Get the free American Tax Consultants of Florida - famguardian1

Show details

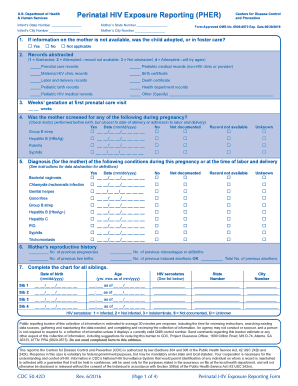

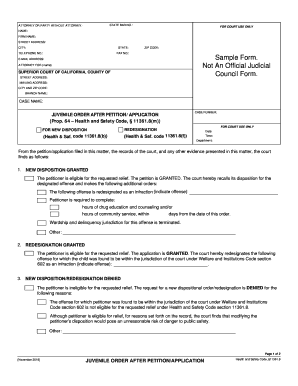

Este documento es un formulario de consulta para servicios relacionados con impuestos, que incluye la recopilación de datos del cliente, tarifas y otros documentos necesarios para la presentación

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign american tax consultants of

Edit your american tax consultants of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your american tax consultants of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit american tax consultants of online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit american tax consultants of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out american tax consultants of

How to fill out American Tax Consultants of Florida

01

Gather all necessary tax documents such as W-2s, 1099s, and other income records.

02

Collect documentation for deductions, such as receipts for medical expenses, mortgage interest, and charitable donations.

03

Visit the American Tax Consultants of Florida website or call for an appointment.

04

Complete any preliminary paperwork required before your appointment.

05

Meet with a tax consultant to review your tax situation and provide your documents.

06

Ask questions about specific deductions or tax credits applicable to your situation.

07

Review the completed tax return with the consultant to ensure all information is accurate.

08

Sign the necessary tax forms to authorize the filing of your tax return.

09

Make any required payments or arrangements for any taxes owed.

Who needs American Tax Consultants of Florida?

01

Individuals who require assistance in filing their taxes accurately.

02

Self-employed individuals looking for help with tax planning and deductions.

03

Families wanting to maximize their tax credits and deductions.

04

Business owners who need professional guidance on tax compliance.

05

Anyone who is facing complex tax situations or audits.

Fill

form

: Try Risk Free

People Also Ask about

What does a tax consultant do?

A tax consultant researches tax issues, recommends strategies to minimize and address tax liability, prepares and files tax returns, and meets with the IRS to represent clients during audits. To advise clients on tax-planning strategies, tax advisors must remain informed on tax law changes.

What is the difference between a tax consultant and a CPA?

Tax advisors primarily concentrate on tax law. CPAs can handle a wider range of financial services. These can include auditing, financial planning, and different forms of accounting, such as management, public, government, or forensic accounting.

How much do tax consultants charge in the US?

Fixed per-service fees For simple returns, with a standard Form 1040 and state tax return, prices may start at around $500. For complex returns with additional income sources or business taxes may start at $1,500 or more per tax return.

Do you need a CPA for tax consulting?

Any person can become a tax return preparer; you just need to present yourself as one. Some people might just read a few books and start doing taxes. A CPA has to obtain a proper degree, pass a complicated exam, obtain professional experience, and face regulation by a state board.

Is a CPA better than a tax preparer?

Bottom Line. A CPA is a full-service financial professional who is generally better suited to provide year-round accounting services and tax planning. A tax preparer is someone who is licensed to prepare and file taxes, and is generally the right choice for someone who specifically needs help when it comes time to file

What do tax consultants charge?

Recommended Rates: Basic tax preparation & bookkeeping: R900 – R1,200 per hour. Business advisory & compliance audits: R1,500 – R2,000 per hour. High-risk tax work (dispute resolution, SARS objections, audits): R1,800 – R2,500 per hour.

How much does it cost to talk to a tax consultant?

The average hourly rates for a tax advisor may vary depending on the location, experience, and complexity of the client's financial situation. Rates typically range from around $100 to $400 per hour, with more experienced advisors commanding higher fees.

What is the difference between a CPA and a tax consultant?

Specialization in Tax Law vs. Broad Financial Expertise: Tax advisors specialize in tax law, planning, and compliance, whereas CPAs offer a wider range of financial services, including auditing and business consulting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is American Tax Consultants of Florida?

American Tax Consultants of Florida is a tax advisory firm that provides services related to tax preparation, planning, and consulting specifically for individuals and businesses operating in Florida.

Who is required to file American Tax Consultants of Florida?

Individuals and businesses that have taxable income or meet certain filing thresholds in Florida are generally required to file with American Tax Consultants of Florida.

How to fill out American Tax Consultants of Florida?

To fill out the forms provided by American Tax Consultants of Florida, gather all relevant financial documents, carefully follow the instructions provided with the forms, and accurately report income, deductions, and credits.

What is the purpose of American Tax Consultants of Florida?

The purpose of American Tax Consultants of Florida is to assist clients in effectively managing their taxes, ensuring compliance with state and federal tax laws, and maximizing potential tax benefits.

What information must be reported on American Tax Consultants of Florida?

Clients must report personal and business income, deductions, tax credits, and any relevant financial transactions that could impact their tax liabilities on forms filed with American Tax Consultants of Florida.

Fill out your american tax consultants of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

American Tax Consultants Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.