Get the free Debtors’ First Modified Plan of Liquidation - kccllc

Show details

This document outlines the modified plan of liquidation for Chicago Newspaper Liquidation Corp. and its affiliates under Chapter 11 of the Bankruptcy Code, detailing treatment of claims, establishment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign debtors first modified plan

Edit your debtors first modified plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your debtors first modified plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit debtors first modified plan online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit debtors first modified plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out debtors first modified plan

How to fill out Debtors’ First Modified Plan of Liquidation

01

Gather all required financial documents and information needed for the plan.

02

Clearly outline the proposed modifications to the existing liquidation plan.

03

List the creditors and their claims, indicating the priority and treatment of each claim.

04

Detail the liquidated assets and their estimated values.

05

Include a timeline for the execution of the proposed plan.

06

Explain the rationale for the modifications in detail.

07

Complete all sections of the form accurately and ensure it complies with legal requirements.

08

Review the plan with legal counsel or a financial advisor before submission.

09

Submit the completed plan to the appropriate court along with any required fees.

Who needs Debtors’ First Modified Plan of Liquidation?

01

Debtors seeking to modify an existing liquidation plan.

02

Creditors who need to understand the new terms and modifications to their claims.

03

Legal representatives of debtors and creditors involved in the liquidation process.

04

Banks and financial institutions with interests in the debtor's assets.

Fill

form

: Try Risk Free

People Also Ask about

Who gets paid first during liquidation?

The Liquidator's fees, costs and expenses are paid first in liquidation. Winding up a company is a substantial investment of time and expertise by the Liquidator. The Liquidator may also incur expenses, such as: Expenses arising from creditor's meetings.

What debts are not dischargeable in Chapter 11?

The most common types of nondischargeable debts are certain types of tax claims, debts not set forth by the debtor on the lists and schedules the debtor must file with the court, debts for spousal or child support or alimony, debts for willful and malicious injuries to person or property, debts to governmental units

What are the disadvantages of Chapter 11?

The Disadvantages of Chapter 11 Bankruptcy Loss of Privacy. Financial Record-Keeping & Reporting Requirements. Profitability Requirements. Some Loss of Control Over Business Operations. Restrictions on Compensation of Debtor's Insiders. Possible Loss of Shareholder Control. The Cost.

How can I stop my Chapter 13 from being dismissed?

To avoid future problems and potential dismissal, debtors should prioritize making timely plan payments and staying current on all mandatory payments, such as mortgage and car payments. It is also important to promptly report any changes in financial circumstances to the bankruptcy attorney and trustee.

What debt cannot be erased?

Bankruptcy is a great way to get rid of credit card debt, medical bills, and personal and payday loans. But bankruptcy can't wipe out recent income tax you owe, alimony, child support, or debt incurred from illegal acts (embezzlement, larceny, etc.).

Does Chapter 11 wipe out all debt?

Chapter 11 Bankruptcy Reorganizing debts often means negotiating a payment plan with creditors and may include settling on a lower repayment. While Chapter 11 bankruptcy does not typically clear debts, it may allow you to retain assets and to operate a business if you have one.

Does Chapter 11 wipe out debt?

Discharge also occurs at the end of a Chapter 11 filer's reorganization plan. If a business timely makes all of its payments on time, then any remaining outstanding liability will be discharged. But, this assumes that all of the business' debts are dischargeable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Debtors’ First Modified Plan of Liquidation?

The Debtors’ First Modified Plan of Liquidation is a document outlining how a debtor intends to liquidate their assets in an orderly manner to repay creditors following a bankruptcy or similar financial distress situation.

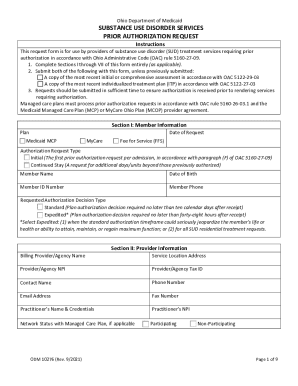

Who is required to file Debtors’ First Modified Plan of Liquidation?

Typically, the debtor or the trustee assigned to the bankruptcy case is required to file the Debtors’ First Modified Plan of Liquidation.

How to fill out Debtors’ First Modified Plan of Liquidation?

To fill out the Debtors’ First Modified Plan of Liquidation, the debtor must provide detailed information regarding their assets, liabilities, distribution plan for creditors, and proposed modifications to the original liquidation plan.

What is the purpose of Debtors’ First Modified Plan of Liquidation?

The purpose of the Debtors’ First Modified Plan of Liquidation is to propose a clear strategy for liquidating assets to satisfy outstanding debts while ensuring compliance with legal requirements and fair treatment of creditors.

What information must be reported on Debtors’ First Modified Plan of Liquidation?

The information that must be reported includes a description of the debtor's assets, anticipated liquidation proceeds, priority and classification of claims, treatment of secured and unsecured creditors, and timelines for the liquidation process.

Fill out your debtors first modified plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Debtors First Modified Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.