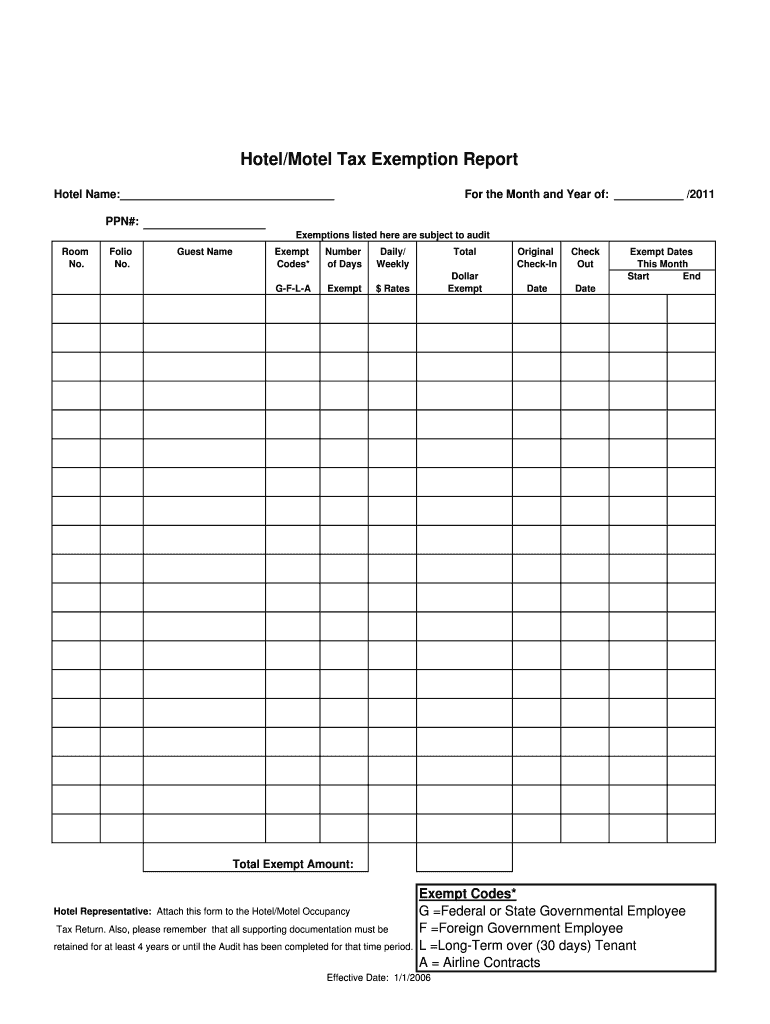

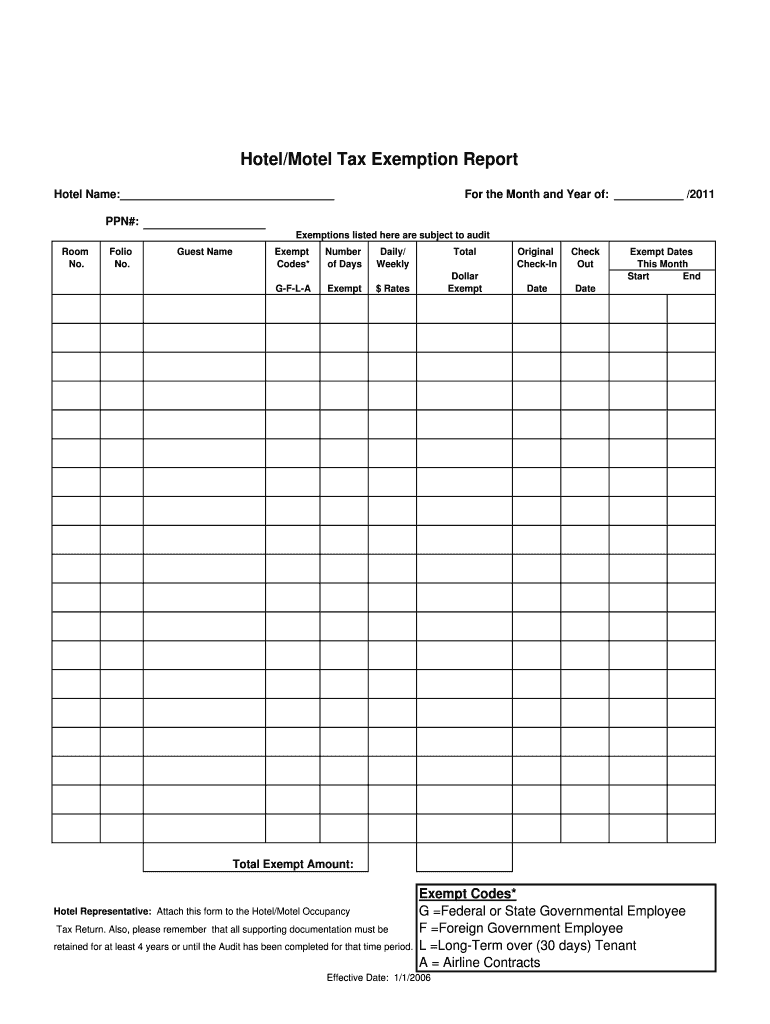

Get the free Hotel/Motel Tax Exemption Report - fiscalofficer cuyahogacounty

Show details

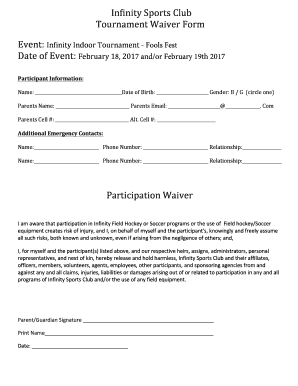

This document is used to report tax exemptions for hotel or motel accommodations for a specific month and year. It collects details such as guest names, room numbers, exemption codes, and total exempt

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hotelmotel tax exemption report

Edit your hotelmotel tax exemption report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hotelmotel tax exemption report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hotelmotel tax exemption report online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit hotelmotel tax exemption report. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hotelmotel tax exemption report

How to fill out Hotel/Motel Tax Exemption Report

01

Obtain the Hotel/Motel Tax Exemption Report form from your local government website or office.

02

Fill out the name of the organization claiming the exemption.

03

Provide the contact information for the organization, including address, phone number, and email.

04

Indicate the purpose of the stay and confirm that it qualifies for tax exemption.

05

List the dates of check-in and check-out.

06

Include the name of the hotel or motel where the stay occurred.

07

Sign and date the form to validate the information provided.

Who needs Hotel/Motel Tax Exemption Report?

01

Organizations or individuals staying in a hotel or motel for tax-exempt purposes, such as government agencies, non-profit organizations, or educational institutions.

Fill

form

: Try Risk Free

People Also Ask about

How to apply for Texas hotel occupancy tax exemption?

You can apply to the hotel for a refund or credit. To receive verification or to apply for exemption, please contact a hotel tax specialist toll free at 1-800-252-1385 or in Austin at 512/463-4600. From a Telecommunications Device for the Deaf (TDD), call 1-800-248-4099 or in Austin 512/463-4621.

How much is the innkeeper fee in Georgia?

Innkeepers and marketplace innkeepers are responsible for collecting and remitting the $5.00 fee for each night a customer is provided accommodation.

What is the hotel motel tax in Iowa?

The state rate for hotel and motel lodging remains at 5%. The hotel motel tax, if any, still applies. The local option tax (LOST) does not apply, whether or not the rental is subject to hotel motel tax. All hotels, motels, and similar establishments will complete an additional schedule when filing their returns.

Is hotel tax a state or local tax?

Hotel taxes in the United States are usually levied at a state level but in some cases cities and counties add additional charges on top.

Is local government exempt from federal excise tax?

Share : Yes, government agencies — particularly state and local governments — are exempt from paying certain Federal Excise Taxes (FET) under specific conditions.

What is the hotel motel tax in Georgia?

The new Hotel/Motel Excise Tax Rate is 8 percent (8%) effective September 1, 2023.

What is the certificate of exemption of local hotel motel excise tax in Georgia?

What is GA Certificate of Exemption of Local Hotel/Motel Excise Tax? The GA Certificate of Exemption of Local Hotel/Motel Excise Tax is a document that allows certain individuals or organizations to claim an exemption from local hotel or motel excise taxes when staying in a lodging facility.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Hotel/Motel Tax Exemption Report?

The Hotel/Motel Tax Exemption Report is a document used by eligible entities to claim exemption from local hotel or motel occupancy taxes typically charged on lodging services.

Who is required to file Hotel/Motel Tax Exemption Report?

Entities such as non-profit organizations, government agencies, and educational institutions that are exempt from paying hotel or motel taxes are usually required to file this report.

How to fill out Hotel/Motel Tax Exemption Report?

To fill out the Hotel/Motel Tax Exemption Report, provide information such as the name of the exempt entity, the purpose of the stay, details of the lodging (dates, location), and any applicable exemption certificates or documentation.

What is the purpose of Hotel/Motel Tax Exemption Report?

The purpose of the Hotel/Motel Tax Exemption Report is to formally document the basis for exemption from hotel or motel taxes, ensuring compliance and facilitating tax administration.

What information must be reported on Hotel/Motel Tax Exemption Report?

The report must include the name and address of the exempt entity, the date of the lodging, the reason for the exemption, and any related documentation or certification supporting the exemption claim.

Fill out your hotelmotel tax exemption report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hotelmotel Tax Exemption Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.