires you to provide details of the person(s) to whom the shares in question will be transferred or issued. Include their full name, residential address, and the number and class of shares they will receive.

04

Complete Section B: In this section, you need to specify the total amount paid or payable on the shares being transferred or issued. If the shares are being transferred, also include the date of the transfer.

05

Fill in Section C (Applicable only if shares are being surrendered): If the shares are being surrendered, provide the details of the person(s) surrendering the shares, including their full name and address.

06

Sign the form: Both the transferor of shares (or the person surrendering the shares) and the transferee must sign the form. Make sure to date the signatures.

07

Lodge the form: Once the form is completed and signed, it needs to be lodged with the relevant regulatory authority. Check the instructions on the form or consult with your company's legal department to determine where and how to lodge the form.

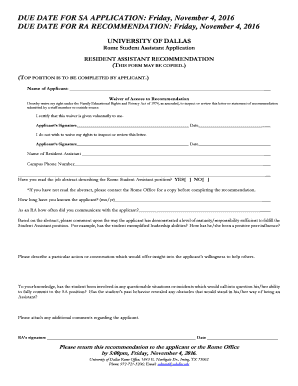

Who needs Form 603 Corporations Act?

01

Existing Companies: Any existing company registered under the Australian Corporations Act that intends to transfer or issue shares to another person or surrender shares will need to fill out Form 603.

02

Company Directors or Shareholders: Directors or shareholders who are involved in the transfer or surrender of shares will be required to complete Form 603.

03

Legal or Compliance Officers: Companies' legal or compliance officers are responsible for ensuring compliance with relevant laws and regulations, including the completion and lodgment of Form 603 when necessary. They should be familiar with this form and its requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 603 corporations act online?

The editing procedure is simple with pdfFiller. Open your form 603 corporations act in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my form 603 corporations act in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your form 603 corporations act and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit form 603 corporations act on an iOS device?

Use the pdfFiller mobile app to create, edit, and share form 603 corporations act from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is form 603 corporations act?

Form 603 corporations act is a document that needs to be filed under the Corporations Act 2001 in Australia. It is used to notify the Australian Securities and Investments Commission (ASIC) of changes in shareholdings of substantial holders in a corporation.

Who is required to file form 603 corporations act?

Any person or entity who becomes or ceases to be a substantial holder in a corporation is required to file form 603 corporations act.

How to fill out form 603 corporations act?

To fill out form 603 corporations act, you need to provide information such as the name and ACN/ARSN of the corporation, the name and address of the substantial holder, details of the change in shareholdings, and any relevant attachments. The form can be filled out online through ASIC's website or submitted in paper form.

What is the purpose of form 603 corporations act?

The purpose of form 603 corporations act is to provide transparency and ensure that ASIC and the public are informed about changes in shareholdings of substantial holders in corporations. It helps in monitoring and regulating corporate ownership and control.

What information must be reported on form 603 corporations act?

The information that must be reported on form 603 corporations act includes the name and ACN/ARSN of the corporation, the name and address of the substantial holder, details of the change in shareholdings (including the date of change, the number and class of securities acquired or disposed of, and the nature of the change), and any relevant attachments.

Fill out your form 603 corporations act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 603 Corporations Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.