Get the free Recipient Created Tax Invoice Agreement - Wishart Contractors

Show details

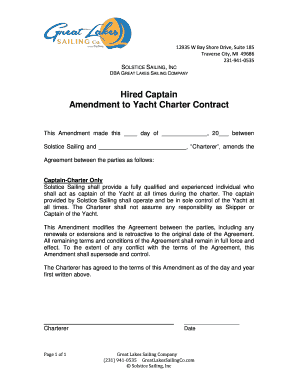

M & LA Wis hart Contractors Pty Ltd Post Office, Lox ton North SA 5333 Phone: (08) 8584 1248 Fax: (08) 8584 1555 Email: trucks wishartcontractors.com.AU Recipient Created Tax Invoice Agreement I /

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign recipient created tax invoice

Edit your recipient created tax invoice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your recipient created tax invoice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing recipient created tax invoice online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit recipient created tax invoice. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out recipient created tax invoice

How to fill out recipient created tax invoice:

01

Obtain the necessary form: Start by obtaining the recipient created tax invoice form, which can usually be downloaded from your country's tax authority website. Make sure to use the most recent version of the form.

02

Fill in your details: Begin by providing your personal information at the top of the form. This includes your name or business name, address, contact details, and tax identification number. Double-check that all information is accurate and up-to-date.

03

Include the recipient's information: Next, fill in the details of the recipient of the invoice. This includes their name or business name, address, and contact information. Make sure to accurately identify the recipient to ensure the invoice is properly documented.

04

Specify the invoice details: Enter the invoice number, date, and payment terms. Clearly state the amount to be invoiced and provide a breakdown of the goods or services provided. Be thorough and accurate in describing what was delivered or performed.

05

Calculate and record the tax: Determine the appropriate tax rate applicable to the sale or service provided. Calculate the tax amount and clearly indicate it on the invoice. Ensure that you are following the tax laws and regulations specific to your jurisdiction.

06

Provide any additional information: If there are any discounts, special terms, or other relevant details to include on the invoice, make sure to clearly document them. This will help avoid confusion and ensure transparency in the transaction.

07

Keep a copy for your records: Make a copy of the completed recipient created tax invoice for your records before sending it to the recipient. This will be useful for your accounting and tax purposes and can serve as backup documentation if needed.

Who needs recipient created tax invoice?

01

Businesses providing goods or services: Any business that sells goods or provides services may need to issue recipient created tax invoices to their customers in certain jurisdictions. This is especially common in countries where the tax system relies on a value-added tax (VAT) or goods and services tax (GST).

02

Individuals involved in business activities: Even if you are an individual engaged in business activities, such as freelancing or consulting, you may still need to issue a recipient created tax invoice under certain circumstances. It is important to check the tax laws in your jurisdiction to determine if this applies to you.

03

Compliance with tax regulations: The purpose of a recipient created tax invoice is to ensure compliance with tax regulations and to properly document transactions for tax purposes. It helps track taxable supplies, calculate and report taxes accurately, and establish a clear record of business transactions. Maintaining proper documentation is essential for businesses and individuals to avoid penalties and audits by tax authorities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is recipient created tax invoice?

A recipient created tax invoice is an invoice that is generated by the recipient of goods or services rather than the supplier.

Who is required to file recipient created tax invoice?

The recipient of goods or services is required to file a recipient created tax invoice.

How to fill out recipient created tax invoice?

To fill out a recipient created tax invoice, the recipient must include all relevant details such as their own details, the supplier's details, the invoice date, a description of the goods or services, the quantity, the price, and the total amount payable.

What is the purpose of recipient created tax invoice?

The purpose of a recipient created tax invoice is to allow the recipient to document and claim input tax credit on the goods or services they have received.

What information must be reported on recipient created tax invoice?

The recipient created tax invoice must include details such as the recipient's and supplier's information, invoice date, description of goods/services, quantity, price, and total amount payable.

How can I manage my recipient created tax invoice directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your recipient created tax invoice and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send recipient created tax invoice for eSignature?

To distribute your recipient created tax invoice, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for the recipient created tax invoice in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Fill out your recipient created tax invoice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Recipient Created Tax Invoice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.