Get the free FORM 3B.48 LOAN ASSUMPTION AND MODIFICATION AGREEMENT

Show details

This document outlines the agreement between the undersigned purchasers and the mortgage holder regarding the assumption of a mortgage on a specific property, including terms of payment, interest

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 3b48 loan assumption

Edit your form 3b48 loan assumption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 3b48 loan assumption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 3b48 loan assumption online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 3b48 loan assumption. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 3b48 loan assumption

How to fill out FORM 3B.48 LOAN ASSUMPTION AND MODIFICATION AGREEMENT

01

Begin by downloading the FORM 3B.48 LOAN ASSUMPTION AND MODIFICATION AGREEMENT from the official website or request a physical copy.

02

Carefully read the instructions provided at the top of the form.

03

Fill in the names and addresses of the current borrowers in the designated fields.

04

Enter the name and address of the new borrower assuming the loan.

05

Provide the loan number and describe the loan type, including any relevant details.

06

In the section regarding loan terms, specify any modifications, such as interest rates or repayment periods.

07

Include any necessary signatures from both the existing borrower(s) and the new borrower.

08

Ensure all required dates are filled in and the document is dated at the end.

09

Review the entire form for accuracy and completeness before submission.

10

Submit the completed form to the lender as per their guidelines.

Who needs FORM 3B.48 LOAN ASSUMPTION AND MODIFICATION AGREEMENT?

01

Individuals who want to assume a loan from an existing borrower.

02

Current borrowers looking to modify loan terms.

03

Lenders who need to document the change of borrowers or modifications in loan agreements.

Fill

form

: Try Risk Free

People Also Ask about

What is a loan assumption agreement?

The Essential Documents for a Mortgage Assumption Original Mortgage Agreement or Loan Documents. Mortgage Assumption Application. Seller's Authorization to Transfer the Loan. Proof of Income and Financial Documentation (Buyer) Property Appraisal. Title Report or Title Search. Homeowner's Insurance.

What documents are needed for a loan modification?

Send in all items the servicer requests. An application is complete once you've sent in everything the servicer requested — like a financial worksheet, pay stubs, bank statements, asset information, tax returns, and a hardship statement.

What documents are needed for a loan assumption?

Requirements for Assuming a VA Loan You must have a 12-month history of on-time mortgage payments. You must agree to assume all the liabilities associated with the loan. You must have enough residual income. You must pay 0.5% of the loan balance as the funding fee (unless you have a qualifying service related disability)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

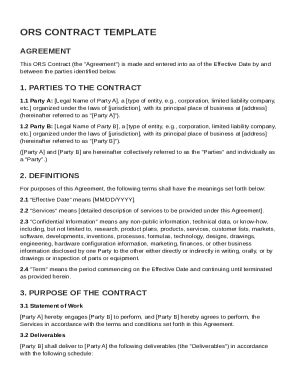

What is FORM 3B.48 LOAN ASSUMPTION AND MODIFICATION AGREEMENT?

FORM 3B.48 LOAN ASSUMPTION AND MODIFICATION AGREEMENT is a legal document used to formalize the transfer of loan obligations and any modifications to the terms of the loan between parties.

Who is required to file FORM 3B.48 LOAN ASSUMPTION AND MODIFICATION AGREEMENT?

Parties involved in a loan assumption or modification, typically including the current borrower, the new borrower, and the lender, are required to file this form.

How to fill out FORM 3B.48 LOAN ASSUMPTION AND MODIFICATION AGREEMENT?

To fill out FORM 3B.48, provide the necessary identifying information for all parties involved, describe the loan's original terms, outline the terms of the assumption or modification, and obtain signatures from all parties.

What is the purpose of FORM 3B.48 LOAN ASSUMPTION AND MODIFICATION AGREEMENT?

The purpose of FORM 3B.48 is to legally document the transfer of loan responsibilities and any changes to the loan terms, ensuring all parties agree to the new conditions.

What information must be reported on FORM 3B.48 LOAN ASSUMPTION AND MODIFICATION AGREEMENT?

The form must report the names and addresses of all parties involved, loan account details, the original terms of the loan, the new terms after modification, and the effective date of the agreement.

Fill out your form 3b48 loan assumption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 3B48 Loan Assumption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.