Get the free Rights Issue Oct 2013 Letter to Shareholders.docx. Form 603 for Delta Gold NL

Show details

This document informs shareholders about a non-renounceable entitlement offer by Syndicated Metals Limited, detailing the terms, timetable, and required actions for shareholders wishing to participate.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rights issue oct 2013

Edit your rights issue oct 2013 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rights issue oct 2013 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rights issue oct 2013 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit rights issue oct 2013. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rights issue oct 2013

How to fill out rights issue Oct 2013?

01

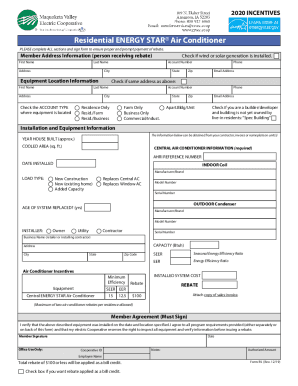

Obtain the rights issue form: Contact the company or your broker to request the rights issue form for Oct 2013. They will provide you with the necessary documents and instructions.

02

Read through the instructions: Carefully review the instructions provided with the rights issue form. Make sure you understand the terms and conditions, as well as the deadlines for submitting your application.

03

Complete the personal information section: Fill out your personal details accurately, including your full name, contact information, and any other required information specified in the form.

04

Indicate the number of rights shares to be subscribed: Enter the number of rights shares you wish to subscribe to. This is typically mentioned in the rights issue announcement.

05

Calculate the subscription price: Determine the subscription price per share based on the formula mentioned in the rights issue announcement. Multiply this price by the number of shares you want to subscribe to and enter the total amount in the form.

06

Arrange payment: Prepare to make the payment for the subscribed shares by the specified deadline. Follow the instructions provided for payment method, which could include cash, check, or online transfer.

07

Submit the completed form: Once you have filled out the rights issue form accurately and arranged the payment, submit the form along with any supporting documents required. Make sure to submit it before the deadline specified by the company.

Who needs rights issue Oct 2013?

01

Existing shareholders: The rights issue is typically offered to existing shareholders of a company. If you already own shares in the company, you may be eligible to participate in the rights issue.

02

Investors seeking to increase their stake: Those investors who want to increase their ownership percentage in the company may find the rights issue as an opportunity to do so. By subscribing to additional shares, they can increase their stake in the company.

03

Individuals interested in the company: Even if you don't currently own shares in the company, you may still participate in the rights issue if you are interested in investing in the company. It provides a chance to acquire shares at a discounted price compared to the market value.

Note: The eligibility and participation criteria may vary based on the company's specific terms and conditions for the rights issue. It is advisable to review the announcement and consult with your financial advisor or broker for accurate information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send rights issue oct 2013 for eSignature?

Once you are ready to share your rights issue oct 2013, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit rights issue oct 2013 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing rights issue oct 2013 right away.

How do I complete rights issue oct 2013 on an Android device?

Complete rights issue oct 2013 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is rights issue oct letter?

The rights issue oct letter is a formal document that outlines the rights issue being offered to the shareholders of a company in the month of October (Oct). It provides information about the terms, conditions, and timeline of the rights issue.

Who is required to file rights issue oct letter?

The company undertaking the rights issue is responsible for filing the rights issue oct letter. It is typically prepared by the company's management or legal team and sent to all eligible shareholders.

How to fill out rights issue oct letter?

To fill out the rights issue oct letter, the company needs to include details such as the purpose of the rights issue, the number of shares being offered, the subscription price, the subscription period, and any other relevant information. It should also provide instructions on how shareholders can exercise their rights and participate in the rights issue.

What is the purpose of rights issue oct letter?

The purpose of the rights issue oct letter is to inform shareholders about the upcoming rights issue and provide them with all the necessary information to make an informed decision. It aims to ensure transparency and compliance with regulatory requirements.

What information must be reported on rights issue oct letter?

The rights issue oct letter should include information such as the company's name, the purpose of the rights issue, the number of shares being offered, the subscription price, the subscription period, the record date, the rights entitlement ratio, the payment details, and any other relevant information as required by the regulatory authorities.

Fill out your rights issue oct 2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rights Issue Oct 2013 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.