Get the free Main Center Redevelopment Tax bAbatement Program Applicationb

Show details

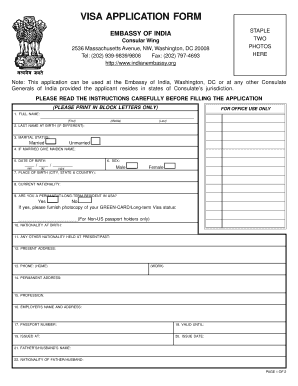

Main Center Redevelopment Tax Abatement Program Application Project Name: Applicant: Project Address: Phone Number: Has this property received MARC abatement before? Are you applying for any other

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign main center redevelopment tax

Edit your main center redevelopment tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your main center redevelopment tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing main center redevelopment tax online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit main center redevelopment tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out main center redevelopment tax

How to fill out main center redevelopment tax:

01

Gather all necessary documents and information: Start by collecting all the relevant documents and information needed to fill out the main center redevelopment tax form. This may include income statements, property records, and any other documentation related to the redevelopment project.

02

Understand the requirements and guidelines: Before filling out the form, it is important to familiarize yourself with the specific requirements and guidelines for the main center redevelopment tax. This can usually be found in the instructions provided with the form or by contacting the appropriate tax authority.

03

Complete the form accurately: Take your time to carefully fill out each section of the main center redevelopment tax form. Make sure to provide accurate and up-to-date information, as any errors or omissions could lead to delays or penalties.

04

Double-check your work: Once you have completed the form, review it thoroughly to ensure all information provided is accurate and complete. Check for any missing or incorrect details, as well as any supporting documentation that may be required.

05

Submit the form: Once you are confident that the main center redevelopment tax form is filled out correctly, submit it to the appropriate tax authority. This can typically be done online, by mail, or in person, depending on the specific instructions provided.

Who needs main center redevelopment tax?

01

Developers: Developers involved in the redevelopment of a main center or central business district may be required to pay the main center redevelopment tax. This tax is often imposed to fund the revitalization and improvement of commercial areas.

02

Property owners: Property owners within the main center or central business district may also be subject to the main center redevelopment tax. This tax is usually calculated based on the assessed value of the property and is intended to contribute to the funding of redevelopment efforts.

03

Business owners: Depending on the specific regulations and requirements of the jurisdiction, business owners operating within the main center or central business district may also be liable for the main center redevelopment tax. This tax is often based on factors such as business revenue, square footage, or occupancy.

Overall, the main center redevelopment tax is typically applicable to individuals or entities involved in the redevelopment of a main center or central business district, including developers, property owners, and business owners operating within the area. It is essential to consult the specific regulations and guidelines of the jurisdiction to determine who exactly needs to pay this tax.

Fill

form

: Try Risk Free

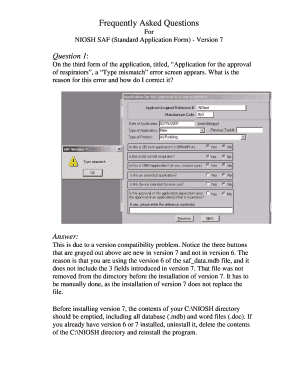

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete main center redevelopment tax online?

pdfFiller has made filling out and eSigning main center redevelopment tax easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for signing my main center redevelopment tax in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your main center redevelopment tax and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out main center redevelopment tax using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign main center redevelopment tax and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is main center redevelopment tax?

Main center redevelopment tax is a tax levied on properties within designated redevelopment areas to fund improvements and revitalization projects in the area.

Who is required to file main center redevelopment tax?

Property owners within the designated redevelopment areas are required to file main center redevelopment tax.

How to fill out main center redevelopment tax?

Main center redevelopment tax can be filled out by completing the necessary forms provided by the local tax authorities and submitting them with the required documentation and payment.

What is the purpose of main center redevelopment tax?

The purpose of main center redevelopment tax is to generate revenue for the improvement and revitalization of designated redevelopment areas.

What information must be reported on main center redevelopment tax?

Main center redevelopment tax typically requires information such as property details, income generated from the property, and any exemptions or deductions claimed.

Fill out your main center redevelopment tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Main Center Redevelopment Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.