Get the free 2011 HMDA Edits

Show details

This document provides guidelines and edits for the Home Mortgage Disclosure Act (HMDA), including definitions of syntactical, validity, and quality edits that financial institutions must adhere to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2011 hmda edits

Edit your 2011 hmda edits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 hmda edits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

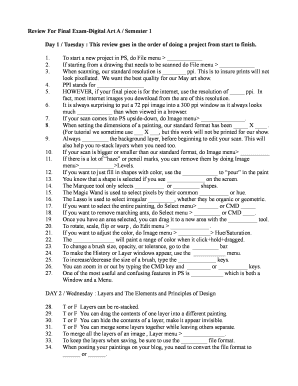

Editing 2011 hmda edits online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2011 hmda edits. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2011 hmda edits

How to fill out 2011 HMDA Edits

01

Step 1: Gather all required data for the 2011 Home Mortgage Disclosure Act (HMDA) report.

02

Step 2: Review the data for accuracy and completeness to ensure all required fields are filled.

03

Step 3: Utilize HMDA reporting software or tools to input and validate your data against the 2011 edits.

04

Step 4: Check for common errors such as missing data points or incorrect formatting according to the 2011 guidelines.

05

Step 5: Make necessary corrections to resolve any identified errors or discrepancies.

06

Step 6: After reviewing the edits, finalize the data submission through the appropriate channels.

Who needs 2011 HMDA Edits?

01

Mortgage lenders and financial institutions that originate mortgage loans.

02

Regulatory compliance officers responsible for ensuring adherence to HMDA requirements.

03

Data analysts who need to analyze mortgage lending data for fair lending practices.

Fill

form

: Try Risk Free

People Also Ask about

Is mortgage information publicly available?

The Home Mortgage Disclosure Act (HMDA) requires many financial institutions to maintain, report, and publicly disclose loan-level information about mortgages.

Is HMDA data public?

The HMDA data and reports are the most comprehensive publicly available information on mortgage market activity. The data and reports can be used along with the Census demographic information for data analysis purposes. Available below are the data and reports for HMDA data collected in or after 2017.

Is HMDA data available to the public?

The HMDA data and reports are the most comprehensive publicly available information on mortgage market activity. The data and reports can be used along with the Census demographic information for data analysis purposes.

Who is required to report HMDA data?

HMDA reporting entities Financial institutions like banks, savings associations, mortgage lending institutions, and credit unions must report under HMDA. Any institution with loan origination of 200 or more open-end lines of credit must gather, record, and submit their reports to HMDA.

What is the history of HMDA?

Congress enacted HMDA in 1975. An Act to extend the authority for the flexible regulation of interest rates on deposits and share accounts in depository institutions, to extend the National Commission on Electronic Fund Transfers, and to provide for home mortgage disclosure.

When did HMDA reporting start?

The Home Mortgage Disclosure Act requires certain financial institutions to collect, report, and disclose information about their mortgage lending activity. HMDA was originally enacted by the Congress in 1975 and is implemented by Regulation C (12 CFR Part 1003).

Does HMDA apply to HELOCs?

Home equity lines of credit (HELOCs) may not be in the data even if intended for home improvement or home purchase because reporting HELOCs is optional. Additionally, not all mortgage lenders are HMDA reporters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2011 HMDA Edits?

The 2011 HMDA Edits refer to the reporting requirements and guidelines established under the Home Mortgage Disclosure Act (HMDA) for mortgage lenders to ensure compliance with data collection and reporting standards for housing-related loans.

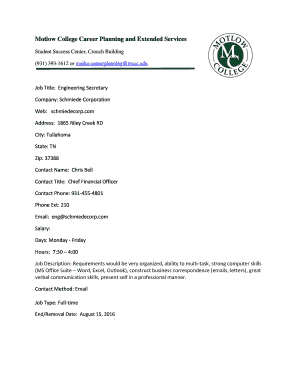

Who is required to file 2011 HMDA Edits?

Financial institutions, including banks and credit unions, that meet certain criteria regarding loan volume, assets, and location must file the 2011 HMDA Edits, specifically lenders that originate at least 25 home purchase loans in a given year.

How to fill out 2011 HMDA Edits?

To fill out the 2011 HMDA Edits, lenders must collect data from their loan applications according to the guidelines provided by the Consumer Financial Protection Bureau (CFPB) and submit the information through the appropriate electronic filing system.

What is the purpose of 2011 HMDA Edits?

The purpose of the 2011 HMDA Edits is to facilitate the collection of consistent and accurate data regarding housing loans, promote transparency in the mortgage lending process, and support fair lending practices.

What information must be reported on 2011 HMDA Edits?

The information that must be reported on the 2011 HMDA Edits includes the loan amount, property location, applicant demographics (such as race, ethnicity, and sex), loan purpose, and underwriting decisions.

Fill out your 2011 hmda edits online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011 Hmda Edits is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.